14 DeFi Tokens all wrapped into ONE

- The S&P 500 of DeFi

- Strict/transparent token inclusion criteria

- Redeem underlying tokens any time

- Market-cap weighted index

- Auto-rebalancing monthly

- Eliminate costly transactions

- Diversified #DeFi Portfolio

DeFi Pulse Index $DPI

- The S&P 500 of DeFi

- Strict/transparent token inclusion criteria

- Redeem underlying tokens any time

- Market-cap weighted index

- Auto-rebalancing monthly

- Eliminate costly transactions

- Diversified #DeFi Portfolio

DeFi Pulse Index $DPI

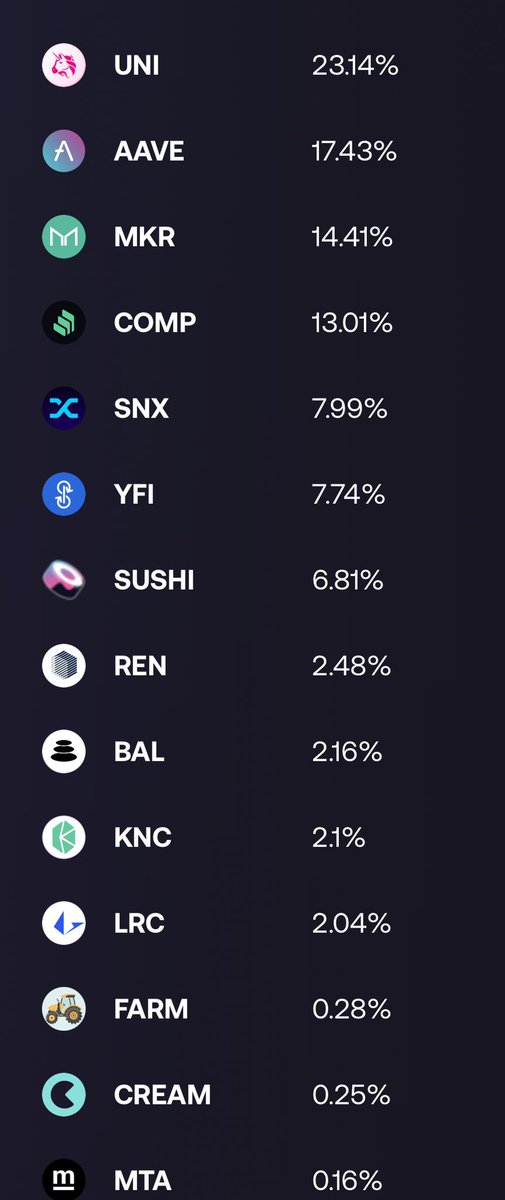

Each $DPI token contains (as of 5/11):

$UNI - 23.1%

$AAVE - 17.4%

$MKR - 14.4%

$COMP - 13.0%

$SNX - 8.0%

$YFI - 7.7%

$SUSHI - 6.8%

$REN - 2.5%

$BAL - 2.2%

$KNC- 2.1%

$LRC - 2.0%

$FARM - 0.3%

$CREAM - 0.3%

$MTA - 0.2%

$UNI - 23.1%

$AAVE - 17.4%

$MKR - 14.4%

$COMP - 13.0%

$SNX - 8.0%

$YFI - 7.7%

$SUSHI - 6.8%

$REN - 2.5%

$BAL - 2.2%

$KNC- 2.1%

$LRC - 2.0%

$FARM - 0.3%

$CREAM - 0.3%

$MTA - 0.2%

The $DPI is a crypto-native digital asset index for #DeFi. The index is weighted based on the circulating supply. #DPI tracks projects with significant usage, maintenance and development.

@sassal0x explains on @BanklessHQ podcast

@sassal0x explains on @BanklessHQ podcast

Strict/transparent token inclusion criteria revolves around:

- Token’s Descriptive Characteristics

- Token’s Supply Characteristics

- Project’s Traction Characteristics

- Protocol’s User Safety Characteristics

- Token’s Descriptive Characteristics

- Token’s Supply Characteristics

- Project’s Traction Characteristics

- Protocol’s User Safety Characteristics

For more information about the methodology, underlying assets, or how to get broad exposure to this new and innovative asset class. Go to the @indexcoop.

IndexCoop.com

IndexCoop.com

...and if you think $DPI is cool. Check out the Metaverse Index #MVI.

$MVI is designed to capture the trend of entertainment, sports, and business shifting to a virtual environment, with economic activity in this environment taking place on the #Ethereum blockchain.

$MVI is designed to capture the trend of entertainment, sports, and business shifting to a virtual environment, with economic activity in this environment taking place on the #Ethereum blockchain.

...ANDDD if you think $DPI and $MVI are awesome. Check out BTC2x-FLI. The #bitcoin 2x leveraged token. Fully collateralized. No liquidation. One-click exposure. @indexcoop @defipulse @tokensets @sassal0x

https://twitter.com/indexcoop/status/1392193512318279680?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh