We believe $SUSHI is now the most undervalued token in digital assets.

A thread on valuation, upcoming catalysts, and why the recent downward price action will be short-lived Down pointing backhand index 👇

A thread on valuation, upcoming catalysts, and why the recent downward price action will be short-lived Down pointing backhand index 👇

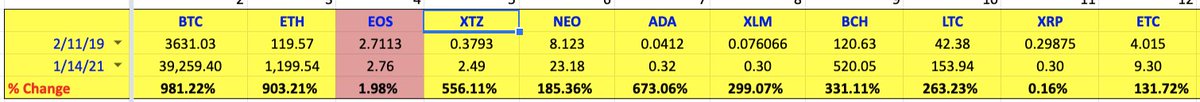

2/ $SUSHI has underperformed both $UNI and the broader DEX market since the beginning of the year.

This is most apparent with the 50% peak-to-trough decline in March and April (still down ~30% from ATH’s)

This is most apparent with the 50% peak-to-trough decline in March and April (still down ~30% from ATH’s)

3/ Why? 3 Overhangs:

1) rolling 6-mo vesting unlock from initial Sushi yield farming

2) PancakeSwap growth

3) Uniswap V3 hype

Let's break each of these down -- none of which have any actual impact on $SUSHI valuation and its core business.

1) rolling 6-mo vesting unlock from initial Sushi yield farming

2) PancakeSwap growth

3) Uniswap V3 hype

Let's break each of these down -- none of which have any actual impact on $SUSHI valuation and its core business.

4/ #1 Impact from Vested Supply

Just as yield farming can create traction for a new project overnight, dilution from yield farming can be just as painful when an asset is out of favor.

We saw this with the $CRV launch and with $UNI during their short yield farming stint.

Just as yield farming can create traction for a new project overnight, dilution from yield farming can be just as painful when an asset is out of favor.

We saw this with the $CRV launch and with $UNI during their short yield farming stint.

5/ At current prices (and assuming the unlock would’ve been gradual):

204m in inflation in April

175m in inflation in May

150m in inflation in June

etc

204m in inflation in April

175m in inflation in May

150m in inflation in June

etc

6/ Does supply overhang matter? Yes, absolutely - see $SUSHI price action in April.

Sushi started Nov 2020 at $0.60. Yield farmers made a killing waiting out the 6-month vesting period, & unloaded after their massive gains vested. The market had to swallow the supply.

Sushi started Nov 2020 at $0.60. Yield farmers made a killing waiting out the 6-month vesting period, & unloaded after their massive gains vested. The market had to swallow the supply.

7/ But from a value investing perspective, overhangs create interesting opportunities. $SUSHI is now clearly mispriced even on a FDV basis after factoring in inflation.

8/ And some of that inflation may be mitigated. An ongoing proposal would lock up add'l $SUSHI into oSushi, similar to veCRV model, where voting power over distribution of pool rewards is based on amount of time a holder locks up tokens.

forum.sushi.com/t/sushinomics-…

forum.sushi.com/t/sushinomics-…

9/ If this proposal passes, $SUSHI tokens will be locked for up to 3 years, offsetting some level of dilution.

97% of the community currently supports this proposal.

97% of the community currently supports this proposal.

10/ #2 Impact from Uniswap V3

The hype surrounding $UNI V3 likely led to some of the $SUSHI underperformance.

But, Sushi & Uni are moving in different directions.

a) Uni is narrowing in on spot trading; Sushi is expanding vertically w/ Kashi & other future Bentobox products.

The hype surrounding $UNI V3 likely led to some of the $SUSHI underperformance.

But, Sushi & Uni are moving in different directions.

a) Uni is narrowing in on spot trading; Sushi is expanding vertically w/ Kashi & other future Bentobox products.

11/ b) $SUSHI CF’s flow directly through to xSushi holders; $UNI's fee switch is still yet to be discussed in governance.

They are competitors, but it is not winner take all. Each is strong; growing in unique directions.

(Disclosure: Arca is long $UNI & $SUSHI)

They are competitors, but it is not winner take all. Each is strong; growing in unique directions.

(Disclosure: Arca is long $UNI & $SUSHI)

12/ c) Again, the V3 overhang has yet to have any impact on SushiSwap trading volumes or CF’s to xSushi holders - metrics that actually matter when valuing $SUSHI.

https://twitter.com/FrenSushi/status/1392560967632838656

13/ #3 Impact from growth of PancakeSwap

Sushi is referred to as the DEX of the people since there was no VC funding, but it's not. It's the DEX of #DeFi power users, yield farmers, & users capable of interacting with multiple dApps and multiple chains with size.

Sushi is referred to as the DEX of the people since there was no VC funding, but it's not. It's the DEX of #DeFi power users, yield farmers, & users capable of interacting with multiple dApps and multiple chains with size.

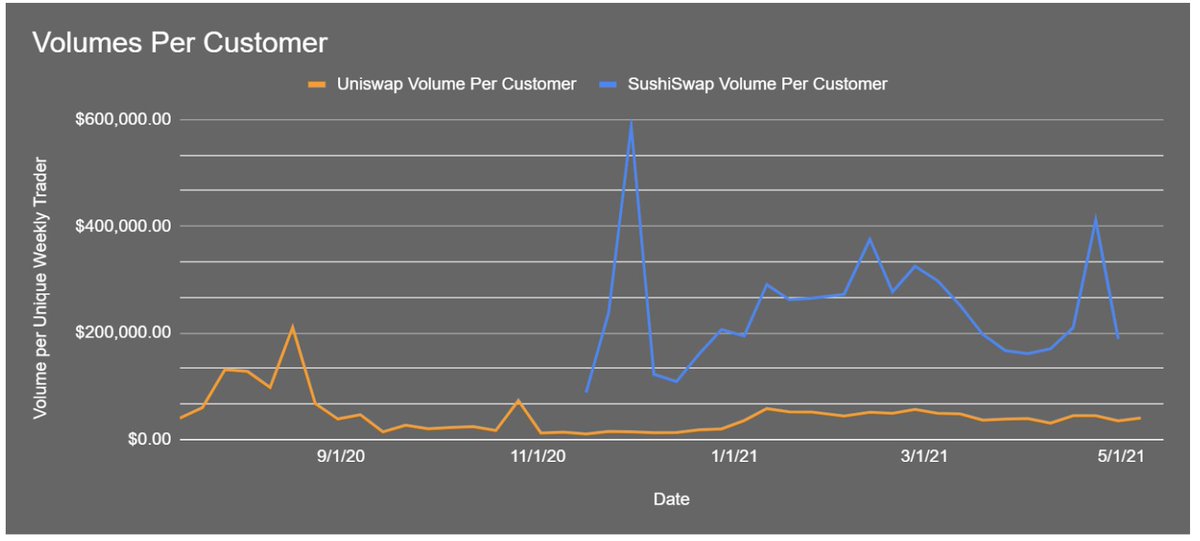

14/ This can be seen looking at unique traders & volume/unique weekly trader - clearly, $SUSHI user's are whales.

This is similar to $FTT vs $BNB / $COIN - FTX caters to a few, big customers while BNB / CB cater to tons of smaller customers.

$FTT has crushed it w/ this approach

This is similar to $FTT vs $BNB / $COIN - FTX caters to a few, big customers while BNB / CB cater to tons of smaller customers.

$FTT has crushed it w/ this approach

15/ $SUSHI's biggest competition is likely $CAKE, not $UNI

High gas fees turned $CAKE into a viable DEX which is why we saw flat TVL on SushiSwap (w/ underlying prices up) & lower volumes in March / April, as users paid nothing in gas and earned higher LM rewards on Pancake.

High gas fees turned $CAKE into a viable DEX which is why we saw flat TVL on SushiSwap (w/ underlying prices up) & lower volumes in March / April, as users paid nothing in gas and earned higher LM rewards on Pancake.

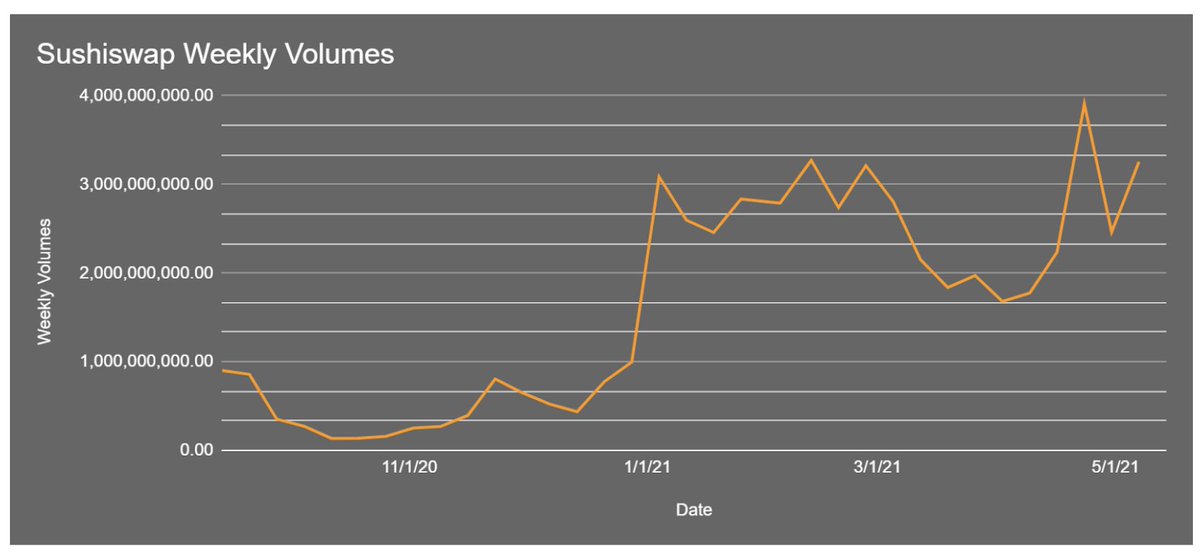

16/ But with TVL and Trading volumes both on the rise again from mid-April to today, and BSC likely not a long term solution for $SUSHI's user demographic, this overhang does not likely have a long term impact on CF’s.

17/ Conclusion: These three overhangs have all impacted $SUSHI's price, but have done very little to impact Sushi’s core business and growth.

Volumes, and thus CF’s to xSushi holders, have grown at 22% CMGR since the DEX went live.

Volumes, and thus CF’s to xSushi holders, have grown at 22% CMGR since the DEX went live.

18/ Meanwhile, $SUSHI has continued to expand, offering optionality of further CF’s to xSushi holders if they are successful.

They have launched cross-chain and are seeing traction.

i.e. $MATIC: $400M in TVL (Avg ~$40M/day in about a week)

(Source: analytics-polygon.sushi.com)

They have launched cross-chain and are seeing traction.

i.e. $MATIC: $400M in TVL (Avg ~$40M/day in about a week)

(Source: analytics-polygon.sushi.com)

19/ And there is an ongoing Treasury Diversification Proposal which would diversify the $SUSHI-only treasury into a basket of blue chip #DeFi tokens, de-risking & strengthening the balance sheet.

snapshot.org/#/sushi/propos…

snapshot.org/#/sushi/propos…

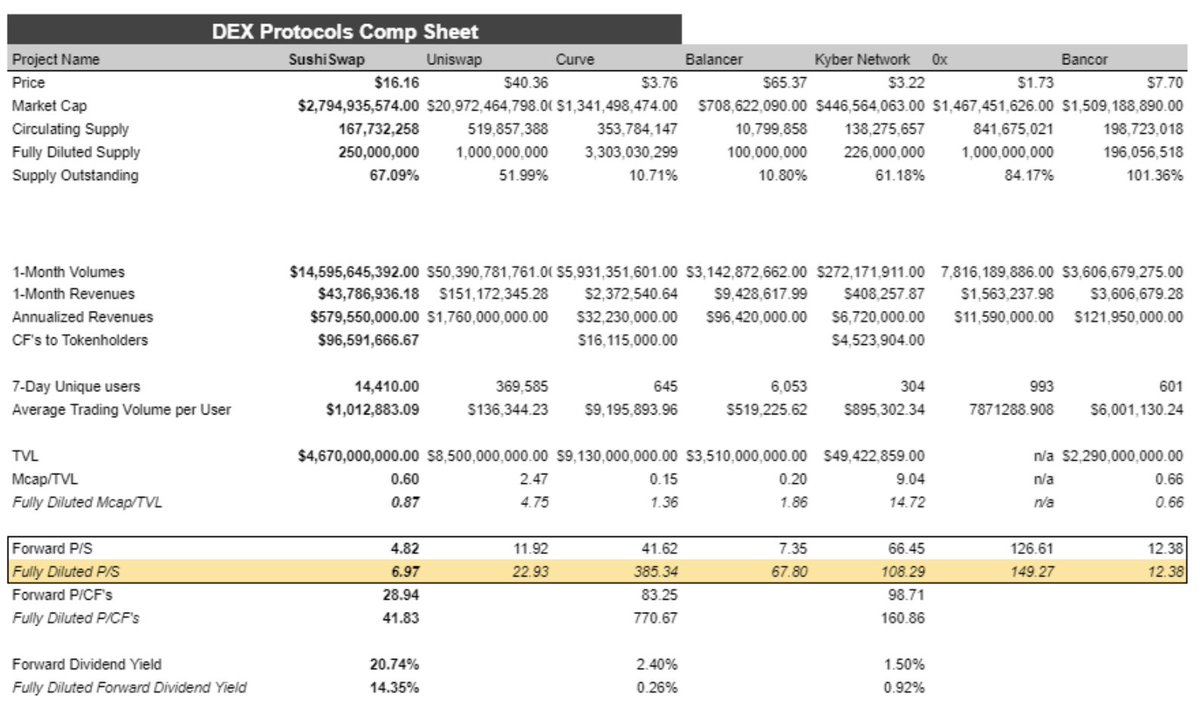

20/ Overhangs that do not impact core businesses create opportunities to buy growing projects at depressed multiples.

Using any observable metric, $SUSHI is cheap. Really cheap.

Using any observable metric, $SUSHI is cheap. Really cheap.

https://twitter.com/block49capital/status/1392583778795720707?s=21

21/ This optionality creates further upside:

- limiting the dilution via oSushi

- TVL / Volume growth from Polygon, add'l CF’s via Bentobox & Kashi business lines

- The diversified Treasury Proposal

- SUSHI IDO platform

- limiting the dilution via oSushi

- TVL / Volume growth from Polygon, add'l CF’s via Bentobox & Kashi business lines

- The diversified Treasury Proposal

- SUSHI IDO platform

https://twitter.com/SushiSwap/status/1392615574212018177

22/ As investors rotate back to into #DeFi (and they are), these are the opportunities to look for.

https://twitter.com/mrjasonchoi/status/1392918475983638528

23/ We get a lot wrong investing in this asset class too, but all of our recent public calls (See past threads on $UNI, $LEO, $WNXM, $EOS) have been extremely profitable because they share a common theme:

Identifying value & picking up cheap upside optionality

Identifying value & picking up cheap upside optionality

• • •

Missing some Tweet in this thread? You can try to

force a refresh