The @USNavyCNO in his testimony #HASC placed #sealift for @US_TRANSCOM @MSCSealift @DOTMARAD as the second strategic area for the ship construction budget, behind Columbia SSBN.

His concept is to buy old versus build new.

This is the WRONG APPROACH.

1/

appropriations.house.gov/events/hearing…

His concept is to buy old versus build new.

This is the WRONG APPROACH.

1/

appropriations.house.gov/events/hearing…

2/The @USNavyCNO notes that it would cost $300-500 million to obtain new ships, vice used ships at $20-25 million with 20 years of life. Here is what is wrong with that statement.

First, their market analysis has alerted the ship owners of US government interest...

First, their market analysis has alerted the ship owners of US government interest...

3/This interest, along with a massive uptick in commercial market, will make ships much more expensive plus conversion costs.

Second, this follows what was done after 1991, when @DOTMARAD added ro/ros to their fleet. Ships built back then had longer service lives than today...

Second, this follows what was done after 1991, when @DOTMARAD added ro/ros to their fleet. Ships built back then had longer service lives than today...

4/Used ships today will not have 20 years of service life left, unless they are brand new.

Third, this merely kicks the can down the road & prioritizes money for warships over #sealift. The Navy attempted to correct this with the CHAMP program to build a common hull...

Third, this merely kicks the can down the road & prioritizes money for warships over #sealift. The Navy attempted to correct this with the CHAMP program to build a common hull...

5/OMB balked at the $1.2B price per hull. When the Navy needed auxiliaries in the past, they procured them from the commercial market - look at the auxiliaries in WWI, WWII, & Cold War.

The @USNavyCNO should be the loudest advocate for commercial shipbuilding in the U.S...

The @USNavyCNO should be the loudest advocate for commercial shipbuilding in the U.S...

6/If the US was building commercial ro/ros, containerships and tankers, they could take those ships in hand and convert them into oilers, tenders, support ships, and myriad of other designs. Look at @DOTMARAD NSMVs for the maritime training academies.

7/The decision made in the 1980s to end construction and operations differentials have come back to haunt the US Navy and merchant marine. OpDiffs were restored - minimally - in 1996 with the Maritime Security Program, but ConstDiffs have not...

8/This decision has led to Korea, Japan, and China dominating the commercial shipbuilding sector with 92.5% of world construction. The US is at 0.2%.

This bifurcation between the military and industry has magnified the shipbuilding issues within the Navy...

This bifurcation between the military and industry has magnified the shipbuilding issues within the Navy...

9/Yet, there are advocates in the US calling for ending any remaining support to the US maritime sector and shifting the remaining commercial base and infrastructure offshore. One only needs to see Chinese shipyards with new warships being built alongside commercial vessels...

10/Yes, used foreign ships alleviate the immediate shortfall addressed by @US_TRANSCOM in #sealift. However, failure to invest in domestic ship construction will further erode the ability of the @USNavy to field viable and successful warships in the future...

11/Which nation is the better at executing Sea Power?

The US with the #1 Navy & the #21 merchant marine

OR

China with the #2 Navy, the #2 merchant marine & the largest shipbuilding infrastructure?

The US with the #1 Navy & the #21 merchant marine

OR

China with the #2 Navy, the #2 merchant marine & the largest shipbuilding infrastructure?

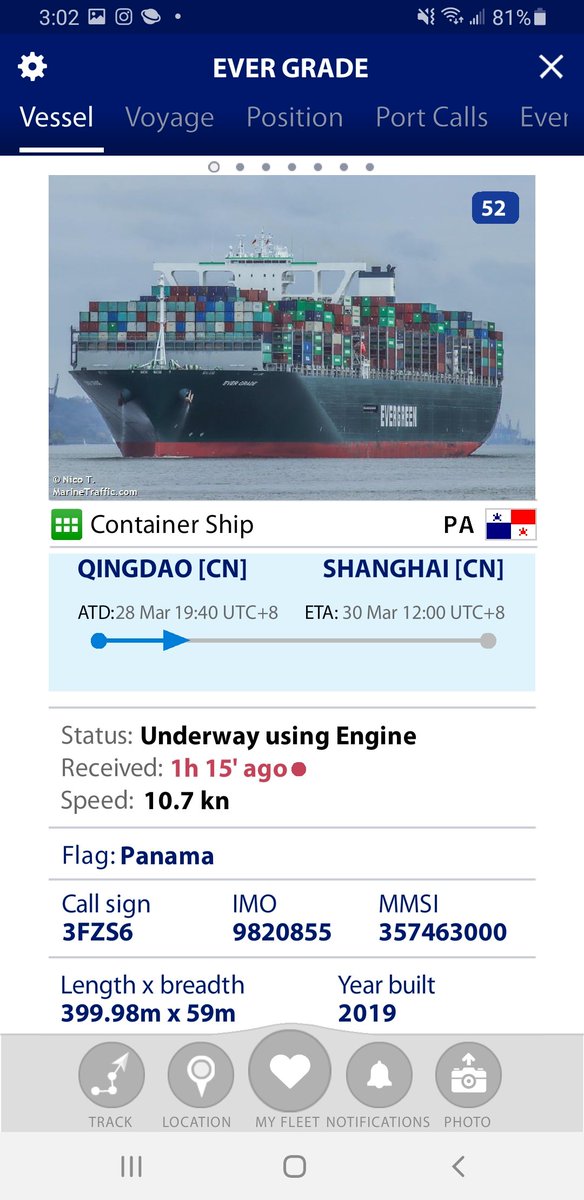

A year ago, ships were laid up. Now they are back up and running meaning that cost for these vessels will increase, or the ones that are the most suitable for military application may be unavailable due to commercial needs.

maritime-executive.com/article/wallen…

maritime-executive.com/article/wallen…

• • •

Missing some Tweet in this thread? You can try to

force a refresh