WHY to RAISE A FUND or How to Get people to Give you $$$?

I've raised for big players (Goldman, SSgA, First Trust, EEC) to the tune of literally tens of billions...

(Hand slaps face for not getting more equity)...

A thread:

I've raised for big players (Goldman, SSgA, First Trust, EEC) to the tune of literally tens of billions...

(Hand slaps face for not getting more equity)...

A thread:

At @GoldmanSachs (should I name drop again 🙄) we were shown a study on generational wealth...

Almost 100% of the wealth was made 1 of 5 ways:

Lucky Sperm Club (ok it said Inheritance)

Owner of a Business

Marry Rich

Public Co C Suite Exec

Asset Management

Almost 100% of the wealth was made 1 of 5 ways:

Lucky Sperm Club (ok it said Inheritance)

Owner of a Business

Marry Rich

Public Co C Suite Exec

Asset Management

The last one is intriguing...

Building a fund and then a fund family (a group of funds)

Building a fund and then a fund family (a group of funds)

Fund managers (PE, VC) make $ when the Cos they invest in make $.

2 revenue streams:

1. Carry: share profits realized by investors

2. Management fee: usually a 2% fee to run the fund

3. Fundraising/admin costs: aka jets, offices in Connecticut etc

2 revenue streams:

1. Carry: share profits realized by investors

2. Management fee: usually a 2% fee to run the fund

3. Fundraising/admin costs: aka jets, offices in Connecticut etc

Carry - 20% is standard

For example:

If a fund makes $10 million in profits (or returns)

The partners take a $2 million to $3 million cut before distributing the rest among their investors.

For example:

If a fund makes $10 million in profits (or returns)

The partners take a $2 million to $3 million cut before distributing the rest among their investors.

Management Fee - That fee is paid as a percentage of total fund size over the life of the fund (5-10 years)

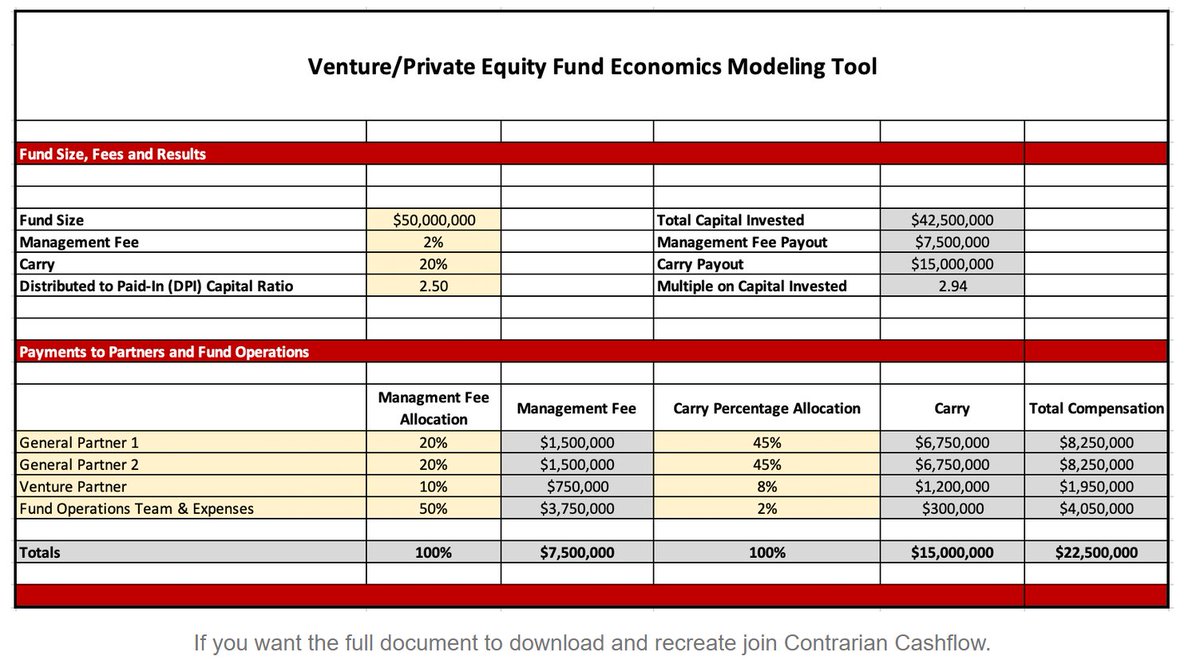

Example in the spreadsheet for $50M fund

- $1M will be paid in each of the first five years

-next 5 years $500 paid out (½ management fee)

Example in the spreadsheet for $50M fund

- $1M will be paid in each of the first five years

-next 5 years $500 paid out (½ management fee)

Look at how the money stacks up.

Not too shabby

Now imagine you raise multiple of these funds over the course of a few years… the payouts ain’t bad.

Not too shabby

Now imagine you raise multiple of these funds over the course of a few years… the payouts ain’t bad.

But before you start putting together fund formation docs and asking your grandma if she’s an accredited investor...

GOLDEN RULE: you have to deliver.

GOLDEN RULE: you have to deliver.

It’s a hits-driven business.

You have one judge, jury, and executioner… your MOIC (Multiple on Invested Capital).

A fancy way of saying I give you $100, do you give me back $300 to $500.

If not, pick a new job.

You have one judge, jury, and executioner… your MOIC (Multiple on Invested Capital).

A fancy way of saying I give you $100, do you give me back $300 to $500.

If not, pick a new job.

Want to learn more follow these buds of mine who raised funds the unconventional way & who share:

@ShaanVP - $3.5M rolling fund

@moseskagan - MF fund In RE

@keith_wasserman - $1.5B+ fund in RE

@fortworthchris - $500M assets in RE

@ShaanVP - $3.5M rolling fund

@moseskagan - MF fund In RE

@keith_wasserman - $1.5B+ fund in RE

@fortworthchris - $500M assets in RE

This isn't an easy game.

Because you are playing a reputation game w/ OPM

You need:

Financial saavy

Access

Investment thesis

Unfair advantage (unique skill stack)

Outcomes are often outside of your control

Because you are playing a reputation game w/ OPM

You need:

Financial saavy

Access

Investment thesis

Unfair advantage (unique skill stack)

Outcomes are often outside of your control

BUT these days you don’t need to have gone to Harvard or be a billionaire to start a fund (although many have and are)

Plenty have killed it within unconventional areas, regions, and backgrounds like @BrentBeshore

Plenty have killed it within unconventional areas, regions, and backgrounds like @BrentBeshore

Weigh the risks then, hey who knows, maybe you too can be a fund manager.

If you're any good... let me know, so I can invest :)

If you're any good... let me know, so I can invest :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh