Gold is one of the most favoured investment options for Indians and it works as a hedge against inflation.

Sovereign Gold Bond 2021-22 Series I is open for subscription from May 17, 2021, to May 21, 2021

Date of Issuance-May 25, 2021

SGB Price-₹4727/g

Gold Price-₹4979/g

Sovereign Gold Bond 2021-22 Series I is open for subscription from May 17, 2021, to May 21, 2021

Date of Issuance-May 25, 2021

SGB Price-₹4727/g

Gold Price-₹4979/g

SGBs are government securities in grams of gold, issued by the RBI on behalf of the Government of India.

Official information is on the RBI webpage - rbi.org.in/Scripts/FAQVie…

If you have an 8-year horizon, SGBs are the best choice as you can save LTCG tax.

Official information is on the RBI webpage - rbi.org.in/Scripts/FAQVie…

If you have an 8-year horizon, SGBs are the best choice as you can save LTCG tax.

Where can you buy SGBs?

You can buy it from your bank, post offices, NSE/BSE, either directly or through agents.

You can apply for Sovereign Gold Bonds through your Net Banking or Demat accounts, like Zerodha, Upstox etc.

zerodha.com/gold/

You can buy it from your bank, post offices, NSE/BSE, either directly or through agents.

You can apply for Sovereign Gold Bonds through your Net Banking or Demat accounts, like Zerodha, Upstox etc.

zerodha.com/gold/

Imagine Instead of buying 10 grams of gold as an investment, you buy a 10-gram Sovereign Gold bond.

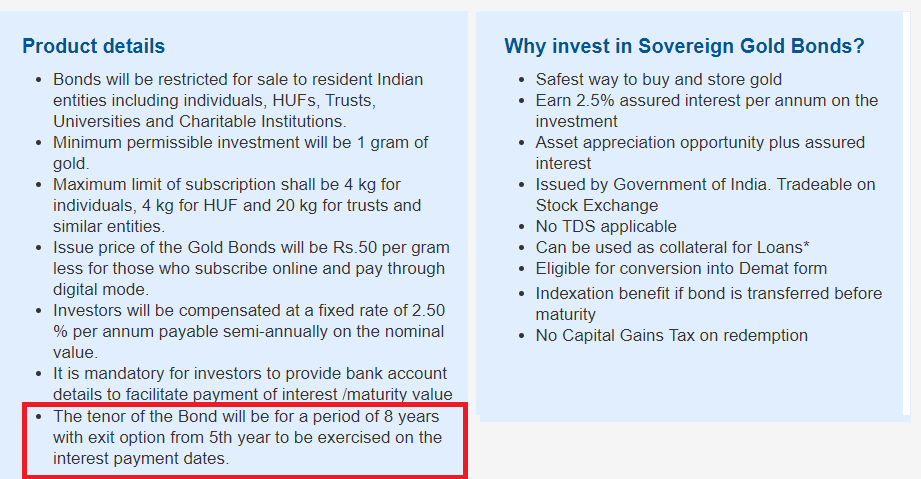

The tenure of the bond is 8 years.

After 8 years, when you redeem the bond you get the price of 10 grams of gold that time.

Now what’s the benefit?

The tenure of the bond is 8 years.

After 8 years, when you redeem the bond you get the price of 10 grams of gold that time.

Now what’s the benefit?

The difference between buying physical gold and SGB is that you will get 2.5% per annum on the investment value. Compounded over 8 years, this is an extra gain of almost 25%. If we assume that gold prices will rise by 5%, the bonds will yield an annualized return of 7.75%.

Please note Interest would be paid semi-annually.

So if you buy Sovereign Gold Bonds worth Rs 52,000. Then annual interest at 2.5% works out to be 1300. You would be paid Rs 650 twice a year.

Refer to the product details -

So if you buy Sovereign Gold Bonds worth Rs 52,000. Then annual interest at 2.5% works out to be 1300. You would be paid Rs 650 twice a year.

Refer to the product details -

Now just look at the historical returns of Gold and Price Performance - ⬇️

Gold has delivered 13.37% annualised CAGR return over the last 15 years, 9.22% for the last 10 years, 14.96% for the last 5 years and 19.75% for the last 3 years.

Gold has delivered 13.37% annualised CAGR return over the last 15 years, 9.22% for the last 10 years, 14.96% for the last 5 years and 19.75% for the last 3 years.

One of the most important benefits of SGBs is that it can be sold in the secondary market if you held them in the Demat account, simply how you sell your stocks in Zerodha.

https://twitter.com/kaushality/status/1394205901305774080?s=20

@pooniawalla summarised this well, I'm a big sucker of SGB and buying every year, Not only for Tax Benefits on Maturity but for all of these benefits -

https://twitter.com/pooniawalla/status/1394204619228651523?s=20

End of the thread, Drop your questions if you've any and RT for more awareness. Thanks for reading. 🙏

https://twitter.com/Ravisutanjani/status/1394201253433909254?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh