1) Let's talk about Tencent Music ($TME) which at a market cap of $29.5bn is the largest music platform in China.

Its strategies for success, positioning and where its future is.

Its strategies for success, positioning and where its future is.

2) Tencent Music today is a consolidated entity between three big music brands QQ music, KuGuo and Kuwo (and a few smaller brands).

Each of these brands has a different positioning from its legacy user base. Though an inorganic evolution, this is great brand strategy

Each of these brands has a different positioning from its legacy user base. Though an inorganic evolution, this is great brand strategy

3)

- KuGuo - blue-collar, 25-30 year old

- QQ music - White-collar professionals, students

- Kuwo - Married 30-40 year olds typically has kids

Each of these groups has different purchasing capacity, interests and music interests. Having sub-brands allows more precise targeting

- KuGuo - blue-collar, 25-30 year old

- QQ music - White-collar professionals, students

- Kuwo - Married 30-40 year olds typically has kids

Each of these groups has different purchasing capacity, interests and music interests. Having sub-brands allows more precise targeting

4) Tencent Music's consolidation needs and ultimate winning strategy versus its thousands of competitors is similar to the paths take by Spotify versus Grooveshark and Kazaa.

They focused on acquiring music license rights before users

They focused on acquiring music license rights before users

5) Back in the early 2010s, copyright laws in China weren't respected nor enforced and thousands of music platforms were floating around. Tencent and Kuguo music were focused on doing things by the book from the beginning (helped that Kuguo's founder was an ex-lawyer).

6) Both of them slowly amassed large catalogue rights and when better copyright laws came into place in China. Flooded the competition with lawsuits (or pointed music studios in the right direction).

Take the moats where you can get them.

Take the moats where you can get them.

7) In the end it made more sense to join forces rather than fight it out as two entities - so Tencent and Kuguo merged. Netease Music in second position ( MAU is 25% of TME) as Baidu and Ali (with their Shrimp music) slowly ceded the stage as celebrities all signed to TME.

8) The biggest boon was undoubtedly Jay Chou moving to TME in 2018. Jay Chou's star power can not be understated in China. He is the post 90 and 80s Chinese generation's Taylor Swift. Today his monosyllabic mug still grace the ads up and down Shanghai's streets

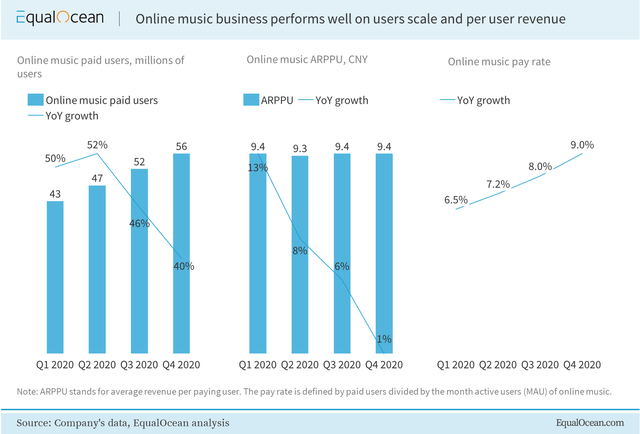

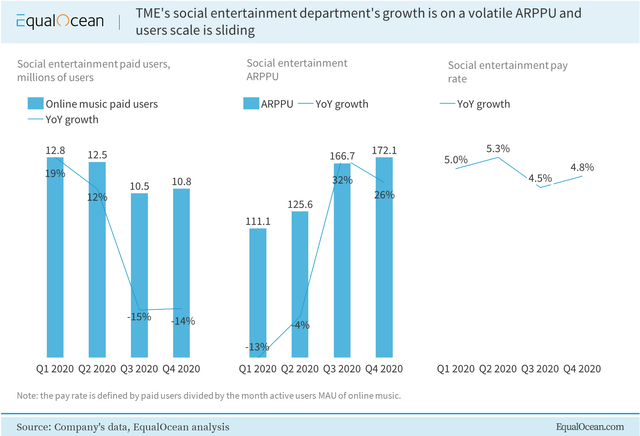

9) While TME has a strong market position, user growth is slowing down across the music industry. As such they are looking for the next avenues of growth in the form of livestreaming tipping, online karaoke and offline performances

10) So who's TME's biggest competitor? I think not Netease, but really Douyin / Tiktok and Kuaishou. Once you move into entertainment you are in competition with all other forms of entertainment. Also these other forms of entertainment are free and bit-sized

11) I'm also personally thinking TME could be next on the anti-monopoly regulation list, having that much market share is a concern. Netease music has been suitable noises in this direction

Writing these Chinese tech threads for the rest of May, follow me to get these spams on your TL.

• • •

Missing some Tweet in this thread? You can try to

force a refresh