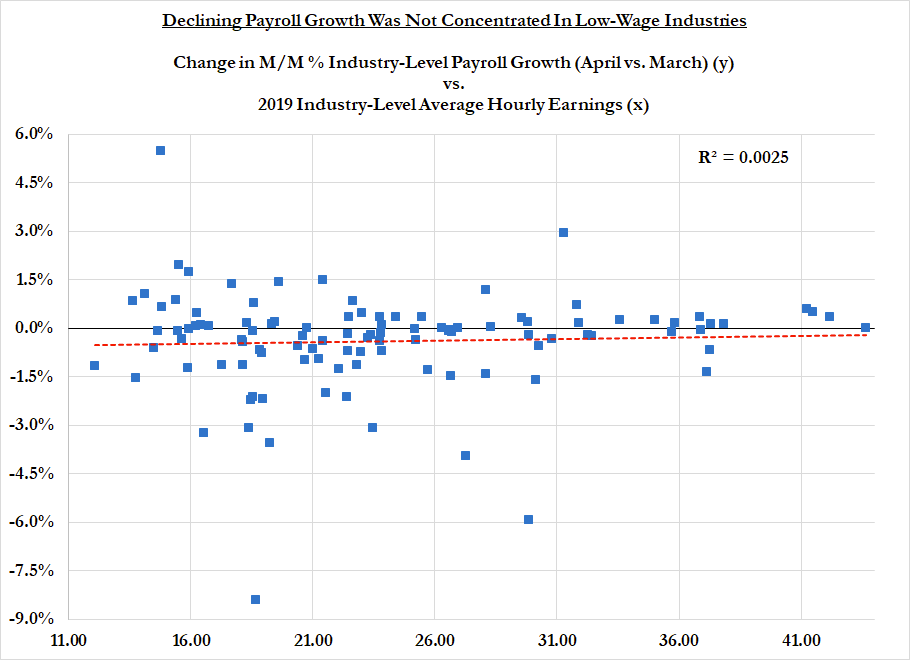

ICYMI: the disincentive explanation for the April drop-off in payroll gains fails to fit the sectoral data. If a $300 weekly supplement was having that effect, we should see it more visibly in low-wage sectors, but we don't. Mid- & high-wage sectors account for bulk of slowdown

For those interested in reading more... I've got you covered: nytimes.com/2021/05/12/opi…

• • •

Missing some Tweet in this thread? You can try to

force a refresh