Loving this chart from BCG: 120 equipment manufacturers active in upstream and downstream of hydrogen.

Source: bcg.com/en-gb/publicat…

Source: bcg.com/en-gb/publicat…

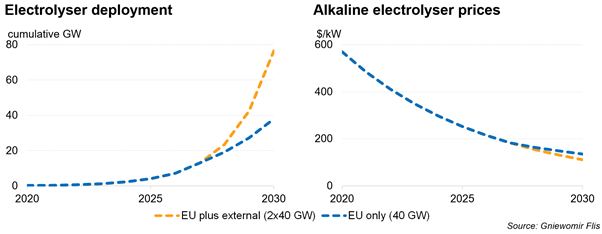

Electrolysers are the single biggest market. OEMs active across electrolysers and fuel cells can leverage manufacturing synergies to accelerate the cost curve for competitive advantage.

But stack manufacturing synergies will only get you so far. Balance of plant can account for as much as half of electrolyser system costs.

Important savings can come from closer coupling of electrolysers with renewable energy sources. Just yesterday @nelhydrogen announced its partnership with @FirstSolar

nelhydrogen.com/press-release/…

nelhydrogen.com/press-release/…

I reckon the last companies standing at the end of the hydrogen battle royale will be those that:

1) Multiply manufacturing experience across upstream and downstream

2) Minimise balance of plant through embedded coupling with solar

1) Multiply manufacturing experience across upstream and downstream

2) Minimise balance of plant through embedded coupling with solar

No coincidence that world's largest PV manufacturer, Chinese Longi Solar, is looking to get into hydrogen

bloomberg.com/news/articles/…

bloomberg.com/news/articles/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh