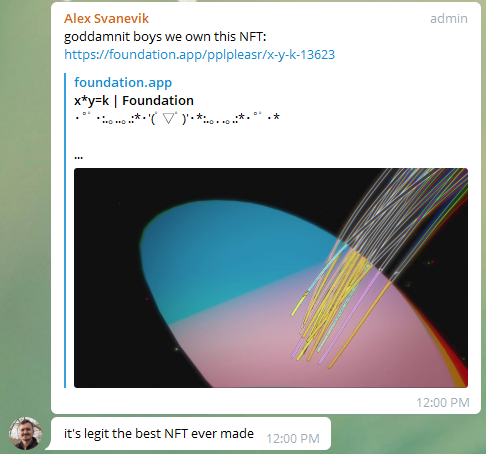

Almost got into a bidding war with an army of simps today but ended up being a part of @pleasrdao, a first of its kind Art DAO dedicated towards crypto art

The future is community ownership

The future is community ownership

https://twitter.com/TrustlessState/status/1375630683398307847

Was not aware of the DAOs existence and initially planned to win it. Started with an initial 100 ETH bid

There were two options on the table:

1. Engage in a bidding war against the DAO for individual ownership

2. Join forces w/ good friends and fractionalize the ownership

1. Engage in a bidding war against the DAO for individual ownership

2. Join forces w/ good friends and fractionalize the ownership

2 was the obvious choice

Not only do we get to "win" with friends

But our collective ownership and appreciation of the NFT (and the incredible story), imposes more value for the NFT than if any individual/central entity owned it themselves

Not only do we get to "win" with friends

But our collective ownership and appreciation of the NFT (and the incredible story), imposes more value for the NFT than if any individual/central entity owned it themselves

Some other whales went with option 1

But after seeing a constant stream of ETH flowing into the DAO address from 20+ members, I'd have to imagine they got disheartened and dropped out of the race

But after seeing a constant stream of ETH flowing into the DAO address from 20+ members, I'd have to imagine they got disheartened and dropped out of the race

@_jamiis said it best

"the future of art collectives is 100% DAO’s. guppies will be outbid by orgs. you will buy “shares” of an ethos instead of individually bidding. no one will be able to beat art DAO’s. this is just the beginning"

"the future of art collectives is 100% DAO’s. guppies will be outbid by orgs. you will buy “shares” of an ethos instead of individually bidding. no one will be able to beat art DAO’s. this is just the beginning"

The theory played out and in the end, @pleasrdao won the auction

Thank you to @pplpleasr1 for this opportunity, the namesake of the DAO and also for donating the proceeds to good causes

• • •

Missing some Tweet in this thread? You can try to

force a refresh