1) Let's talk about the international investment strategy of Tencent and Alibaba (and how this differs from their domestic strategy).

Both are kingmakers in the Chinese ecosystem as they bring value-add. But how does this translate once they turn towards international markets?

Both are kingmakers in the Chinese ecosystem as they bring value-add. But how does this translate once they turn towards international markets?

2) Domestically, Tencent and Alibaba are tier 1 investors in the Chinese VC system. What they bring to the table is traffic in the form of being allowed access to closed garden ecosystems.

Non-Tencent invested companies (aka Douyin) are cut off from sending links on wechat.

Non-Tencent invested companies (aka Douyin) are cut off from sending links on wechat.

3) They are still 'strategic investors' at the end of the day, and similar to CVCs of the West, investment decisions will involve both financial and strategic considerations.

Their investment decisions will typically involve input from both business units and the investments.

Their investment decisions will typically involve input from both business units and the investments.

4) As we know, both Tencent and Alibaba have highly varied diversified business units. In China, though from the outset their investment patterns seemed varied, there's always a link to one area of the domestic business.

So nascent bets in areas like SaaS or semis make sense.

So nascent bets in areas like SaaS or semis make sense.

5) International investment is a slightly different story and strategy.

Both firms go back to their core competencies in the international market and some good old time machine management theory.

Both firms go back to their core competencies in the international market and some good old time machine management theory.

https://twitter.com/lillianmli/status/1308426990836428802

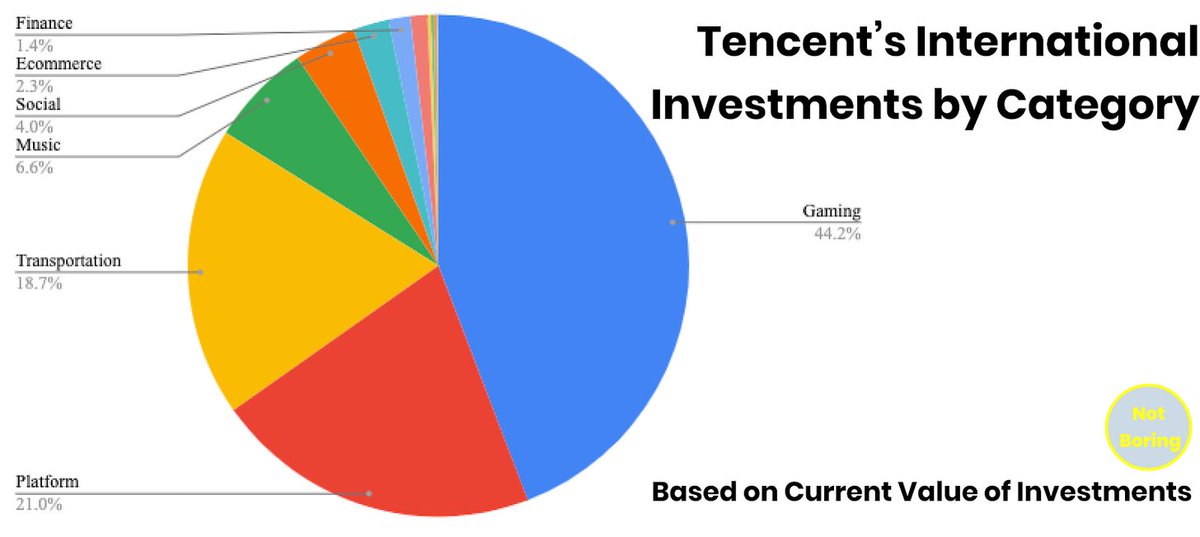

6) For Tencent, they are a social network and investment firm that monetises through media, (specifically games).

For their investment strategy gaming and various other types of media enablers (digital rights and IP in the form of Pex and Petsnap) are top of mind.

For their investment strategy gaming and various other types of media enablers (digital rights and IP in the form of Pex and Petsnap) are top of mind.

7) They own significant shares in Epic, Ubisoft, Activate Blizzard, Supercell and a lot more. Investment in these gaming companies allows Tencent to bring that sweet sweet IP back to China and make more monies (also a win-win for the investee company).

8) They'll also invest in areas that they know well such as social messaging platforms (such as mail. ru in Russia, Snap in Us and Kaokao in Korea), superapps (Sea in SEA), communities (Discord, Reddit).

9) Also I assume it's whatever Martin Lau's GS banker friends tell him is hot and raising a growth round, Telsa and Lilium are slight headscratchers. For granularity on this, recommend @packym's excellent list of Tencent investment

docs.google.com/spreadsheets/d…

docs.google.com/spreadsheets/d…

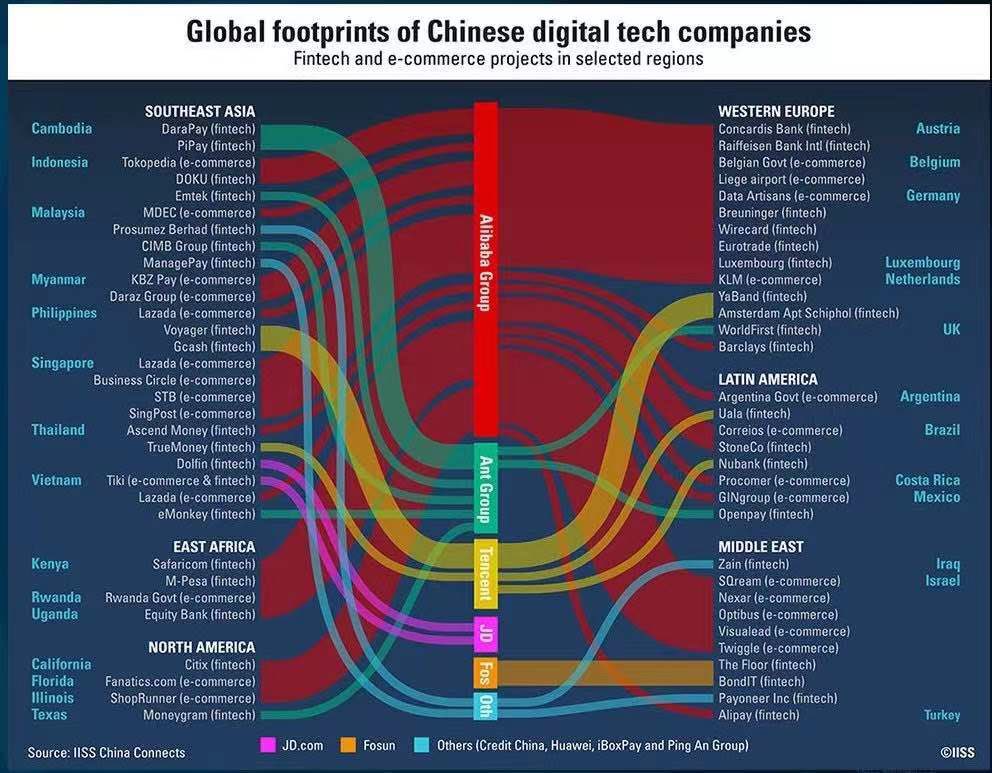

10) Alibaba and its affliate Ant Group's investment strategy has leaned heavily on e-commerce and payment from day one.

They have an existing merchant base who are looking to go overseas at home, and they also know a thing or two about e-commerce and payments.

They have an existing merchant base who are looking to go overseas at home, and they also know a thing or two about e-commerce and payments.

11) Payment is highly localised due to regulations and having a large international portfolio allows Alibaba to better 'partner' aka seal with an investment, with local payment providers.

Selected projects below(not all are investment, India is left out):

Selected projects below(not all are investment, India is left out):

12) The motto for Alibaba is to make it easy to do business anywhere, and they hold global ambitions. They've focused on SEA and Europe for now (based partly on the one road and one belt mapping somewhat).

13) Alibaba will probably have a decision of buy, built or partner strategy for each region and investment is a strong partnering card. They might also consider acquisition too after a while. (case study: Lazada)

14) South East Asia has been the hot investment area for Tencent and Alibaba for the past few years. Europe is heating up as the next stop (Ant is opening up a fintech fund in Berlin). US is too much of a hot button topic right now.

15) I'm very curious to see how these two players do internationally. From a large stage war chest perspective, there's not many firms internationally that can write a few checks in the hundreds of millions easily. But not there's not that many of those deals around.

16) So they'll probably go earlier and face more competition. Will their brands hold enough sway now that they aren't able to bring the same level of value add? For their core areas of gaming and e-commerce, this has not been a problem but curious to whether this changes

I'm writing threads like this for the rest of May, follow me if you'd like these to spam your TL

• • •

Missing some Tweet in this thread? You can try to

force a refresh