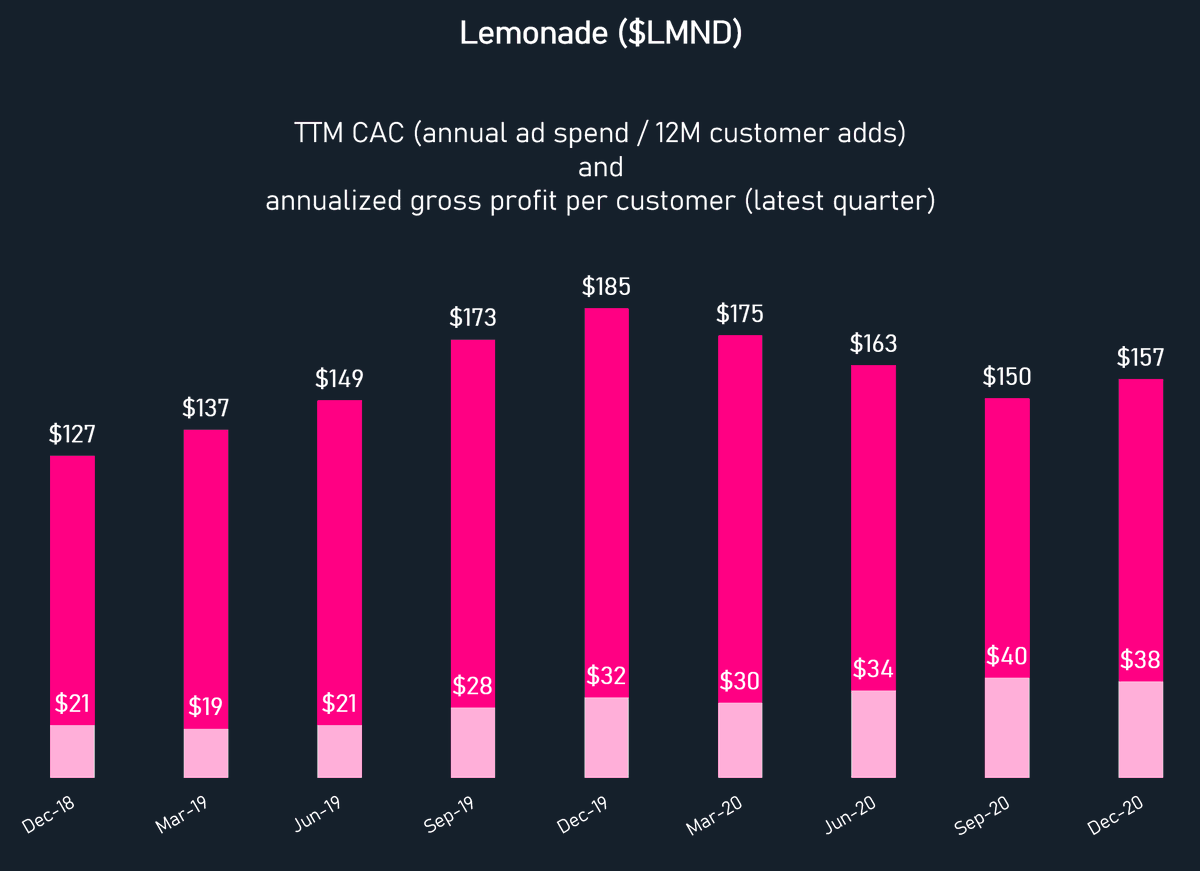

Here's a narrative on the bear case for $LMND. I'm sharing it with the permission of the anonymous analyst in my DMs. The main questions include: can LMND really achieve the 17% operating margin target by @tebixby, which would mean lower expense ratios than the giants? 🧵

Here is what this analyst wrote:

----------------------------------

So let's be clear and distinguish between expense ratio (that's admin, marketing stuff) and the loss ratio (that's the actual insurance loss)

and lets talk specifically about auto.

----------------------------------

So let's be clear and distinguish between expense ratio (that's admin, marketing stuff) and the loss ratio (that's the actual insurance loss)

and lets talk specifically about auto.

So in auto the expense ratio leader is Geico.

Progressive is trying to catch up.

Roughly speaking Geico's fixed expenses are about 10% of premiums and then there is about 6%-8% of customer acquisition/growth spend.

For a total of 16%-18% of premiums.

Progressive is trying to catch up.

Roughly speaking Geico's fixed expenses are about 10% of premiums and then there is about 6%-8% of customer acquisition/growth spend.

For a total of 16%-18% of premiums.

For Progressive the numbers come to ~20%

For the rest of the industry they come to 25%

That 10% fixed cost base expense that Geico has is full blown cost spread over scale that is not gonna be replicated unless you have that scale (this is where PGR is trying to catch up)

For the rest of the industry they come to 25%

That 10% fixed cost base expense that Geico has is full blown cost spread over scale that is not gonna be replicated unless you have that scale (this is where PGR is trying to catch up)

Growth spend is...well growth spend.

My point: on that expense ratio side there is very little fat the two primary competitors are no slouches.

Very difficult to improve there: neither PGR nor Geico are slouches on the internal systems/tech side.

My point: on that expense ratio side there is very little fat the two primary competitors are no slouches.

Very difficult to improve there: neither PGR nor Geico are slouches on the internal systems/tech side.

Ok so now move to the other bit: the loss ratio. There are roughly two subcomponents here, one is actual loss and other is loss adjustment (think claims handeling and things of that nature).

Now all the automation and tech can help with loss adjustment, but this already only runs in single digit % for the big boys.

Not only that all the stuff that Lemonade is talking about doing, the big boys already do automated.

Finally you get to the big fat remaining losses bit.

Not only that all the stuff that Lemonade is talking about doing, the big boys already do automated.

Finally you get to the big fat remaining losses bit.

So here Lemonade is suggesting that insurers are not good at matching rate to risk (they are pooling, good drivers are subsidizing bad, etc.)

Root has made the same pitch.

Root has made the same pitch.

Problem is that PGR is eons ahead of everyone, including Geico in this arena and it takes a long time to get this right.

In their earnings call when Lemonade referenced Geico's admission on being late to telematics, the context was Buffett admitting that they had underinvested in underwriting and Progressive had pulled ahead.

However, even here note that Lemonade *is even more late than Geico*.

However, even here note that Lemonade *is even more late than Geico*.

You put it together and what you see is a lot of claims with not much substantiating them (that 17% op margin).

The other thing to note is that, say they even manage through some miracle to get to that op margin.

Well this is a regulated industry.

The other thing to note is that, say they even manage through some miracle to get to that op margin.

Well this is a regulated industry.

No insurance regulator is going to let them keep margins like that for an extended period of time.

Now I don’t doubt that they have a better mousetrap on the expense side in renters.

Now I don’t doubt that they have a better mousetrap on the expense side in renters.

It is well known that renters is ignored by the majors and underserved because the premiums and churn in the market are not worth it.

Hence, it is an interesting strategy to use this niche as a beachhead.

Hence, it is an interesting strategy to use this niche as a beachhead.

However, you have to be careful about extrapolating what they have accomplished in a low competition, neglected line to a line of biz (auto) where the competition is extremely fierce.

For instance, even with the massive structural advantages that Geico and Progressive have,...

For instance, even with the massive structural advantages that Geico and Progressive have,...

...it has taken them *decades* to move up the league tables, and still the largest market share is commanded by State Farm. They will both surpass State Farm at some point, but this is a very different playing field from what Lemonade has been in.

/end

/end

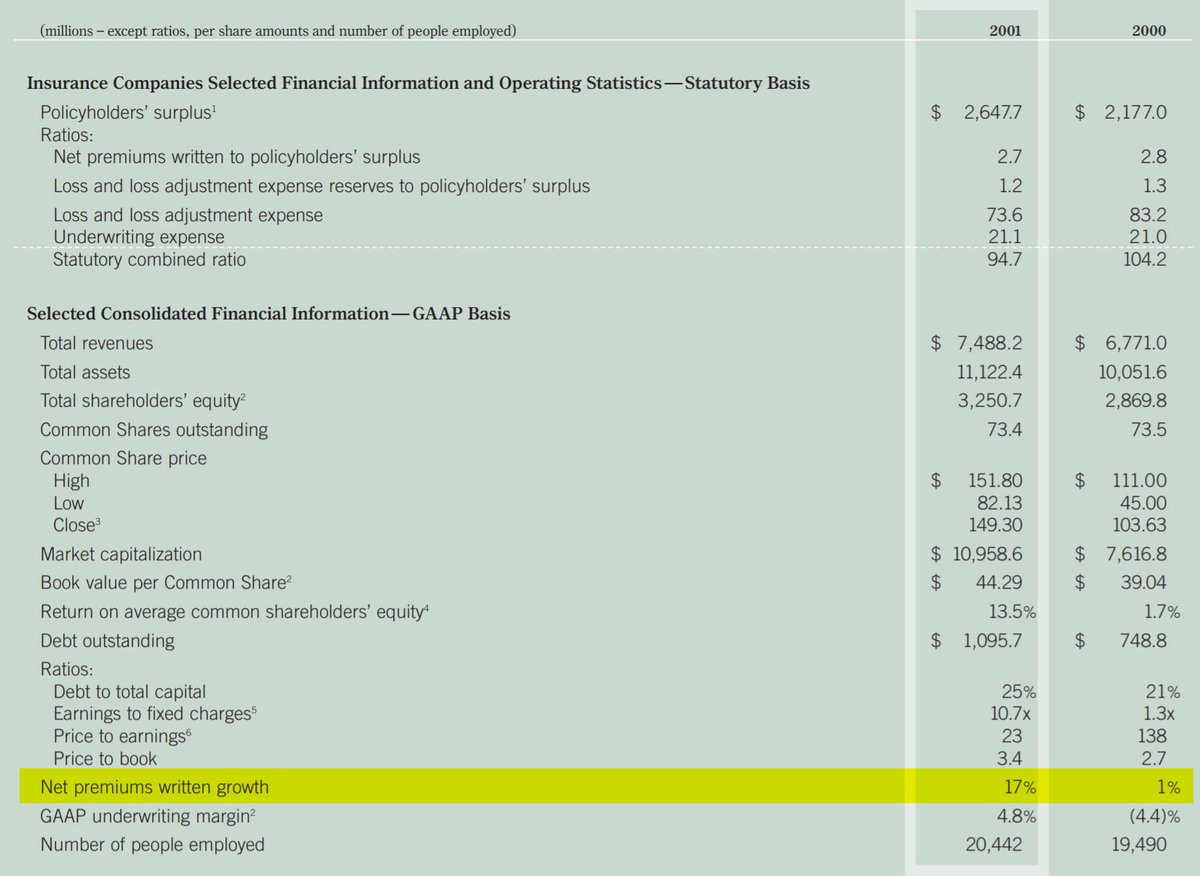

One observation (mine): it's known that financial companies that grow fast have higher risk of blowing up. Many believe insurance companies should not grow fast. Yet it's obvious that the huge returns for early investor of GEICO (Ben Graham) happened because of such...

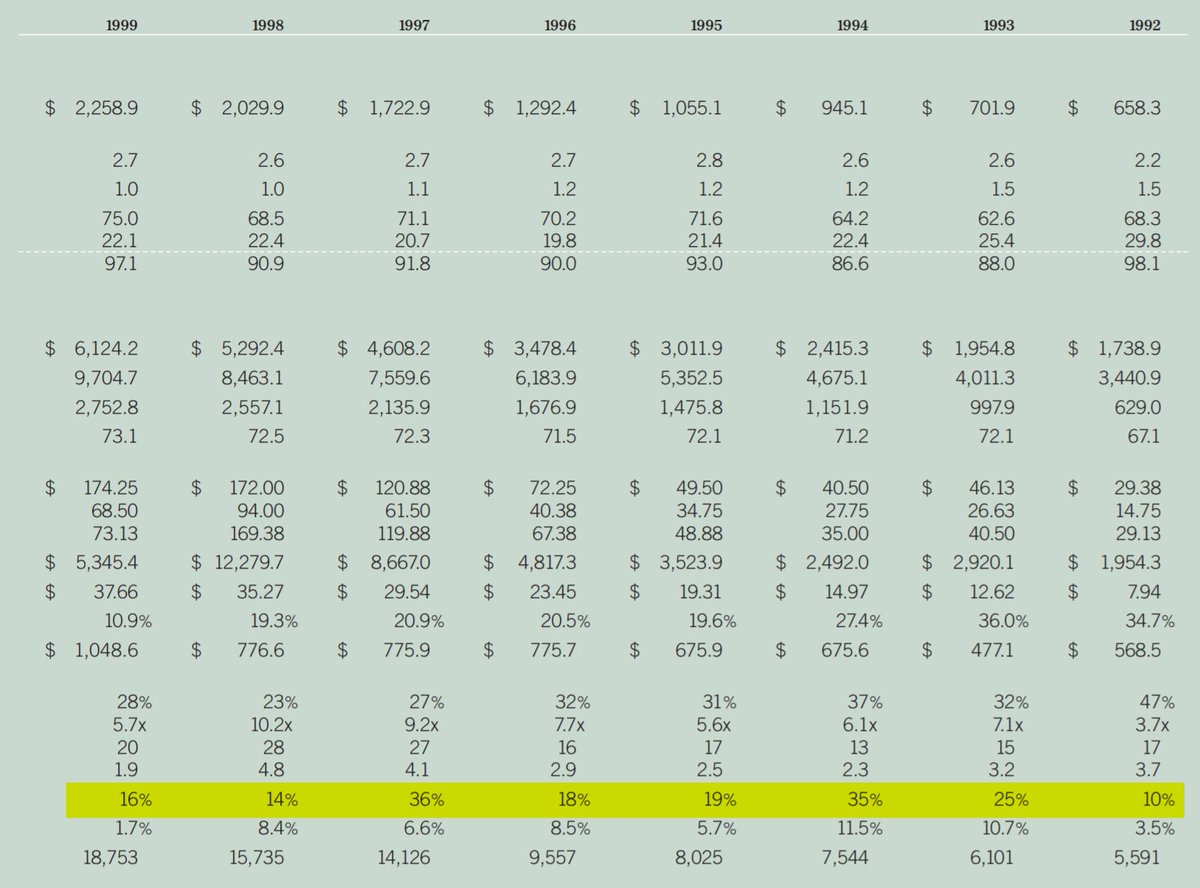

...growth. I don't have early numbers for GEICO but these are early growth rates for Progressive. Net premium written growth was rapid in the 90s (see highlighted row):

• • •

Missing some Tweet in this thread? You can try to

force a refresh