For anyone trying to understand Lemonade's story, here's what I recommend. Start with the slim book on the founding of the company ($LMND):

amazon.com/Making-Lemonad…

amazon.com/Making-Lemonad…

Watch the IPO video:

vimeo.com/437029189

vimeo.com/437029189

Read the blog entries by @shai_wininger (I wish there was a way to filter these). For example, this one:

lemonade.com/blog/the-sixth…

lemonade.com/blog/the-sixth…

Listen to the podcast interviews with Dan:

listennotes.com/search/?q=dani…

listennotes.com/search/?q=dani…

There are other great interviews with Dan, Shai and Tim (CFO) on YouTube -- just search

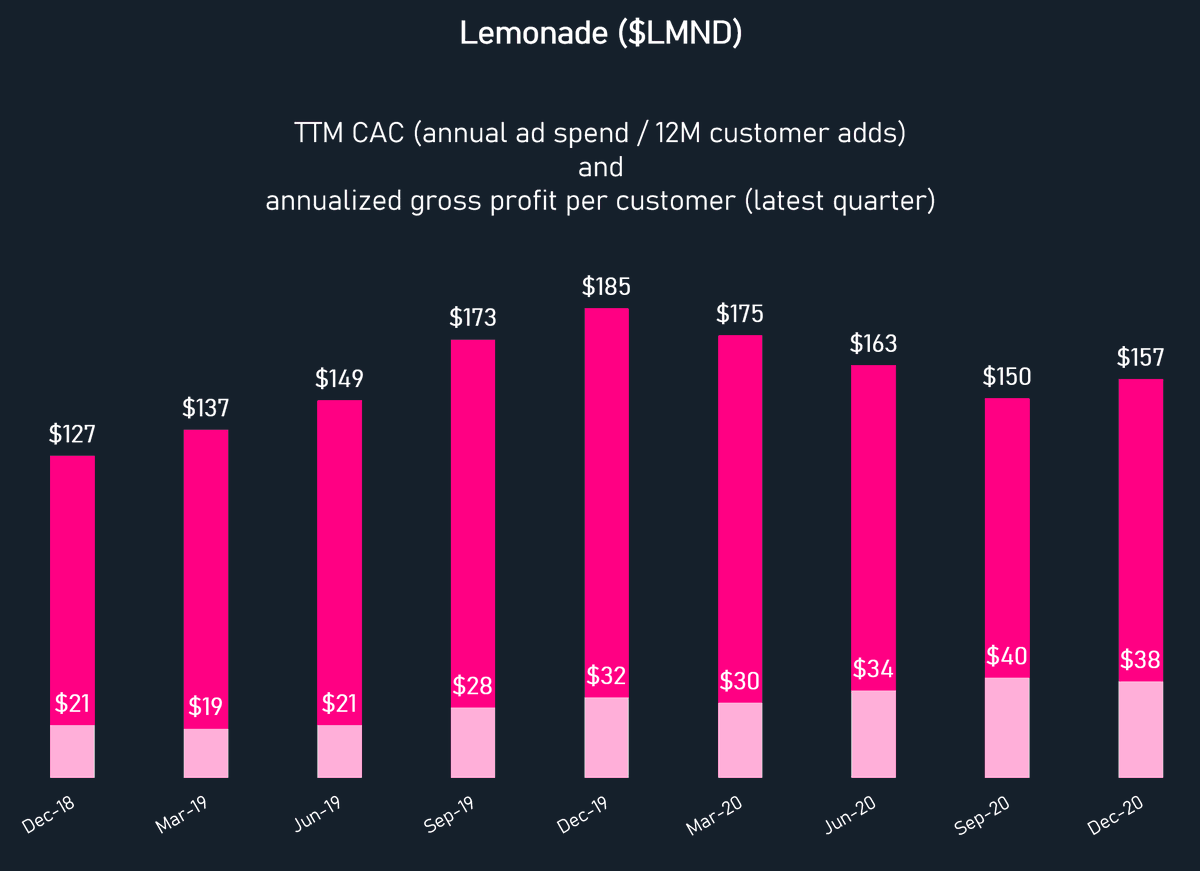

Read the S-1 and 10-K. Lots of good stuff.

Read the letters to shareholders, listen to calls and events since IPO.

Hope this helps!

Read the S-1 and 10-K. Lots of good stuff.

Read the letters to shareholders, listen to calls and events since IPO.

Hope this helps!

• • •

Missing some Tweet in this thread? You can try to

force a refresh