#Thread

1/ @ProjectSerum and the vision to flourish the ecosystem no.1

The thread explains the idea behind Serum, how Serum will flourish and an illustrative case about Raydium.

Based on Serum, SRM, and an Ecosystem for the Future - @SBF_Alameda

1/ @ProjectSerum and the vision to flourish the ecosystem no.1

The thread explains the idea behind Serum, how Serum will flourish and an illustrative case about Raydium.

Based on Serum, SRM, and an Ecosystem for the Future - @SBF_Alameda

2/ First, let talk about Serum DEX.

Serum DEX is a permissionless and trustless decentralized exchange with an on-chain central limit order book model (CLOB).

Serum DEX is a permissionless and trustless decentralized exchange with an on-chain central limit order book model (CLOB).

3/ Why order book?

It’s clear that AMM model still dominates DEXes nowadays but why Serum still choose to walk in this challenging route?

It’s clear that AMM model still dominates DEXes nowadays but why Serum still choose to walk in this challenging route?

4/ Order book is a model that has been proven from traditional finance for many years. The order of buyers & sellers will be matched and non exist slippage like AMM.

This is essential if you want to push DeFi to mainstream when the trading volume can reach to trillion dollars.

This is essential if you want to push DeFi to mainstream when the trading volume can reach to trillion dollars.

5/ But there are some challenges for on-chain order book today:

-Expensive cost and long waiting time: This depressed both average users and market makers.

-Low liquidity: DeFi still hasn’t attracted enough liquidity so we still have a significant gap between buyers and sellers.

-Expensive cost and long waiting time: This depressed both average users and market makers.

-Low liquidity: DeFi still hasn’t attracted enough liquidity so we still have a significant gap between buyers and sellers.

6/ The first problem is solved thanks to @solana and its scalable design.

The value offered is straightforward: a Dex with an on-chain order book brings a trading experience similar to CEX and is non-custodial and trustless too.

The value offered is straightforward: a Dex with an on-chain order book brings a trading experience similar to CEX and is non-custodial and trustless too.

https://twitter.com/solanians_/status/1385553465003315201

7/ Serum approached the second problem through its partnerships and unique design.

Example about partnerships: Wormhole, a cross-chain bridge that allows users to convert between ERC20 and SPL tokens, can help users from Ethereum take advantage of Solana’s costs and speeds.

Example about partnerships: Wormhole, a cross-chain bridge that allows users to convert between ERC20 and SPL tokens, can help users from Ethereum take advantage of Solana’s costs and speeds.

8/ About the design, I’ve already made a thread explaining the magic behind Serum structure and why it’s will attract all liquidity and value from projects built in the Serum ecosystem.

https://twitter.com/solanians_/status/1373134520363347973

9/ With a design that embraces composability of Serum

- An AMM can compose with Serum’s CLOB to reduce slippage

- Provided value-added features like automated strategies

- A borrow-lending protocol matches borrowers and lenders via an order book to establish a fairer price.

- An AMM can compose with Serum’s CLOB to reduce slippage

- Provided value-added features like automated strategies

- A borrow-lending protocol matches borrowers and lenders via an order book to establish a fairer price.

10/- Or even maybe real-world apps can connect to that borrow-lending protocol to generate yield for tradfi users.

Whichever way the ecosystem is expanded, it all bottoms out to the DEX and order book.

Whichever way the ecosystem is expanded, it all bottoms out to the DEX and order book.

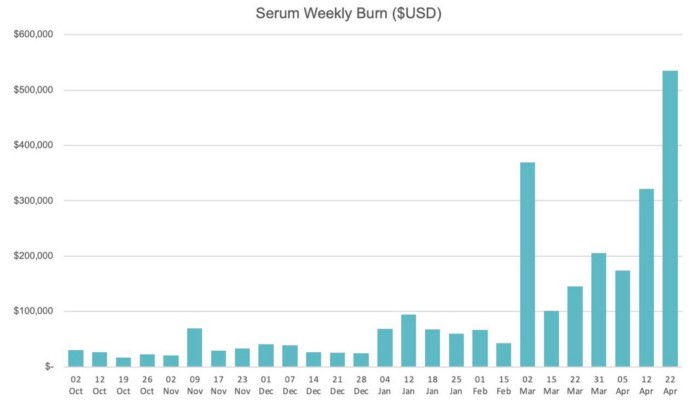

11/ And as $SRM holders know, Serum collects DEX fees from all platforms, with 80% going to SRM buy and burn and 20% going to DEX hosting.

The result speaks for itself, volume and burn sizes in Serum have been increasing consistently.

The result speaks for itself, volume and burn sizes in Serum have been increasing consistently.

12/ Now let’s talk about one illustrative case @RaydiumProtocol.

Raydium is an incredible AMM building on the Serum and Solana ecosystems and the first to source its liquidity from an order book.

Raydium is an incredible AMM building on the Serum and Solana ecosystems and the first to source its liquidity from an order book.

https://twitter.com/RaydiumProtocol/status/1387463002593525760

13/ Unlike other AMMs, Raydium provides on-chain liquidity to a central limit order book, meaning that Raydium liquidity providers get access to the entire order flow and liquidity of Serum and traders reap the benefits of greater liquidity and less slippage.

14/ Approximately 50% of Raydium’s swaps end up on the order book.

Serum is benefited from fees created by Raydium.

The relationship between Serum ($SRM) and Raydium ($RAY) is therefore not one of competitive hostility, but of ambitious synergy.

Serum is benefited from fees created by Raydium.

The relationship between Serum ($SRM) and Raydium ($RAY) is therefore not one of competitive hostility, but of ambitious synergy.

14/ Some of you might ask, do recent Serum Swap’s deprecation affect Serum eco?

The answer is not much. In fact, Serum Swap never sent orders to Serum DEX’s CLOB.

It means Raydium generates fees towards buy and burn when Serum Swap doesn’t.

The answer is not much. In fact, Serum Swap never sent orders to Serum DEX’s CLOB.

It means Raydium generates fees towards buy and burn when Serum Swap doesn’t.

15/ But it doesn’t mean that Serum Swap is a failure. It represented a significant milestone for Serum, demonstrating just how powerful AMMs can be when swaps are cheap and fast.

And now it steps down and lets others and more advanced protocols shine the whole ecosystem.

And now it steps down and lets others and more advanced protocols shine the whole ecosystem.

16/The vision - towards mass adoption, the action - no afraid to change, the moat - unique structure to support ideas. This is why I believe in the flourish of the ecosystem.

Let’s moon together.

$SOL #SOL #Solanaszn #solsummer

Let’s moon together.

$SOL #SOL #Solanaszn #solsummer

• • •

Missing some Tweet in this thread? You can try to

force a refresh