Iron ore prices have surged to a RECORD HIGH. And that's a great excuse to tell you about how the market has changed over the last 75 years.

Iron ore is the main raw material to make steel (and that's why steel prices are surging too). And it's a cash cow for big miners 🧵1/15

Iron ore is the main raw material to make steel (and that's why steel prices are surging too). And it's a cash cow for big miners 🧵1/15

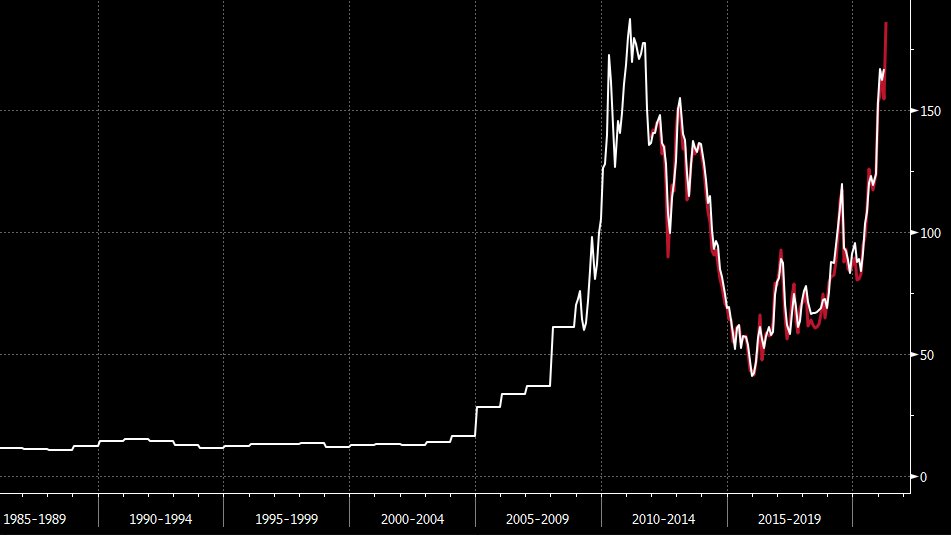

For decades, iron ore prices were set in secretive annual talks between steelmakers and miners that created a "benchmark price". Once a benchmark was established, the price for iron ore was fixed at that level for the rest of the year for everyone else in the industry🧵2/15

Because the cost of iron ore affects steel prices and, ultimately, the cost of everyday goods, the iron ore benchmark talks were for many years (until 2010) one of the most important commodity price negotiations for the global economy🧵3/15

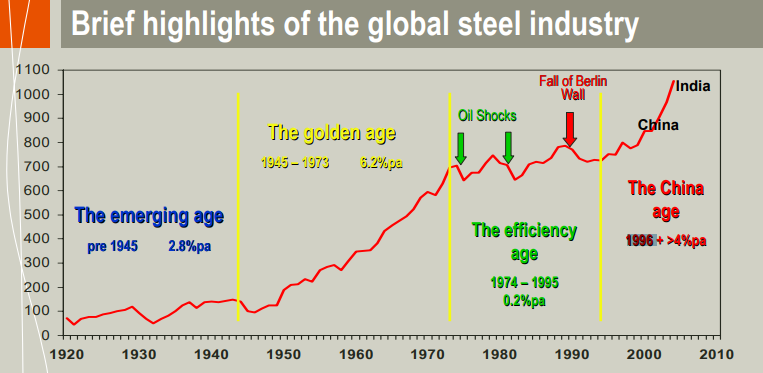

After the Second World War, with European steelmakers dominating, the "benchmark price" for iron ore was set in Rotterdam for the Jan-to-Dec calendar. It was the golden age for steel, with demand increasing >6% per year from 1945 to 1973 🧵4/15

The rise of the Japanese steel industry from the mid-1970s (and a slow down in steel demand to 0.5% per year) shifted the pricing talks to Asia. The benchmark system continued, with the only difference that prices were fixed annually on the Japanese fiscal year: Apr-to-Mar 🧵5/15

During the 1980s and until 2010, iron ore prices were set the same way: annual benchmark deals, often first in Asia. Iron ore became an odd commodity, one of the few whose price was fixed in producer-consumer talks, rather than fluctuate due to supply and demand forces 🧵6/15

Between 1980 and 2000, the annual price of iron ore barely moved: it fluctuated from $15 per tonne in 1991 to a low of $10.5 per tonne in 1988. But by the late 1990s, the age of China had started, and with it global steel demand growth accelerated to >4% per year 🧵7/15

With the increase in Chinese steel demand, the annual iron ore market shifted again. Baosteel, then the top Chinese steelmaker, took the lead on the annual talks, relegating the Japanese steelmakers. And prices started to rally. By 2008, iron ore prices have surged to $60 🧵8/15

The benchmark system struggled as prices surged. Beijing took a prominent role in the annual talks via the China Iron and Steel Association (CISA), staffed with former government bureaucrats, during the China International Steel and Raw Materials conference in Qingdao🧵9/15

While the system of long-term supply contracts and annual "benchmark price" talks continued to rule, a burgeoning spot market emerged, mostly for ore originating in India. Iron ore spot prices fluctuated daily, and increasingly prices were higher than in the annual talks🧵10/5

The system started to crumble in 2009, after the Chinese steelmakers rejected a "benchmark price" deal agreed between the big miners and Japanese steelmakers. For months, the miners sold iron ore into China based on indicative prices that Beijing formally was rejecting🧵11/15

Ultimately, the benchmark system collapsed in March 2010, when BHP and Japanese steelmakers reached a tentative deal to replace annual contracts and lengthy negotiations with short-term contracts linked to the spot market (and much higher prices)🧵12/15 ft.com/content/f7dfde…

Marius Kloppers, then CEO of BHP, was the major force behind the collapse of the iron ore annual benchmark price system. He disliked that the price of a commodity was set by talks, rather than market forces, and thought miners would benefit from the change. He was right🧵13/15

The change was the latest shift in the wider commodities markets. Iron ore followed other examples, such as the transformation of the crude oil pricing system in the late 1970s, and thermal coal in the early 2000s. Today, supply and demand, rather than secret talks, rule🧵14/15

Since 2010, the iron ore market has been a rollercoaster. Chinese demand is now outstripping supply (with Vale struggling to boost output) sending prices above $185 per tonne, above the highest level ever achieved in the pre-2010 world of annual benchmark price deals 🧵15/15

• • •

Missing some Tweet in this thread? You can try to

force a refresh