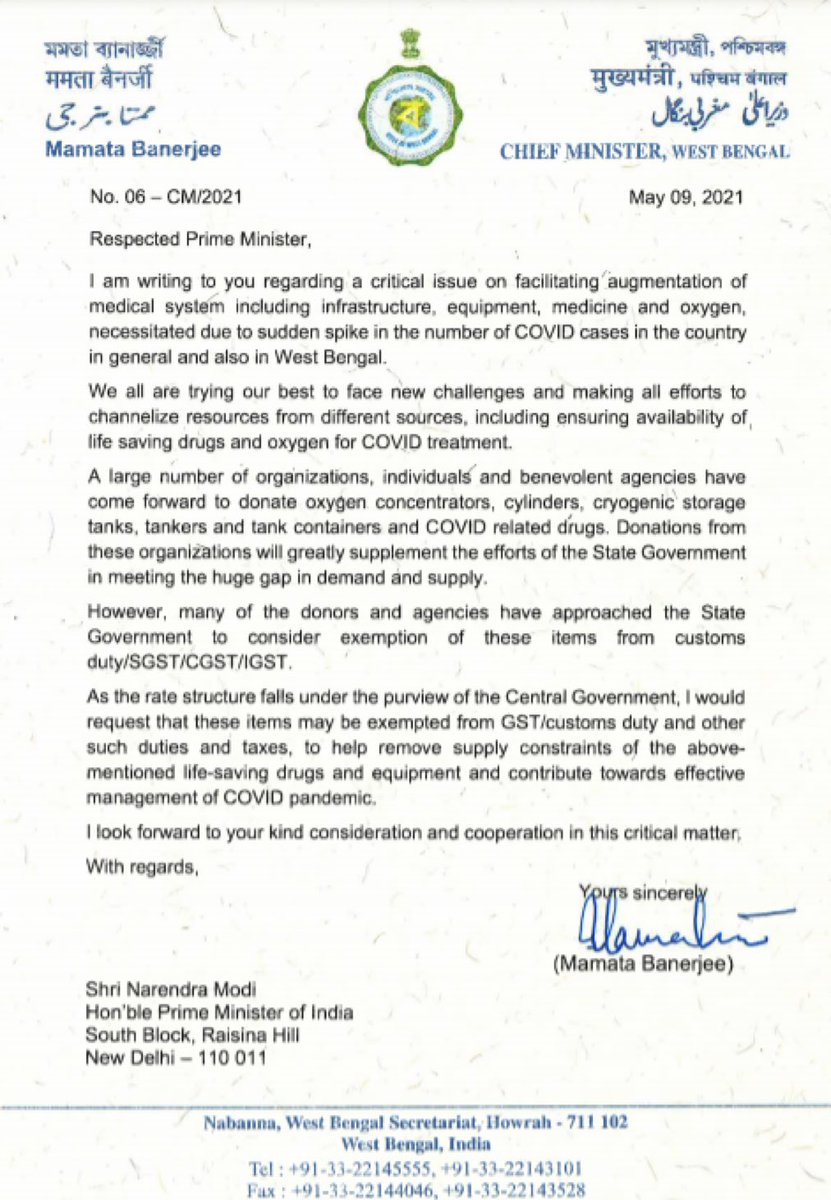

1/ Hon. CM of West Bengal @MamataOfficial has written to the Hon @PMOIndia seeking exemption from GST/Customs duty and other duties and taxes on some items and COVID related drugs.

My response is given in the following 15 tweets.

@ANI @PIB_India @PIBKolkata

My response is given in the following 15 tweets.

@ANI @PIB_India @PIBKolkata

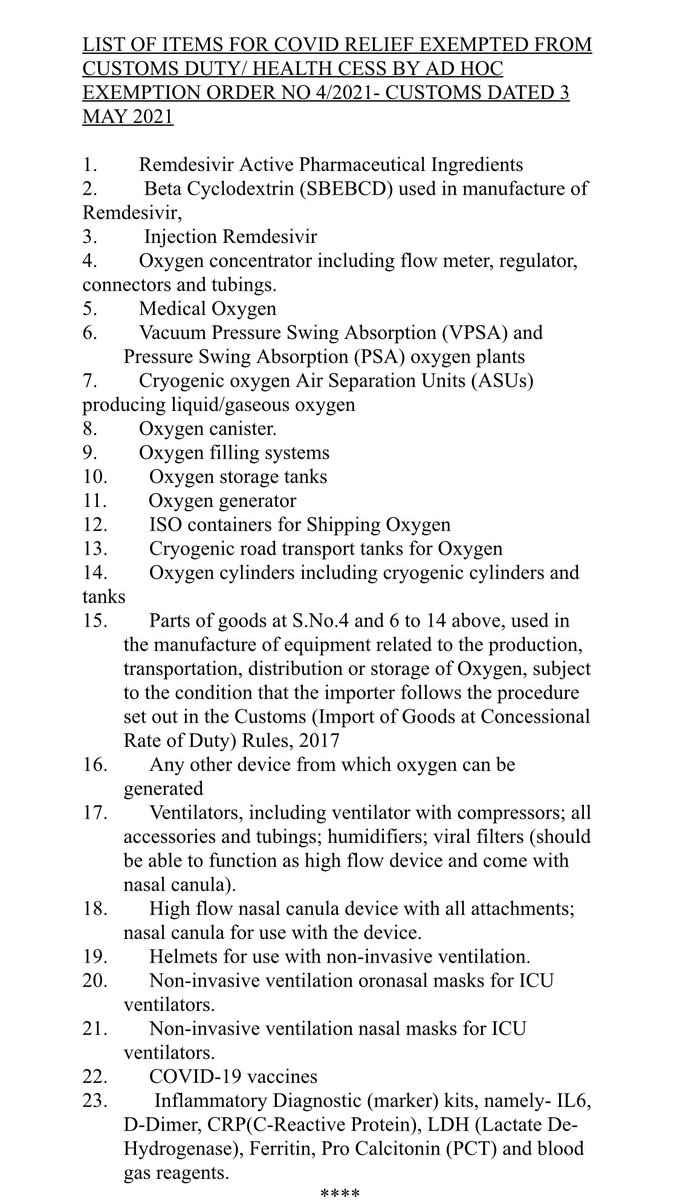

2/ A list of items for COVID relief granted exemption from IGST for imports was issued on 3rd May’21. These were given exemption from Customs Duty/health cess even earlier.

Hon. CM @MamataOfficial , may notice that items in your list are covered.

@ANI @PIB_India @PIBKolkata

Hon. CM @MamataOfficial , may notice that items in your list are covered.

@ANI @PIB_India @PIBKolkata

3/ Full exemption from Customs duties, including IGST, is already available to ALL COVID relief material (not confined to a list) imported by @IndianRedCross for free distribution in the country.

@ANI @PIB_India @PIBKolkata

@ANI @PIB_India @PIBKolkata

4/ With effect from 3 May, 2021, full exemption from all duties has been provided to Remdesivir injections, Remdesivir API, and for a chemical for the manufacture of this drug.

@ANI @PIB_India @PIBKolkata

@ANI @PIB_India @PIBKolkata

5/ Also to Medical Oxygen, equipment used for the manufacture, storage and transportation of oxygen, equipment used for providing oxygen therapy to COVID patients such as Oxygen Concentrators, Ventilators, Non-invasive oxygen masks etc.

@ANI @PIB_India @PIBKolkata

@ANI @PIB_India @PIBKolkata

6/ Also to Inflammatory diagnostic kits and reagents for COVID testing and COVID vaccines.

@ANI @PIB_India @PIBKolkata

@ANI @PIB_India @PIBKolkata

7/ This exemption applies to all above mentioned goods when imported free of cost for free distribution in the country by any entity, State Govt, relief agency or autonomous body on the basis of a certificate issued by a State Government.

@ANI @PIB_India @PIBKolkata

@ANI @PIB_India @PIBKolkata

8/ In order to augment the availability of these items, Government has also provided full exemption from basic customs duty and health cess to their commercial imports.

@ANI @PIB_India @PIBKolkata

@ANI @PIB_India @PIBKolkata

9/ GST at rates varying from 5% (on vaccines), 12% (COVID drugs, oxygen concentrators) is applicable to domestic supplies and commercial import of these items.

@ANI @PIB_India @PIBKolkata

@ANI @PIB_India @PIBKolkata

10/ If IGST ₹100 is collected on an item, ₹50 accrues to the Centre and the States each as CGST and SGST respectively. Further 41% of the CGST revenue is devolved to States.

So out of a collection of ₹100, as much as ₹70.50 is the States’ share.

ANI @PIB_India @PIBKolkata

So out of a collection of ₹100, as much as ₹70.50 is the States’ share.

ANI @PIB_India @PIBKolkata

11/ If full exemption from GST were given, the domestic producers of these items would be unable to offset taxes paid on their inputs and input services and would pass these on to the end consumers by increasing their price.

@ANI @PIB_India @PIBKolkata

@ANI @PIB_India @PIBKolkata

12/ COVID vaccines are being provided free of cost by the GoI to those who are 45 yrs of age & above and to all frontline workers.

On Government supplies, GST is also paid by the Government.

@ANI @PIB_India @PIBKolkata

On Government supplies, GST is also paid by the Government.

@ANI @PIB_India @PIBKolkata

13/ From the GST collected on vaccine, half is earned by the Centre and the other half by the States. Further, 41% of Centre’s collections also get devolved to the States.

@ANI @PIB_India @PIBKolkata

@ANI @PIB_India @PIBKolkata

14/ So States end up receiving almost 70% of the total revenue collected from vaccines.

In fact, a nominal 5% GST is in the interest of the domestic manufacturer of vaccine and in the interest of the citizens.

@ANI @PIB_India @PIBKolkata

In fact, a nominal 5% GST is in the interest of the domestic manufacturer of vaccine and in the interest of the citizens.

@ANI @PIB_India @PIBKolkata

15/ If full exemption from GST is given, vaccine manufacturers would not be able to offset their input taxes and would pass them on to the end consumer/citizen by increasing the price.

@ANI @PIB_India @PIBKolkata

@ANI @PIB_India @PIBKolkata

16/ A 5% GST rate ensures that the manufacturer is able to utilise ITC and in case of overflow of ITC, claim refund.

Hence exemption to vaccine from GST would be counterproductive without benefiting the consumer.

@ANI @PIB_India @PIBKolkata

Hence exemption to vaccine from GST would be counterproductive without benefiting the consumer.

@ANI @PIB_India @PIBKolkata

• • •

Missing some Tweet in this thread? You can try to

force a refresh