1/ Having followed PayPal for 5 years as a public investor - such an underrated example of biz transformation.

IPO at $40B in 2015, today worth $300B+

Just had their fastest growth quarter as a public company.

Some of what's happened 👇

IPO at $40B in 2015, today worth $300B+

Just had their fastest growth quarter as a public company.

Some of what's happened 👇

2/ It all started with the Choice agreement - which Dan Schulman (CEO) & Bill Ready (COO) signed with card networks in 2016.

Visa / PayPal used to be enemies - bcuz PYPL would steer customers to fund payments with ACH

Lower funding cost = higher margin

vox.com/2016/5/25/1176…

Visa / PayPal used to be enemies - bcuz PYPL would steer customers to fund payments with ACH

Lower funding cost = higher margin

vox.com/2016/5/25/1176…

3/ In July 2016 - PayPal reached a truce with Visa - to stop steering customers towards funding w bank accounts.

Investors and hedge funds freaked out.

They thought gross margins would collapse in the short term.

pymnts.com/news/payment-m…

Investors and hedge funds freaked out.

They thought gross margins would collapse in the short term.

pymnts.com/news/payment-m…

4/ But Dan and Bill had the foresight to see how this would grow the pie.

Consumers loved cards

+ new partners for distribution.

As a result - this massively accelerated PayPal's reach.

Gross margins did compress - but more than offset by higher usage and new customer growth.

Consumers loved cards

+ new partners for distribution.

As a result - this massively accelerated PayPal's reach.

Gross margins did compress - but more than offset by higher usage and new customer growth.

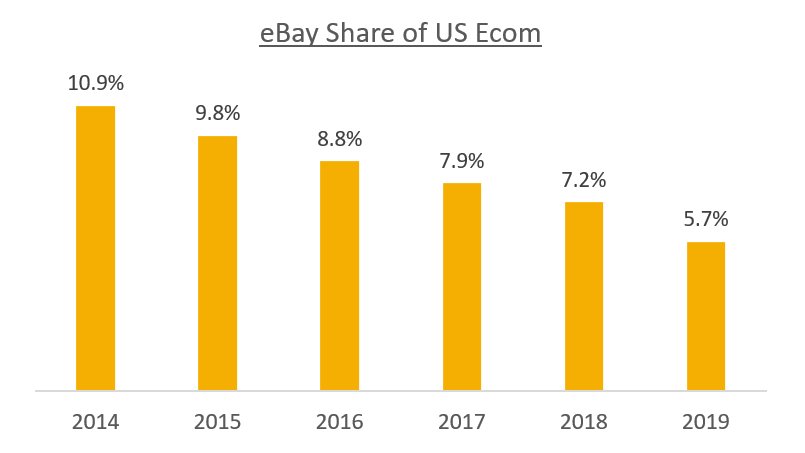

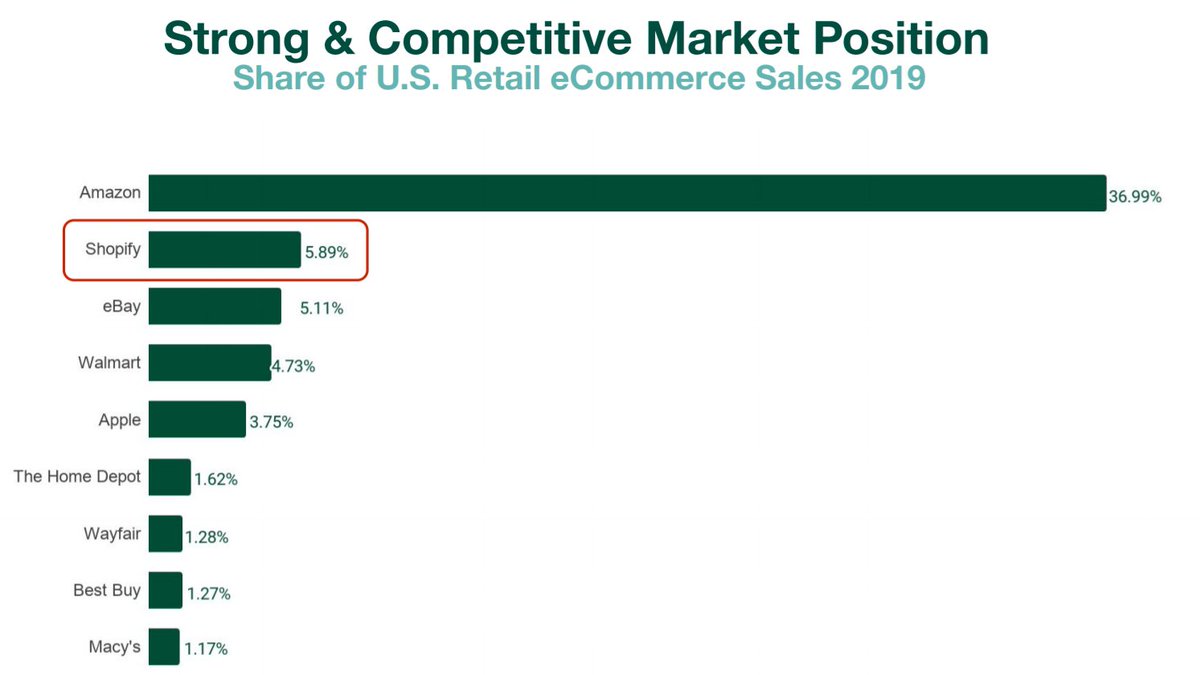

5/ Investors also used to worry about the eBay concentration.

PayPal was owned by ebay for over a decade - and was spun out.

In 2015, eBay was 20% of the volumes, even higher as % of revenue.

PayPal was owned by ebay for over a decade - and was spun out.

In 2015, eBay was 20% of the volumes, even higher as % of revenue.

6/ When eBay announced they would be transitioning off PayPal in Jan 2018 (to Adyen) - investors once again freaked out.

eBay was ~15% of volumes, and ~20% of revenues.

vox.com/2018/1/31/1695…

eBay was ~15% of volumes, and ~20% of revenues.

vox.com/2018/1/31/1695…

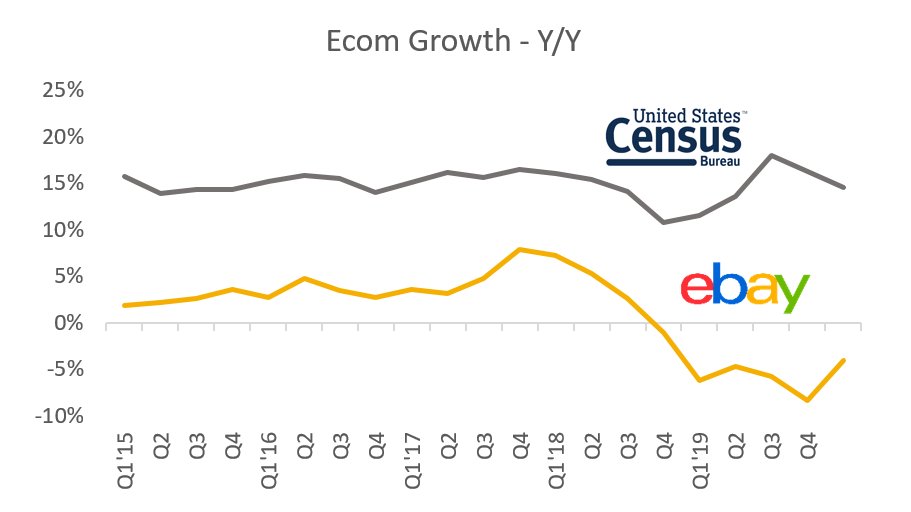

7/ What was quietly happening was the non-eBay business was growing at a rapid pace (~30% annually).

This drove mix shift away from eBay.

By the time eBay rolled off in 2020 (contractually), it was down to 8% of volumes.

This drove mix shift away from eBay.

By the time eBay rolled off in 2020 (contractually), it was down to 8% of volumes.

8/ At the same time company accelerated the push into new areas.

Global expansion

Venmo

QR Codes

Crypto

Buy now pay later

Shopping rewards

Physical POS

All these diversified the biz and grew ways to engage w customers and merchants.

Global expansion

Venmo

QR Codes

Crypto

Buy now pay later

Shopping rewards

Physical POS

All these diversified the biz and grew ways to engage w customers and merchants.

9/ Result of all this is over the last 5 years from 2015-2020:

>3x volumes

>2x revenues

~3x free cash flow

This is an incredible feat - achieved even as payments landscape has only seen more competition...

from Apple, Amazon, Adyen, Stripe, Checkout, Afterpay, Affirm + others.

>3x volumes

>2x revenues

~3x free cash flow

This is an incredible feat - achieved even as payments landscape has only seen more competition...

from Apple, Amazon, Adyen, Stripe, Checkout, Afterpay, Affirm + others.

10/ PayPal is now guiding to 750M+ global users and $50B+ revenue by 2025.

Now a $300B market cap company, consistently growing revenue >20%.

All the while incredibly profitable, expanding margins...

And no real anti trust risk like much else in big tech

Now a $300B market cap company, consistently growing revenue >20%.

All the while incredibly profitable, expanding margins...

And no real anti trust risk like much else in big tech

11/ Reminds me of what Satya Nadella did with Microsoft.

Dan took a legacy asset poorly run by eBay and transformed it.

Turned enemies into partners.

Modernized the tech stack.

Accelerated product releases.

Made the company relevant again to hundreds of M of people globally.

Dan took a legacy asset poorly run by eBay and transformed it.

Turned enemies into partners.

Modernized the tech stack.

Accelerated product releases.

Made the company relevant again to hundreds of M of people globally.

• • •

Missing some Tweet in this thread? You can try to

force a refresh