UPDATE ON MARKETS: The FTSE/JSE All Share (JSE) improved by 0.97% during April, bringing the 12-month returns to 36.4%. SA Property stocks (SAPY) saw a MASSIVE recovery during April by gaining 11.68%, while the SA All Bond Index decreased by 1.9% for the period.

2/9

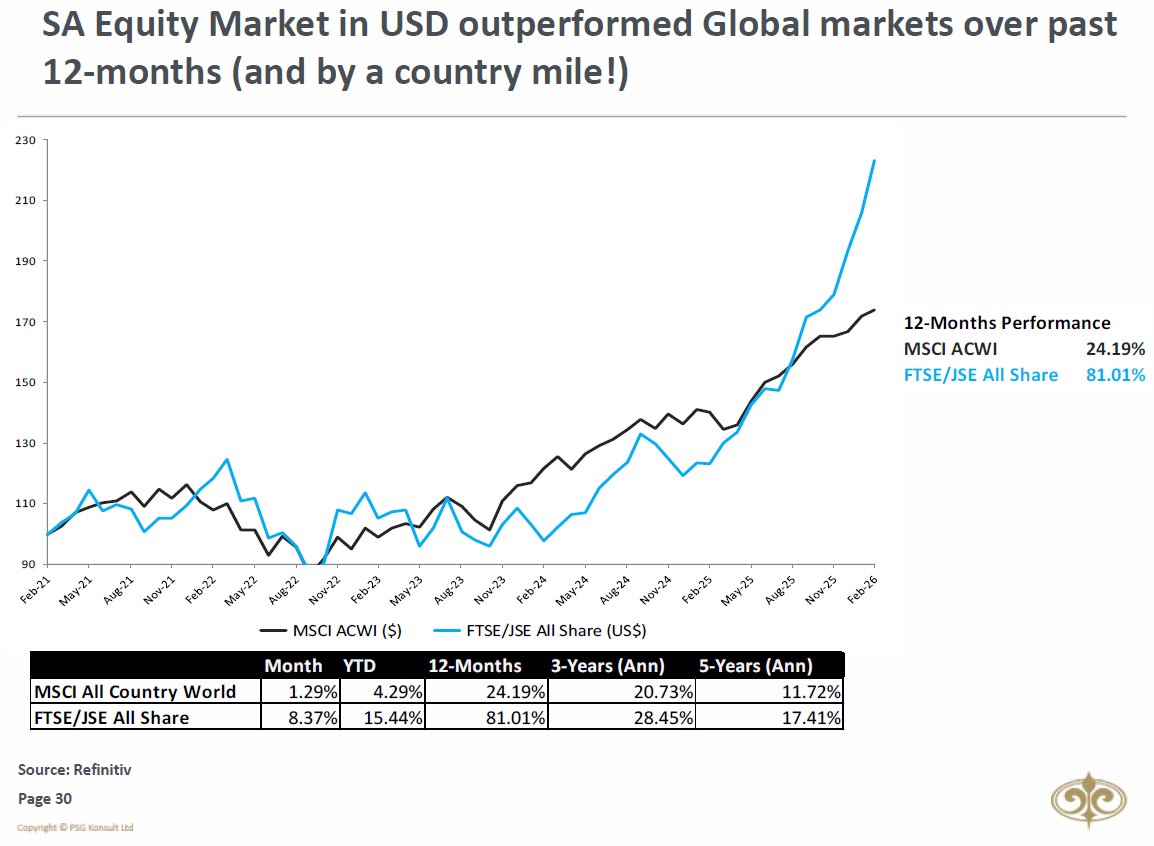

The FTSE/ JSE All Share (+2.84%) had a slower month than the MSCI All Country World Index (+4.37%) in USD terms. It did however managed to outperform the MSCI EM (2.49%). The 12-month performance for the JSE in USD terms still leads the MSCI ACWI’s performance by nearly 30%.

The FTSE/ JSE All Share (+2.84%) had a slower month than the MSCI All Country World Index (+4.37%) in USD terms. It did however managed to outperform the MSCI EM (2.49%). The 12-month performance for the JSE in USD terms still leads the MSCI ACWI’s performance by nearly 30%.

3/9

South African Small Caps again dominated during April, growing by 5.58%. Large Caps and Mid-Caps grew by 0.62% and 2.41%, respectively.

South African Small Caps again dominated during April, growing by 5.58%. Large Caps and Mid-Caps grew by 0.62% and 2.41%, respectively.

4/9

Foreigners were again net buyers of South African Equities in April. They were however net sellers of local bonds.

Foreigners were again net buyers of South African Equities in April. They were however net sellers of local bonds.

5/9

From a sectoral point of view, April saw Resources dominating other sectors. With Naspers/Prosus being the biggest loser in terms of attribution (compared to Capped Swix), saw Industrials lose more than 1% during April.

From a sectoral point of view, April saw Resources dominating other sectors. With Naspers/Prosus being the biggest loser in terms of attribution (compared to Capped Swix), saw Industrials lose more than 1% during April.

6/9

The Rand’s value AGAIN strengthened by 1.9% against the USD. It did however weaken against the Euro over the same period. The Rand again had another great performance month against the other BRICS currency movements. Only Brazil performed better.

The Rand’s value AGAIN strengthened by 1.9% against the USD. It did however weaken against the Euro over the same period. The Rand again had another great performance month against the other BRICS currency movements. Only Brazil performed better.

7/9

The US M2 Money Supply YoY growth rate reached a new all-time high for the eleventh time since early 2020.

The US M2 Money Supply YoY growth rate reached a new all-time high for the eleventh time since early 2020.

8/9

The US Dollar Index again weakened in April and broke below both its 200-day and 50-day Moving Averages. Will still be monitoring a possible Golden-cross in May, which could be positive for the USD technically.

$DXY

The US Dollar Index again weakened in April and broke below both its 200-day and 50-day Moving Averages. Will still be monitoring a possible Golden-cross in May, which could be positive for the USD technically.

$DXY

9/9 & Final

Most commodities enjoyed a great month during April. Palladium was the biggest winner, gaining 13.56% to all-time new highs. Copper wasn’t too far off by gaining 11.85% over the same period

“Sell in May and go Away” - with all the good news, one would be VERY brave!

Most commodities enjoyed a great month during April. Palladium was the biggest winner, gaining 13.56% to all-time new highs. Copper wasn’t too far off by gaining 11.85% over the same period

“Sell in May and go Away” - with all the good news, one would be VERY brave!

Unroll @threadreaderapp

• • •

Missing some Tweet in this thread? You can try to

force a refresh