2/ A common “knock” on Bitcoin is that it is “too volatile”.

However, volatility isn’t necessarily a bad thing. In fact, volatility creates opportunity.

However, volatility isn’t necessarily a bad thing. In fact, volatility creates opportunity.

3/ Volatility and return can be assessed using something called the Sharpe Ratio, a risk adjusted return. The Sharpe ratio divides the asset return by the risk / volatility over a 4 year HODL period.

4/ Bitcoin’s Sharpe ratio has been higher than every other asset class.

This is one of Wall Street’s favorite financial metrics screaming “buy bitcoin”, as it shows that the return of holding bitcoin more than compensates you for the historical downside volatility.

This is one of Wall Street’s favorite financial metrics screaming “buy bitcoin”, as it shows that the return of holding bitcoin more than compensates you for the historical downside volatility.

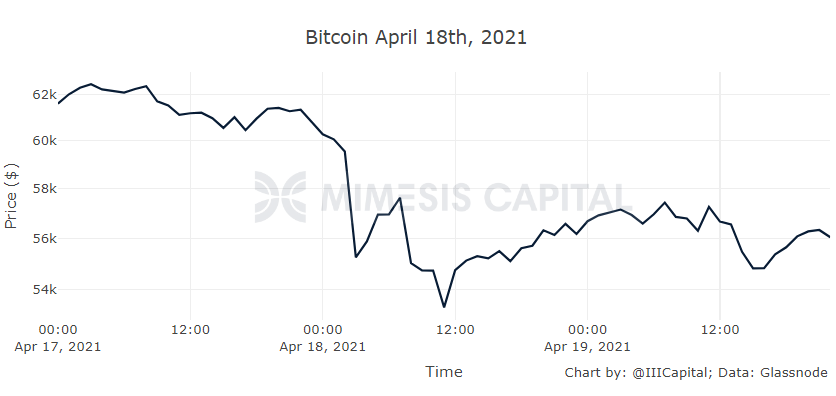

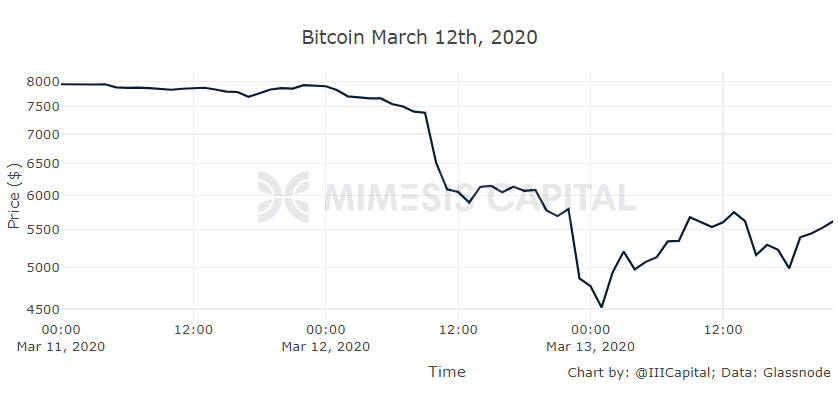

5/ But why does bitcoin have these large sudden moves down in price? What is causing this massive correction in such little time?

6/ Unlike equities (stocks), which tend to be traded aggressively on earnings days (days when the performance and future guidance of the company fundamentally changes), bitcoin tends to trade aggressively on seemingly random days.

7/ Most large sudden moves down are simply driven by excess leverage.

https://twitter.com/parkeralewis/status/1385594419143843841?s=20

8/ As @WClementeIII explained, it is similar to a Jenga tower built on a fragile base.

If funding rates and the futures contango are extremely high without significant buying pressure in the spot market, the Jenga tower only needs a little push before it crashes down.

If funding rates and the futures contango are extremely high without significant buying pressure in the spot market, the Jenga tower only needs a little push before it crashes down.

9/ Ugly feedback loop

1. Price falls.

2. Highly leveraged longs get liquidated.

3. Price falls further.

4. Less leveraged longs get liquidated.

5. Traders see falling prices and jump on the trend.

6. Price falls.

7. Repeat until the fragility of systemic leverage is eliminated.

1. Price falls.

2. Highly leveraged longs get liquidated.

3. Price falls further.

4. Less leveraged longs get liquidated.

5. Traders see falling prices and jump on the trend.

6. Price falls.

7. Repeat until the fragility of systemic leverage is eliminated.

10/ This imbalance, driven by excessive leverage, results in volatility. This volatility results in coins getting transferred from weak hands to strong hands that understand bitcoin. After weak hands sell out, price must adjust to the new equilibrium.

11/ A new base of strong holders is built on a more sustainable price level and then bitcoin’s parabolic bull run continues as it has for more than a decade.

• • •

Missing some Tweet in this thread? You can try to

force a refresh