"Mailed money" has changed the personal income landscape of the US. PI shot up to $24 trillion, 27% yoy. We have never seen anything close to this before.

Wages are the largest component of PI. Econ argue against inflation without wage gains, stimulus has filled that gap.

(1/6)

Wages are the largest component of PI. Econ argue against inflation without wage gains, stimulus has filled that gap.

(1/6)

To further underscore how much this stimulus has meant, the next chart shows that 33.8% of all personal income in the last year was “mailed” from the federal government.

This even exceeds to records set with last year’s CARES Act.

(2/6)

This even exceeds to records set with last year’s CARES Act.

(2/6)

The next chart shows a rolling four-week sum into both stock and bond mutual funds and ETFs. It suggests a great deal of these savings have moved from deposit accounts at banks and into financial markets.

(4/6)

(4/6)

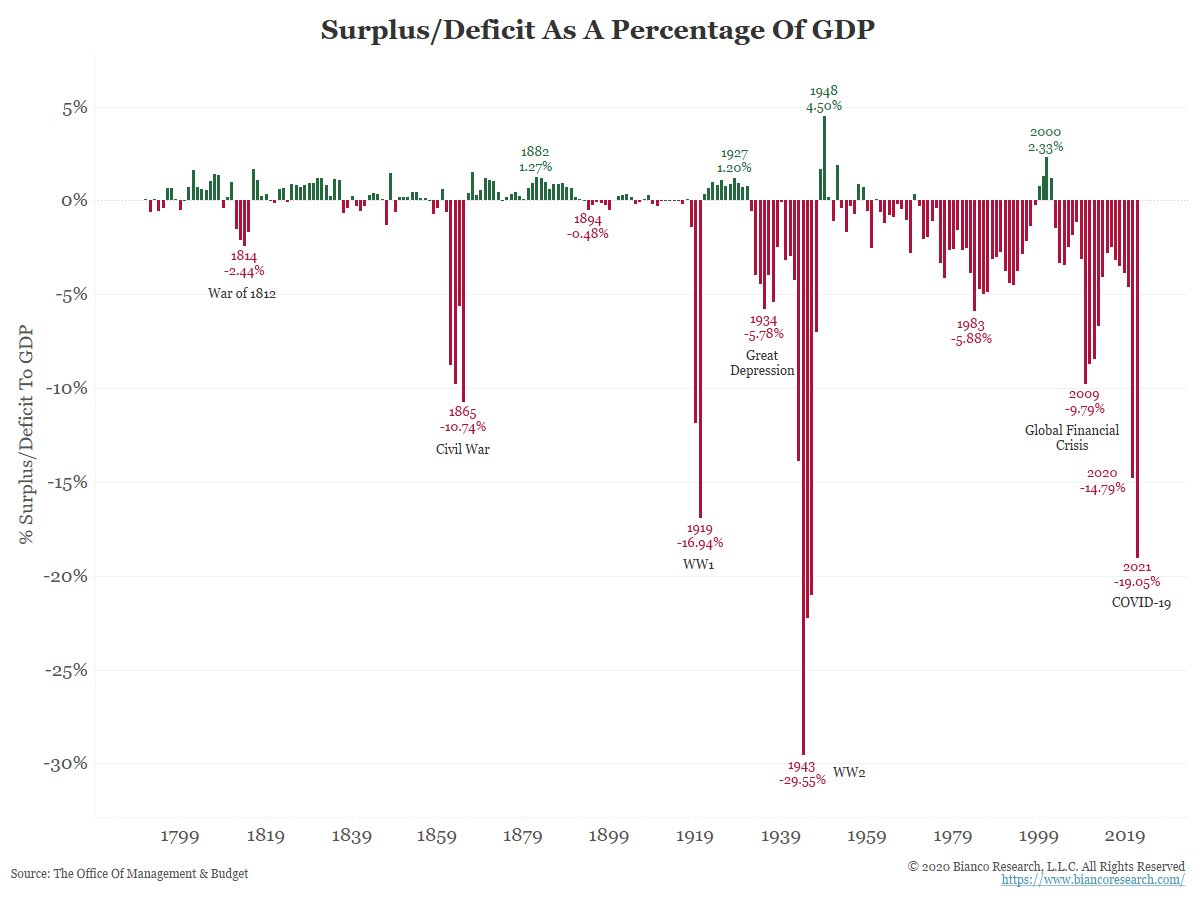

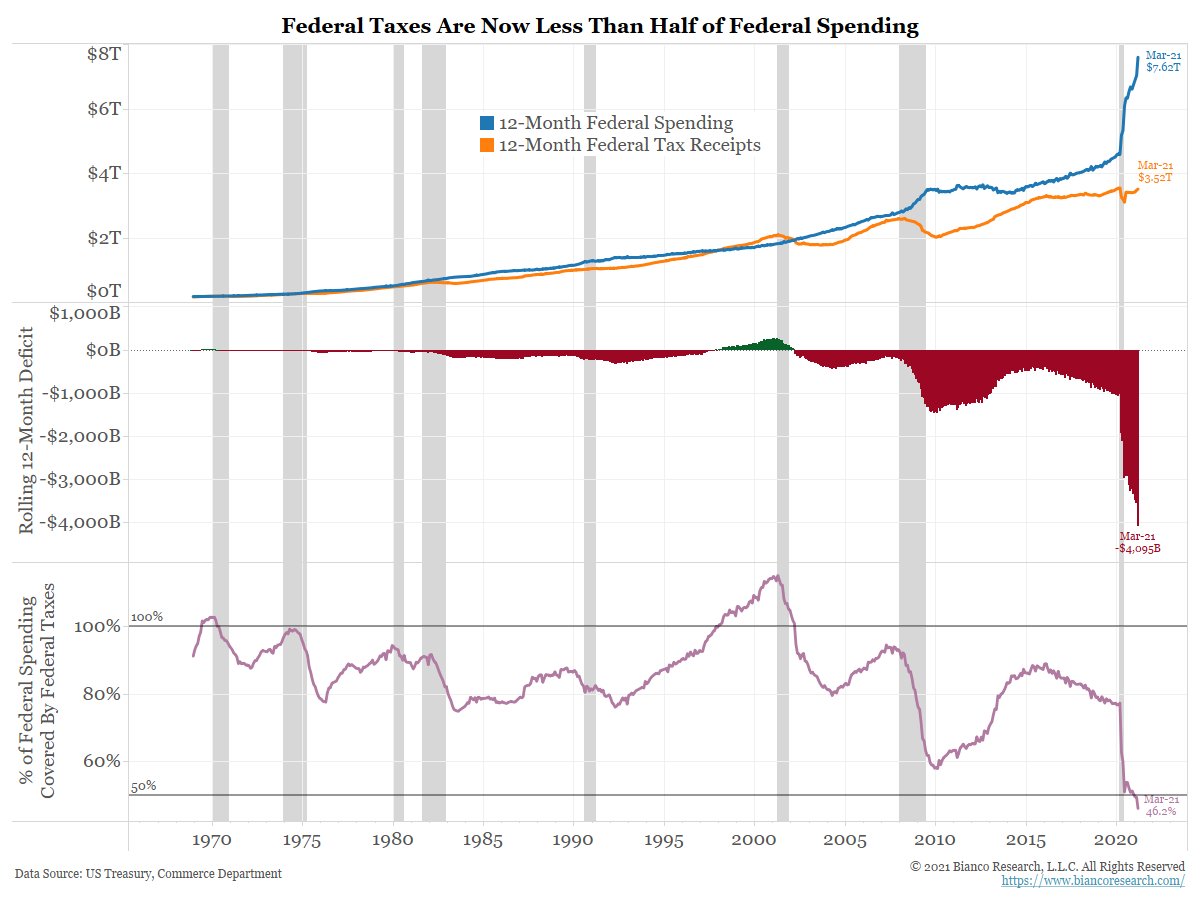

We have argued that 2021 will be the year of inflation. Mail money and people will eventually spend it. And in the last year, the federal government has mailed over one-third of all the income Americans earned, an amount that was inconceivable pre-pandemic.

(5/6)

(5/6)

Thus far, this quasi MMT/UBI has not clearly shown any adverse effects.

So, if everyone wins, coupled with a D controlled federal government, we would expect more of the same. It will only stop when we have gone too far and it produces an adverse outcome, inflation.

(6/6)

So, if everyone wins, coupled with a D controlled federal government, we would expect more of the same. It will only stop when we have gone too far and it produces an adverse outcome, inflation.

(6/6)

• • •

Missing some Tweet in this thread? You can try to

force a refresh