Preston do you own any ETH?

No. Here's why. A Thread.

First, I don’t trust the decentralization of the ETH protocol. In the past, ETH has been governed by the direction of a few key influencers. If you haven’t discovered yet, the essence of this entire movement is removing 1/

No. Here's why. A Thread.

First, I don’t trust the decentralization of the ETH protocol. In the past, ETH has been governed by the direction of a few key influencers. If you haven’t discovered yet, the essence of this entire movement is removing 1/

the authority of a few and putting that power into the hands of the many. This occurs through a system of consensus (not governance) and a core tenant of making sure it is feasible is if all interested parties can run the code. If I want to run a 2/

full node on Ethereum, it's not straightforward. As Vitalik says, “Like, I, for example, am definitely unhappy with the fact you know that Metamask for example is just a client that directly talks to Infura, but whatever.” Many people in the ETH crowd will tell you that a 3/

full node is a “spectrum,” of decentralization, but in November of 2020, Infura went down and so did the exchanges which had to stop allowing ETH withdrawals of their tokens. More concerning for me isn’t just the lack of decentralization today, but 4/

how about in 10 years from now if the size of the code base keeps expanding, what does that mean for anyone interested in running a "full node" (ETH 2.0 plans on having 4 different types of nodes)? The reason the whole 2017 BTC big block Vs small block fork wars 5/

happened is because people (on the winning side) understood how important it was to keep the blocks small so anyone could run the consensus rules and subsequent incentive structure which caps the supply at 21 million coins. What about ETH 2.0? Ok, IF this 6/

happens, they move to a proof-of-stake (PoS) system. And PoS is just like the existing fiat system. If you have a bunch of money, you stake those positions and then you have more influence over the incentives of the overall protocol (through the control of the 7/

hubs routing & confirming transactions). This is what we are trying to avoid in the first place – gatekeepers and kingmakers. How about all the awesome things you can do with the applications on ETH? Decentralized finance is happening on platforms outside of ETH. 8/

For example, Hodl-Hodl is a platform that enables P2P lending & borrowing and it doesn’t have a native token. In fact, even if someone tried to shut-down the website and servers hosting the platform, the existing contracts between both P2P parties can 9/

still settle and complete the terms of their contracts on the Bitcoin blockchain. I could keep going, but at the end of the day, I share a very similar PoV on the topic as @LynAldenContact (article linked). She’s suggesting ETH has too much technical 10/ lynalden.com/ethereum-analy…

risk and doesn’t demonstrate good decentralization, and I couldn’t agree more. Finally, I suspect a lot of people will point to the price action and suggest that’s the proof of why one should own ETH. For this point, I would strongly encourage people go back and look 11/

at what happened during the summer of 2017. This was analogous in the previous Bitcoin bull market to what we are seeing right now. Back then, the price of Bitcoin had surged from nearly $700 to $2,800 over the first 365 days. 12/

Here's the chart for this cycle going from 11 May (halving date) at $8600 to 55,000 today (365 days later). 13/

But, during this same consolidation period (the two months leading up to the 365 day mark), ETH aggressively outperformed BTC (see chart). But what followed, was quite interesting, ETH never achieved the same market cap (in BTC terms) ever again. 14/

Will it happen again, like last cycle? I have no clue. Here's what the chart looks like over the last 2 cycles (ETH measured in BTC). But, having lived that previous cycle as a BTC investor, it sure feels the same (alts pumping while BTC went sideways at the mid-cycle). 15/

At the end of the day, this is my point of view. Do I have a bias toward BTC? Yeap. I think it's a better technical solution solving the problem at hand: Sound, censorship-resistant money, w/ timeless decentralization. Does that mean the market won't need a decentralized 16/

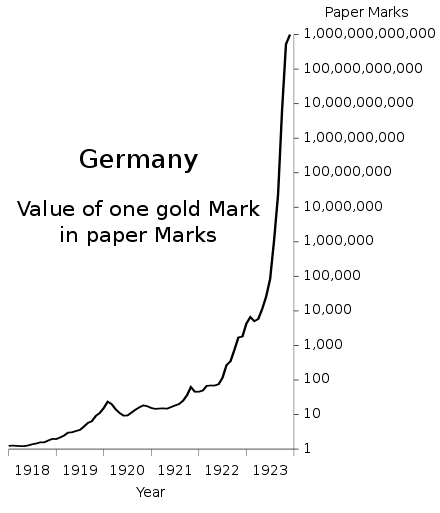

protocol for NFTs, Defi, or whatever else becomes the hot topic? Well, I have no idea. All, I feel like I DO know is the money is broke. Like REALLY broke. I'm looking at 100 trillion + bond market that's already priced to collapse and a technically sound money protocol with 17/

an immutable monetary policy that's ripe to receive the massive flow of funds. Like so massive, people can't comprehend it. If you think the managers coming from these markets are going to seek refuge in a non-government protocol that can be controlled by tech gatekeeps, 18/

I think you're kidding yourself. Anyway, just my two cents. I highly encourage you to think for yourself and invest YOUR money the way YOU see fit. Happy investing. 19/

Finally, here's one of the greatest investors of all time talking about #Bitcoin versus ETH (& any other alt coin). He comes w/ a macro lens in a conversation where he just announced his opinion that the dollar is going to lose reserve currency status.

https://twitter.com/SquawkCNBC/status/1392097180132036610

• • •

Missing some Tweet in this thread? You can try to

force a refresh