DeFi at @katana | Investor/Advisor @SuperDigitalV | @bganpunks #5304 | Fmr. @IndexCoop @FrostBank @DivLend @PB_USA | Alumn. @TexasTech

How to get URL link on X (Twitter) App

Polygon zkEVM is the first zero-knowledge (ZK) scaling solution that is fully compatible with Ethereum

Polygon zkEVM is the first zero-knowledge (ZK) scaling solution that is fully compatible with Ethereum

when users think "Polygon" they think of the Polygon POS chain

when users think "Polygon" they think of the Polygon POS chain

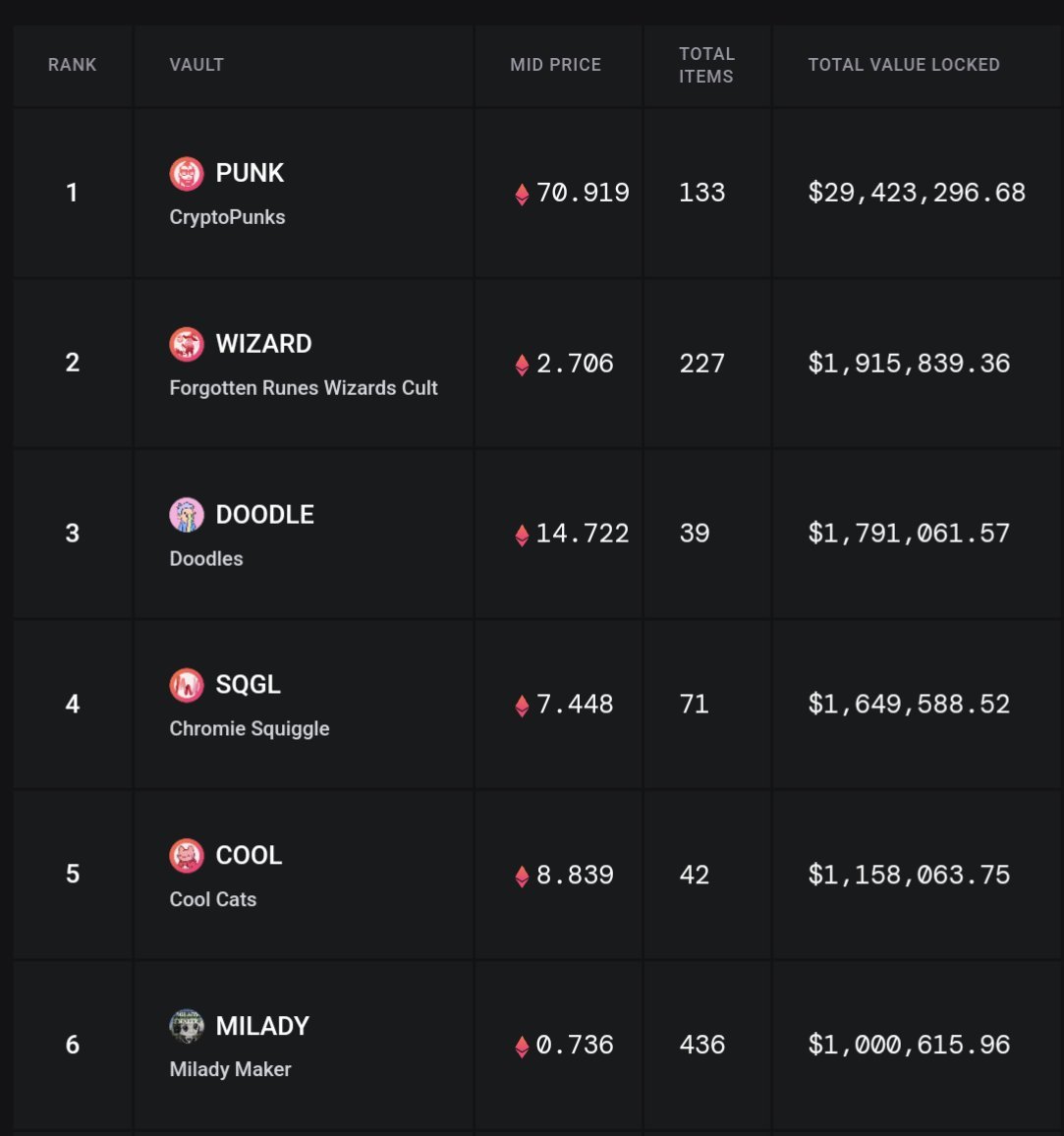

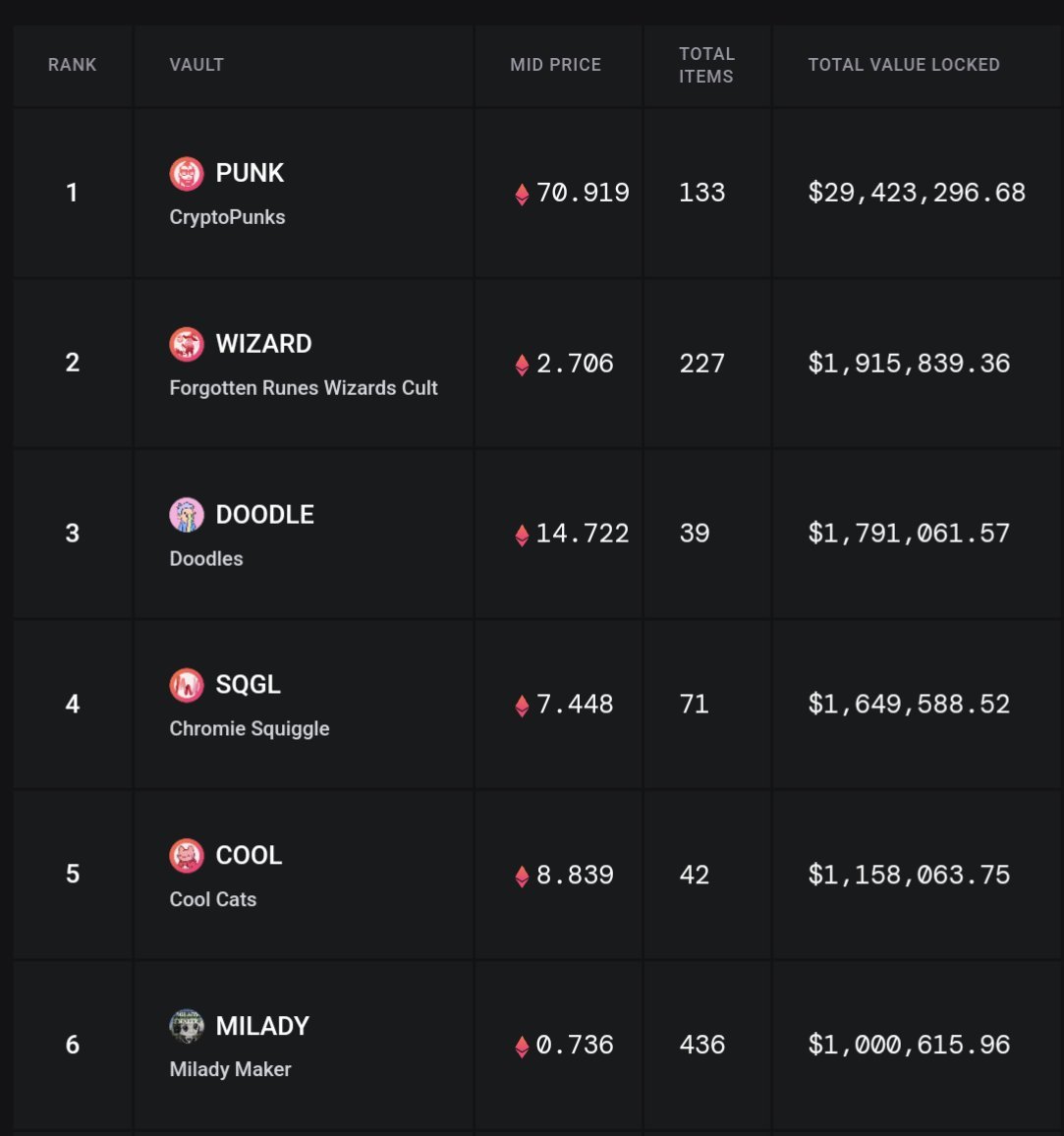

what's @FloorDAO? 💨🧹

what's @FloorDAO? 💨🧹

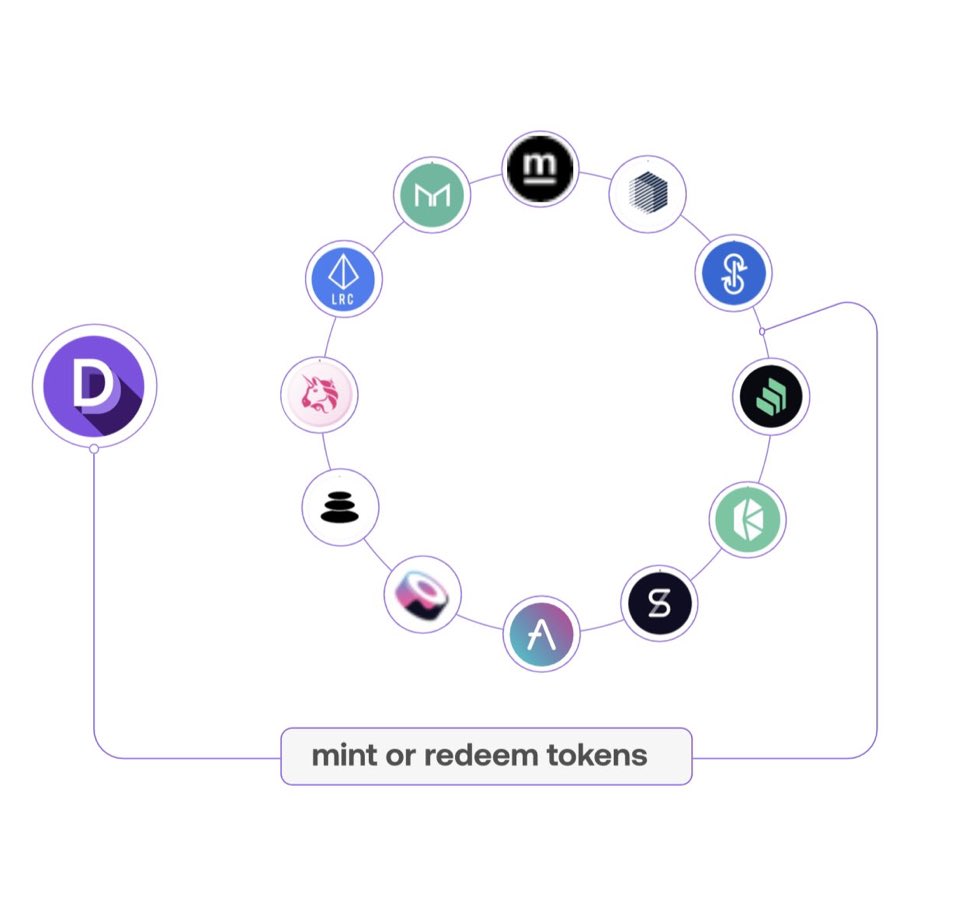

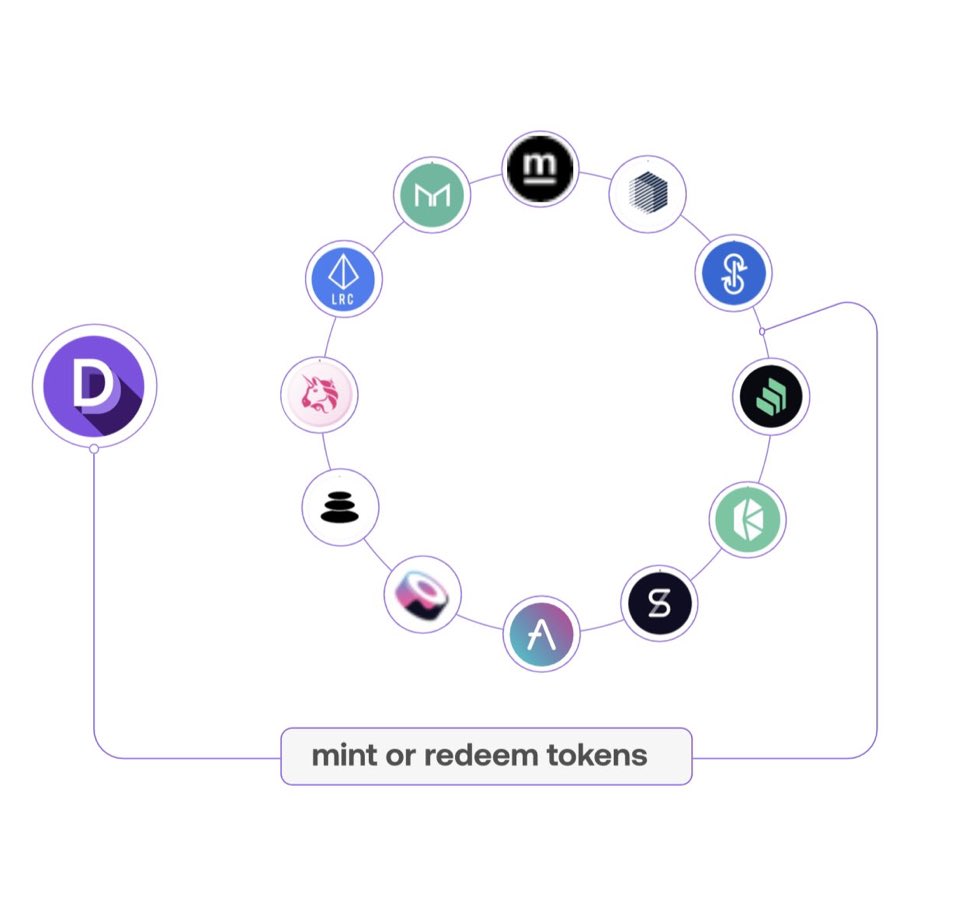

$GMI seeks to capture the performance of emergent DeFi application themes

$GMI seeks to capture the performance of emergent DeFi application themes

#ETH2xFLIP is an ERC20 token that enables traders to automate leverage to $ETH in a decentralized way using the Aave Leverage Module.

#ETH2xFLIP is an ERC20 token that enables traders to automate leverage to $ETH in a decentralized way using the Aave Leverage Module.

What is $YGG?

What is $YGG?

https://twitter.com/NathanHeadPhoto/status/1455516975476641792There are two types of scaling solutions:

1a/ Where to get yield on $MVI?

1a/ Where to get yield on $MVI?

First, where are $DPI protocols deployed?

First, where are $DPI protocols deployed?

1a/

1a/

2/

2/

2/ @Uniswap

2/ @Uniswap https://twitter.com/Uniswap/status/1400847744596598792?s=20

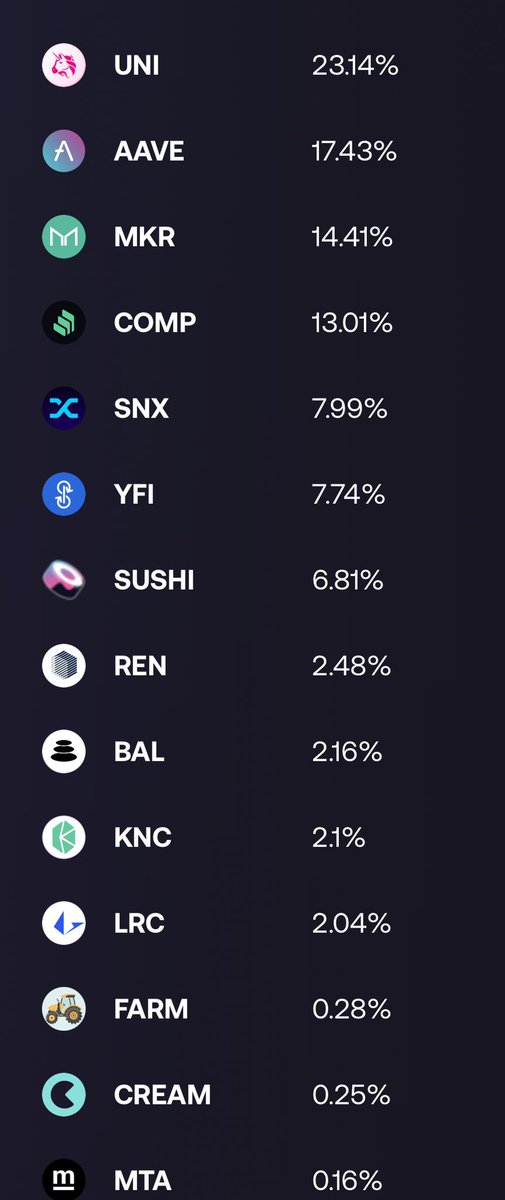

Each $DPI token contains (as of 5/11):

Each $DPI token contains (as of 5/11):