Amazon’s latest corporate filings in Luxembourg revealed that the company collected record sales income of €44bn (£38bn) in Europe last year, but did not have to pay any corporation tax to the U.K., @guardian reports. theguardian.com/technology/202…

This year, countries are expected to negotiate a global minimum corporate tax scheme and digital tax reform at the OECD in order to get big tech companies and multinationals to “pay their fair share and do so in the right place.” icij.org/inside-icij/20…

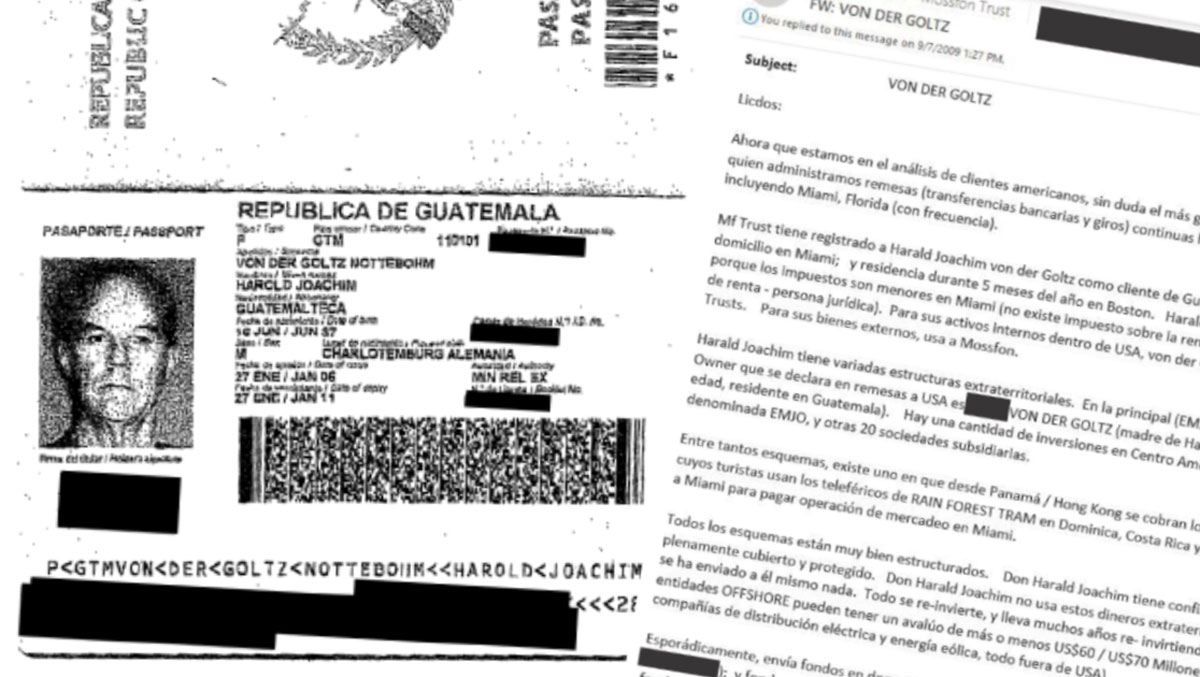

ICIJ's #LuxLeaks investigation brought attention to Luxembourg's role as a corporate tax haven for multinational companies that cut deals around complex financial structures designed to create drastic tax reductions. icij.org/investigations…

Here's a video explainer of some of the more common tax schemes we were seeing in the #LuxLeaks files:

• • •

Missing some Tweet in this thread? You can try to

force a refresh