#Bitcoin returned -1.98% in 4/21. Would #BTC have a negative return month in 5/21?

TLDR: No. Traditionally, May is a decent month for #BTC with monthly returns averaging 18%.

Target prices: $67K-$80K

Time to reach targets: 5/5-5/31

Low: $50K-$55K

TLDR: No. Traditionally, May is a decent month for #BTC with monthly returns averaging 18%.

Target prices: $67K-$80K

Time to reach targets: 5/5-5/31

Low: $50K-$55K

1a/ Let's recap. #BTC didn't had a good month in 4/21 as expected, but it hit the lowest price target of $64K. After that, it corrected 27% to $47K before rebounding to $58K on 4/30.

I thought the 2nd dip (blue) corresponded to those of the last 2 cycles, but that wasn't it.

I thought the 2nd dip (blue) corresponded to those of the last 2 cycles, but that wasn't it.

1b/ CTM now has its own ATH Tracker. Big shout out to @irandall13! We could track the projected price action of #BTC with more precision!

Per the ATH Tracker, #BTC could have a major run up in 5/21.

Per the ATH Tracker, #BTC could have a major run up in 5/21.

2a/ #BTC's fundamentals are bullish. A summary of recent key developments:

- Ex-regulators work for crypto firms (eg. Brian Brooks, Chris Giancarlo)

- Ex-Acting CIA Director supports cryptos

- Congress passed bill to set up group w/ SEC/CFTC to give clarity on digital assets

- Ex-regulators work for crypto firms (eg. Brian Brooks, Chris Giancarlo)

- Ex-Acting CIA Director supports cryptos

- Congress passed bill to set up group w/ SEC/CFTC to give clarity on digital assets

2b/ More heavy-weight US institutions are offering #BTC products/services to their clients (eg. Goldman Sachs, JPMorgan, Morgan Stanley, US Bank, State Street, CI Global, Wealthfront...)

- NYDIG works with P/C insurers such as Liberty Mutual to launch #BTC-denominated products

- NYDIG works with P/C insurers such as Liberty Mutual to launch #BTC-denominated products

2c/ - Visa intends to use #BTC for cross-border settlements

- Venmo launched crypto purchases

- More overseas listed companies such as Nexon, Meitu allocated #BTC as reserves

- Venmo launched crypto purchases

- More overseas listed companies such as Nexon, Meitu allocated #BTC as reserves

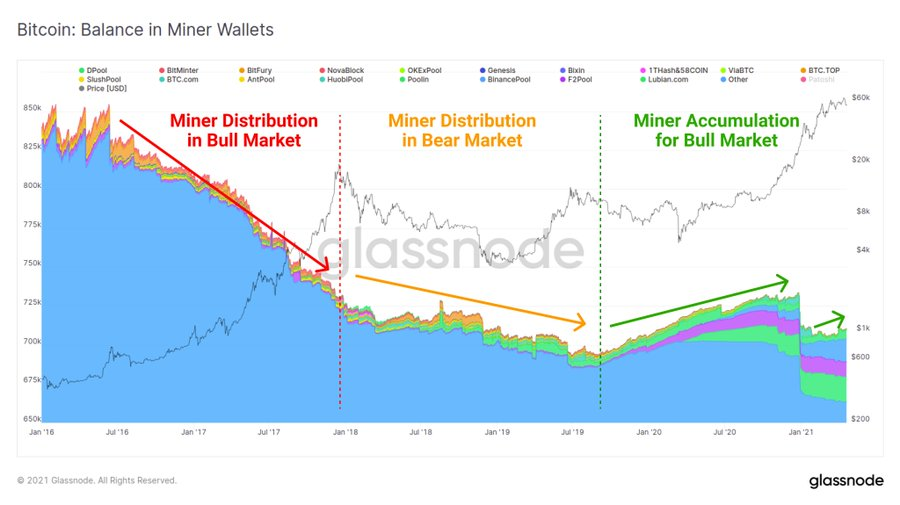

3/ On-chain metrics continue to indicate #BTC is in its bull phase with $BTC's price still having a lot of room to surge.

Miners are not selling, but accumulating #BTC.

Charts: Realized Cap HODL Waves, HODL Waves, Balance in Miners' Wallets

Source: Glassnode

Miners are not selling, but accumulating #BTC.

Charts: Realized Cap HODL Waves, HODL Waves, Balance in Miners' Wallets

Source: Glassnode

4/ The #BTC derivatives markets need to be watched closely.

#BTC options point to a bullish 5/21 w/ put/call ratio at 0.77. Range: $50K-$80K.

#BTC futures OI indicates that current price action is bullish. Funding rates of perpetual swaps are normal with no excessive leverage.

#BTC options point to a bullish 5/21 w/ put/call ratio at 0.77. Range: $50K-$80K.

#BTC futures OI indicates that current price action is bullish. Funding rates of perpetual swaps are normal with no excessive leverage.

5a/ Now, we look at TA.

#BTC broke out of the bull flag on 4/27, but didn't continue its upward push until 4/30 after #BTC options expired. It's consolidating again at $58K. Next resistance is $60K.

The price target as projected by the breakout of the bull flag is $65.5K.

#BTC broke out of the bull flag on 4/27, but didn't continue its upward push until 4/30 after #BTC options expired. It's consolidating again at $58K. Next resistance is $60K.

The price target as projected by the breakout of the bull flag is $65.5K.

5b/ In fact, #BTC has formed an inverse head & shoulder pattern. Neck line is at $57K. The 4/30 confirmed bull flag breakout coincided with the breakout of the inverse H&S pattern. The price target for this pattern is $67K.

5c/ As I tweeted before, #BTC is moving in a manner similar to the fractal in 3/21, but much faster!

Taking the relevant portion of that fractal and apply that to the current price action of BTC, it is expected that #BTC will hit $67K as well (inverse H&S target) around 5/5.

Taking the relevant portion of that fractal and apply that to the current price action of BTC, it is expected that #BTC will hit $67K as well (inverse H&S target) around 5/5.

5d/ We could use Fib extension to estimate the current impulse move of #BTC. This time we do something different & compare the monthly, weekly & daily Fib extensions. Given the most recent #BTC price action, cut off should be at 1.68 Fib.

Price targets: $68K/$74K/$81-$82K

Price targets: $68K/$74K/$81-$82K

5e/ If $BLX on a log scale is used to map out the price action of #BTC. Then,

5/5- $67K

5/11- $70K

5/21- $74K

5/31- $80K

5/5- $67K

5/11- $70K

5/21- $74K

5/31- $80K

6/ Conclusion: 5/21 should be a bullish month for #Bitcoin.

Price targets*:

5/5- $67K

5/11- $70K

5/21- $74K

5/31- $80K

May low: $50K-$55K

*Estimates only & will update as needed.

Price targets*:

5/5- $67K

5/11- $70K

5/21- $74K

5/31- $80K

May low: $50K-$55K

*Estimates only & will update as needed.

* Crypto-friendly Gary Gensler is now the SEC Chair, portending the coming of US #BTC ETFs in 2021?

* CME’s launch of #BTC micro futures on 5/3 could fuel increase in futures OI and price volatility.

• • •

Missing some Tweet in this thread? You can try to

force a refresh