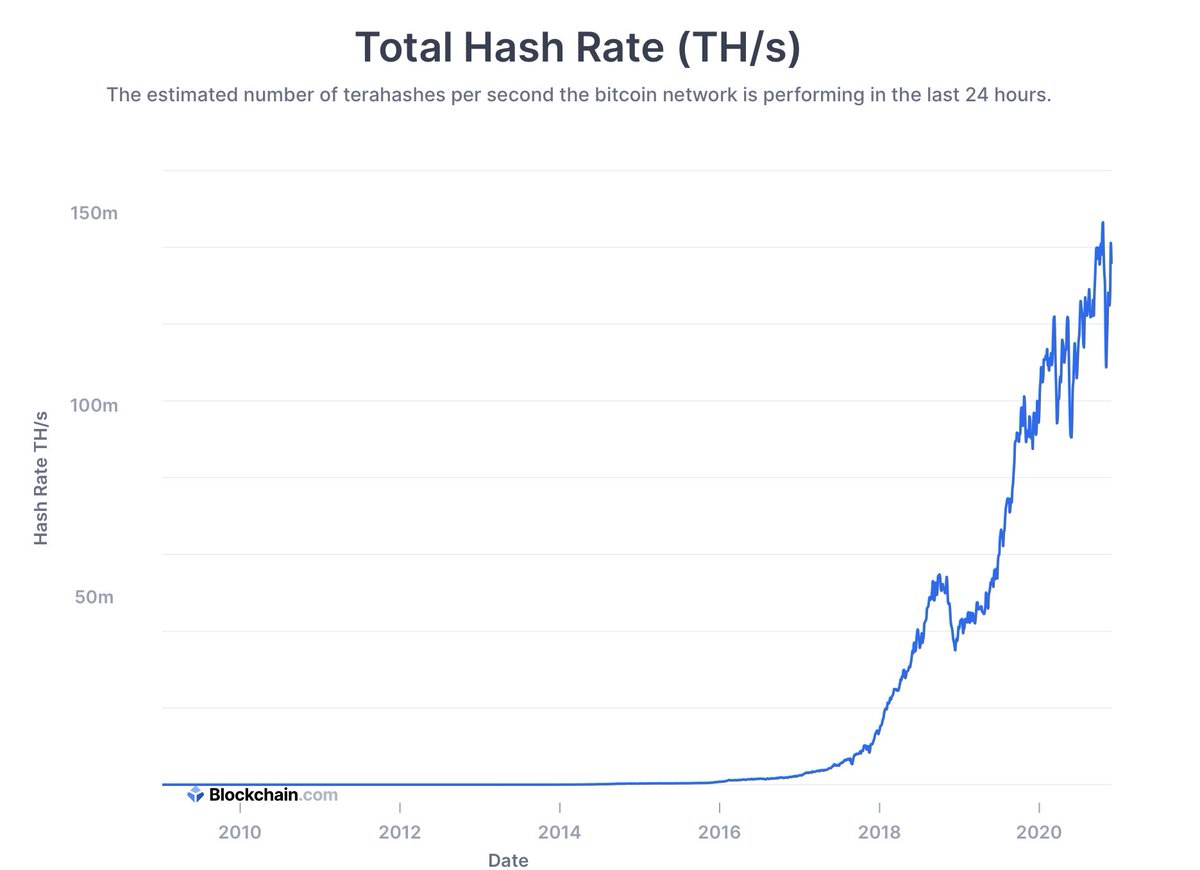

Here’s my thoughts with BTC lending as this cycle heats up. During the previous cycle we saw BTC prices jump from 10,000 to 20,000 in 16 days. This means that if the borrower overcollateralized with an LTV of 50%, their escrow will be liquidated (unless margin is met)...1/

within half a month. Now, what happens if this cycle produces growth that keeps running at double the price action in another 16 days from there? Well, it means those that just met the previous margin calls, now only have 4 days to respond to the next. So what does 2/

this mean for spreads? It means borrowers start to disappear from the market...which also means the spreads in the derivative market don’t get market makers to service the short-side of the trade. For lending/borrowing platforms that are completely overcollateralized, there 3/

shouldn’t be any problems for the depositors, but if lending/borrowing platforms are cutting corners for some of their borrowers (and they aren’t overcollateralized), the borrowers ability to meet margin calls due to counter-party risks in other parts of their portfolio mix ...4/

could cause systematic risk for all participants of the borrowing/lending platform. This is why transparency on borrowing/lending platforms are paramount to long-term trust and growth in the industry. I suspect the risk to lending/borrowing platforms is actually....5/

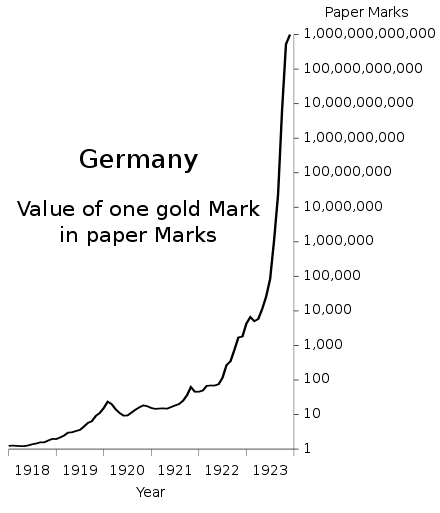

more severe for upward BTC price moves (especially if it’s accompanied with devastating downward fiat price moves in other parts of the economy). This is something I’ll be paying very close attention to later in the year because it’s a scenario that’s never ..6/

happened in Bitcoin, but could be a very real possibility IMHO. One of the things I love about Bitcoin is it’s a true free and open market, so if you choose or don’t choose to participate in these markets, you can’t blame anyone but yourself. No one is coming to bail you out. 7/

Bitcoin is making personal responsibility, accountability, and free and open markets real again. Finally, I’m not an expert in derivatives. Many people that will read this are. Please tell me where you think I’m wrong or what I might be missing. 8/

I know many undercollateralized lenders might suggest that it’s also important to consider reserves and the duration of terms for lending versus repayment, but I suspect a hyperbolic BTC price movement might make these traditional forms of managing risk correct in the ...9/

fractional reserve textbooks, but wrong in the unapologetic free and open Bitcoin market. My point in writing this post isn’t to point to any particular business or practice. My point is to raise awareness and start and important discussion...10/

that will serve the entire industry and market participants if such a scenario would play out in the future. @CaitlinLong_ @JeffBooth @BitcoinTina END/

• • •

Missing some Tweet in this thread? You can try to

force a refresh