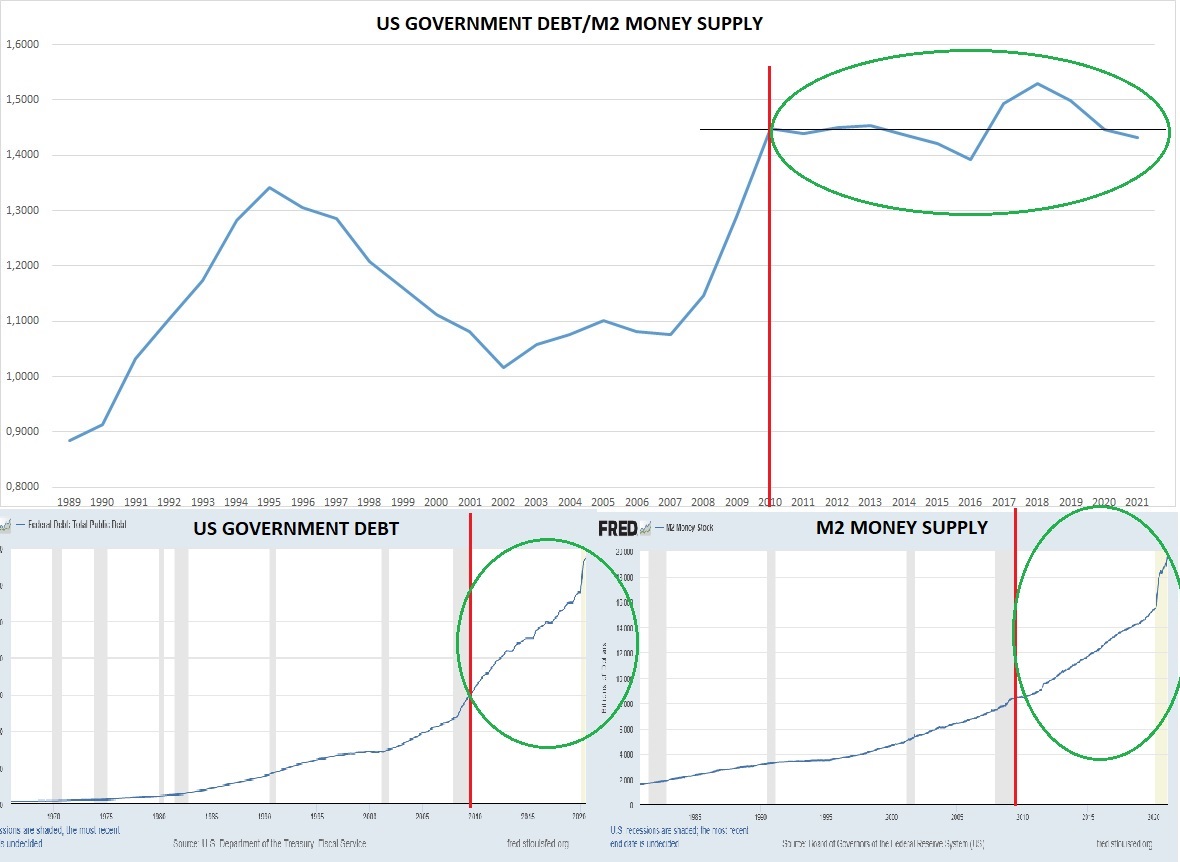

1-Modern monetarists or Keynesians want to convince us that as long as the economy grows by 2% and issuance is 2%, that does not generate inflation. Of course, it does not produce inflation from 0 onwards, but it does not allow deflation to arise.

2-what sense does it make to producers to let the GOV introduce more MONEY if we already sow that it is not necessary to let trade flow, only smaller units are needed in deflationary economies. see this thread

https://twitter.com/franciscocapde8/status/1384873374107815939

3-it is not logical that producers of goods and services generate economic and productive effort to produce and GOV without any effort or any benefit for society, introduce at ZERO cost more monetary units. literally zero with digital money

4-Why should producers receive this money in exchange for their effort if it does not take any time, energy or sacrifice to create it and does not give us any extra benefit? THE STATE SHOULD BE FINANCED, FOR ITS SERVICES, ONLY WITH THE TAXES IT CHARGES,

5-THE CURRENCY MUST BE CONSTANT AND NOT ANOTHER SOURCE OF FINANCING FROM THE STATE.

THIS IS WHAT I CALL THE SLAVERY OF THE 21ST CENTURY.

THIS IS WHAT I CALL THE SLAVERY OF THE 21ST CENTURY.

Money shouldnt be used to overheat/cool economies because distorts basis on which production´s prices of goods are expressed,MONEY in a economy should only be an instrument that allows the AGILITY of trading,under no circumstances should be used to manipulate the economy prices.

• • •

Missing some Tweet in this thread? You can try to

force a refresh