Dfinity's $ICP is the most well-funded project you've never heard of. Mostly because it's technically complex and the vision is abstract. The token will be freely traded today and its code base was just released

Let me ELI5 $ICP and @dfinity

1/

messari.io/article/an-int…

Let me ELI5 $ICP and @dfinity

1/

messari.io/article/an-int…

Dfinity is building the “Internet Computer”. It's not going after $ETH or $DOT. It's going for a "new internet" -- an open Facebook, Tiktok, AWS.

Why? Becaue big-tech platforms are gated and slow entrepreneurship.

With big dreams, @dfinity is one of the most well funded:

2/

Why? Becaue big-tech platforms are gated and slow entrepreneurship.

With big dreams, @dfinity is one of the most well funded:

2/

There have been 3 main funding rounds ($160 million) and 1 airdrop. Funding is dominated by @polychaincap and @a16z.

Check out our spreadsheet for more details here: docs.google.com/spreadsheets/d…

3/

Check out our spreadsheet for more details here: docs.google.com/spreadsheets/d…

3/

Total token supply is 469 million with 26% circulating.

Investors are locked for 1-3 years.

But most of the other unlock schedules is unknown:

4/

Investors are locked for 1-3 years.

But most of the other unlock schedules is unknown:

4/

$ICP could have high inflation due to low circulating supply at Genesis.

But the eventual circulating and unlocked supply depends on its tokenomics.

5/

But the eventual circulating and unlocked supply depends on its tokenomics.

5/

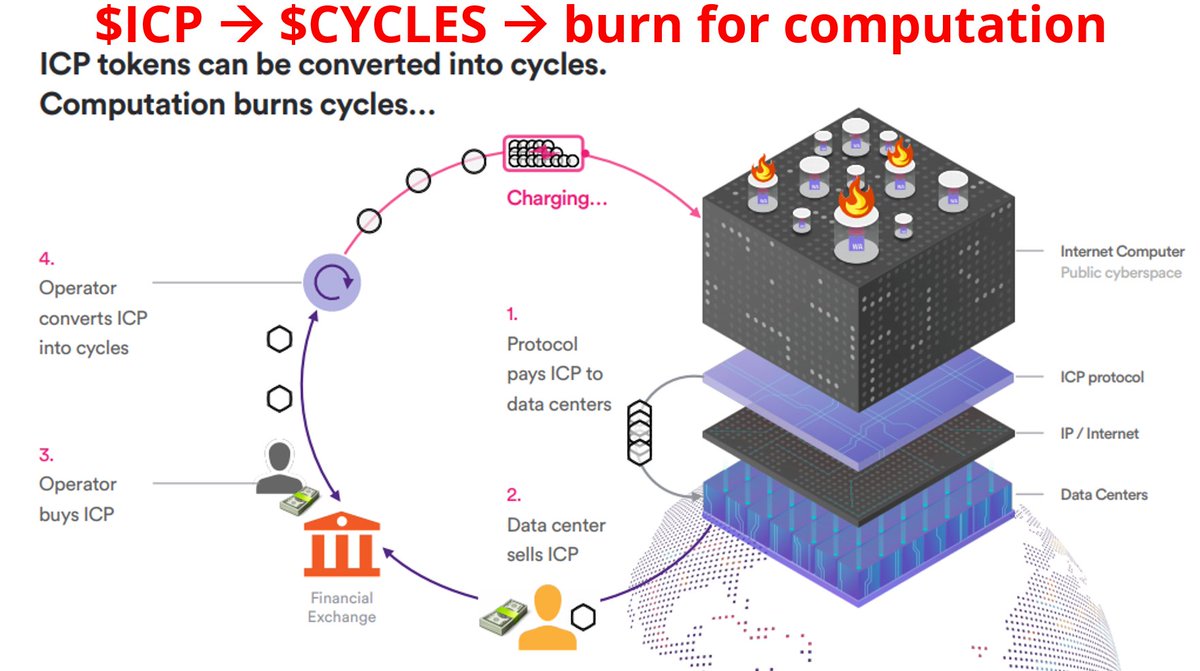

Tokenomics: $ICP tokens can do three major functions -- the first 2 are inflationary while the 3rd is deflationary

1. Facilitate network governance and give rewards for governance participation. Similar to @CurveFinance

2. Reward network participation (to nodes / validators)

6/

1. Facilitate network governance and give rewards for governance participation. Similar to @CurveFinance

2. Reward network participation (to nodes / validators)

6/

and

3. $ICP Produce $CYCLES to fuel computation. $CYCLES is a SDR-pegged stablecoin, stabilized by computation demand.

This also helps keep gas fees low and independent of the price of $ICP

7/

3. $ICP Produce $CYCLES to fuel computation. $CYCLES is a SDR-pegged stablecoin, stabilized by computation demand.

This also helps keep gas fees low and independent of the price of $ICP

7/

So how does @dfinity do this? Compared to other protocols, they're hardware-first.

Data centers around the world host nodes -- which are combined to create subnets (aka blockchains).

8/15

Data centers around the world host nodes -- which are combined to create subnets (aka blockchains).

8/15

Subnets host canisters (a bundle of code that can hold data) to form programs. They can talk to each other and are replicated in all of the nodes (equivalent to a validator).

So an "open Facebook" would be hosted on millions of canisters. Data is both on-chain & sharded:

9/15

So an "open Facebook" would be hosted on millions of canisters. Data is both on-chain & sharded:

9/15

The Network Nervous System oversees all this. For details on the tech -- Noninteractive Distributed Key Generation and Chain Key Technology -- see our free (non-technical) report here:

10/15

messari.io/article/an-int…

10/15

messari.io/article/an-int…

The IOU $ICP token price was up ~30x at the peak this year. Indicating prices rank @DfinityICP in 6th place by Fully Diluted market cap. Is this justified?

It's early days but let's take a look at their ecosystem:

11/15

It's early days but let's take a look at their ecosystem:

11/15

@DfinityICP has a growing infra, DeFi, DApps and social ecosytem. In total, they have raised ~$10 million.

12/15

12/15

If size of ecosystem is any justification of Layer-1 valuations, then Dfinity is on the high end of valuations. $LUNA is on the low-end.

Perhaps this is because $ICP is going after a larger addressable market -- the entire legacy IT system

13/15

Perhaps this is because $ICP is going after a larger addressable market -- the entire legacy IT system

13/15

Dfinity has big goals to remake traditional internet. Like @solana $SOL it relies on data centers for processing. Like $ETH, it wants to be a "world computer". Like @Polkadot it can be a meta-protocol.

14/15

14/15

Competition among programmable Layer 1s is intense. @DfinityICP has luckily launched during a bull market. But creating the ultimate world computer is still at play.

15/15

messari.io/article/an-int…

15/15

messari.io/article/an-int…

• • •

Missing some Tweet in this thread? You can try to

force a refresh