1) State of Chinese Cloud - Part II

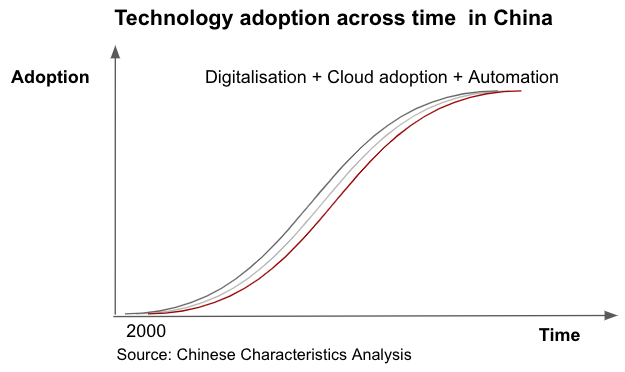

I propose a theory of digital transformation journey called Digitalisation-Cloud-Automation journey (DCA journey for short) and argue that each stage of the DCA journey enabled subsequent stages to occur for the West.

I propose a theory of digital transformation journey called Digitalisation-Cloud-Automation journey (DCA journey for short) and argue that each stage of the DCA journey enabled subsequent stages to occur for the West.

2) The journey is sequential as each step unlocks new business models and technology needs that would be unfeasible or unwanted at an earlier stage.

3) This development sequence is the assumed path for cloud adoption and growth of SaaS, but not so for China. China is undergoing all three stages of digitalisation, cloud adoption and automation concurrently rather than sequentially.

4) Relative to the US, where most firms have digitalised, and cloud adoption is the logical next step. In China, cloud adoption is predicated on whether the industry has digitised first and is highly heterogeneous across sectors.

5) I then go to make some predictions for how this will unfold in China. Check it out.

Oh, I also discovered footnotes. This is literally a game changer for me.

lillianli.substack.com/p/state-of-chi…

Oh, I also discovered footnotes. This is literally a game changer for me.

lillianli.substack.com/p/state-of-chi…

• • •

Missing some Tweet in this thread? You can try to

force a refresh