Is the UK economy in danger of becoming the new Italy?

🇬🇧🇮🇹🤦♂️

A thread...1/23🧵

🇬🇧🇮🇹🤦♂️

A thread...1/23🧵

...@resfoundation and @CEP_LSE raised this prospect as they launched their Economy 2030 research programme yesterday…2/23

economy2030.resolutionfoundation.org/wp-content/upl…

economy2030.resolutionfoundation.org/wp-content/upl…

...So let's look at why it’s such a dire prospect and whether or not it’s possible.

Italy’s a good comparator country for the UK because recently as the 1980s it was broadly equal in economic size, population and prosperity…3/23

Italy’s a good comparator country for the UK because recently as the 1980s it was broadly equal in economic size, population and prosperity…3/23

…Indeed, at one point in 1987 the size of Italy’s economy was reported to have eclipsed that of the UK in an event celebrated in Rome as “il sorpasso”, or the overtaking….4/23

csmonitor.com/1987/0508/oita…

csmonitor.com/1987/0508/oita…

…But there’s clearly been a major divergence between the performance of the UK and Italian economies since then.

A gap began to open in the middle of the 1990s & the trend which accelerated from the turn of the millennium...5/23

A gap began to open in the middle of the 1990s & the trend which accelerated from the turn of the millennium...5/23

..Between 2000 and the eve of the pandemic the UK economy had grown by 40 per cent.

Italy’s was just 3 per cent larger - a shockingly weak performance…6/23

Italy’s was just 3 per cent larger - a shockingly weak performance…6/23

…To some extent this divergence is due to differing rates of population growth.

While the two countries had roughly the same population in 1987 the UK population has grown by around 10m since then while in Italy it’s up by just 3m…7/23

While the two countries had roughly the same population in 1987 the UK population has grown by around 10m since then while in Italy it’s up by just 3m…7/23

…All else equal a country with a larger population will have a larger economy.

But all else has not been equal.

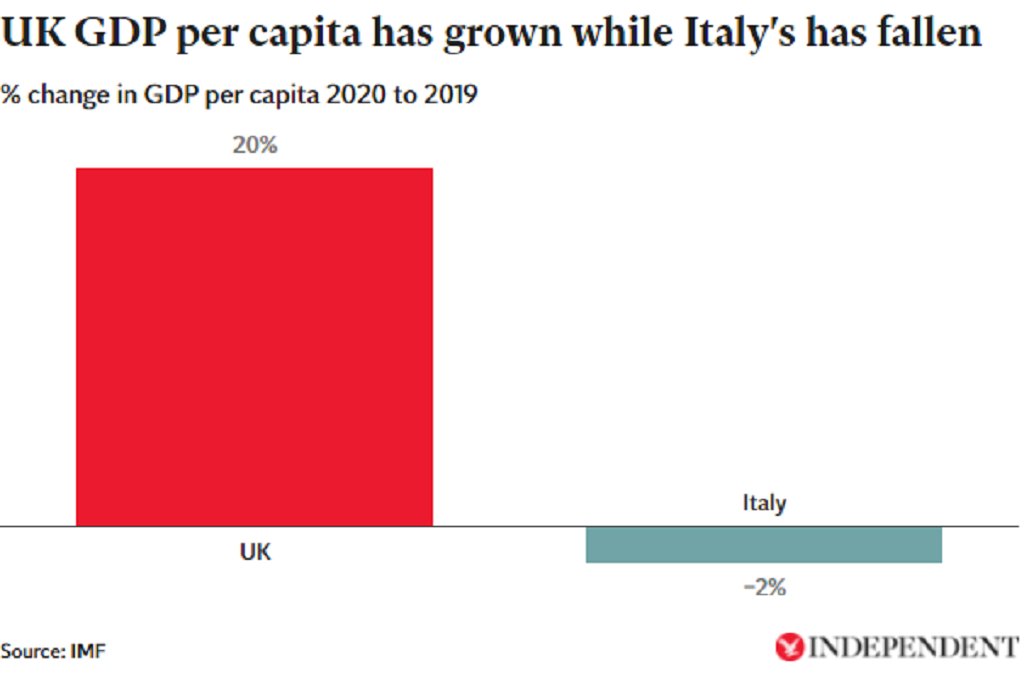

Since 2000 the UK’s GDP per capita (so adjusting for the size of the population) is up by 20 per cent. Italy’s has fallen by 2 per cent...8/23

But all else has not been equal.

Since 2000 the UK’s GDP per capita (so adjusting for the size of the population) is up by 20 per cent. Italy’s has fallen by 2 per cent...8/23

…That’s because the productivity of the Italian workforce and its businesses has barely grown in 20 years.

The consequence of that stagnation that, broadly speaking, the Italian population are, on average, no better off than they were two decades ago...9/23

The consequence of that stagnation that, broadly speaking, the Italian population are, on average, no better off than they were two decades ago...9/23

...More clear evidence of the malaise of the Italian economy is its unemployment rate.

Since 2000 the average jobless rate in the UK has been 5.5 per cent. In Italy it has been above 9 per cent...10/23

Since 2000 the average jobless rate in the UK has been 5.5 per cent. In Italy it has been above 9 per cent...10/23

…Another symptom of Italy’s malaise has been its public sector debt.

Through the 2000s it was more than 110 per cent of GDP and is now, in the wake of the pandemic, is more than 150 per cent...11/23

Through the 2000s it was more than 110 per cent of GDP and is now, in the wake of the pandemic, is more than 150 per cent...11/23

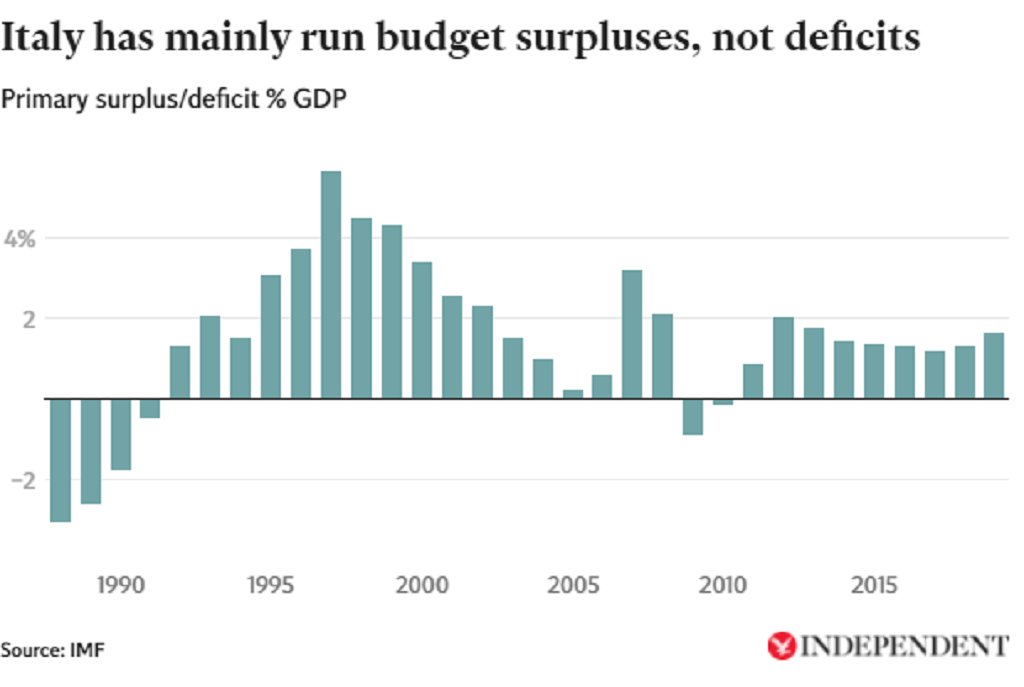

...But it’s vital to note this isn’t all due to excessive government spending – before interest costs the Italian gov has been mostly running budget surpluses since the mid 1990s.

The major driver of the soaring Italian debt to GDP ratio has been weak GDP growth...12/23

The major driver of the soaring Italian debt to GDP ratio has been weak GDP growth...12/23

…So why has Italy fallen into this crisis?

To some extent it's probably joining the euro in 1999.

The European Central Bank’s monetary policy was too tight for Rome in the wake of the 2008 financial crisis...13/23

To some extent it's probably joining the euro in 1999.

The European Central Bank’s monetary policy was too tight for Rome in the wake of the 2008 financial crisis...13/23

...& in 2012 the ECB failed to stand behind the Italian sovereign bond market prompting a disastrous market run on Italian debt and forcing up interest rates to unaffordable levels...14/23

…When the ECB eventually stepped in to calm the market the price effectively imposed on Rome by the European Commission and Germany was a contractionary fiscal policy, which sent Italy back into repeated recessions and pushed up unemployment....15/23

…So the macroeconomic policy imposed on Italy has certainly been a big part of its economic distress, just as it has been a part of the suffering in other eurozone such as Greece, Spain and Portugal....16/23

…Yet it’s by no means all of it.

Over decades Italy’s politicians have also persistently failed to open up Italy’s labour markets, shied away from tackling opaque private business governance, declined to dismantle regulation that chokes innovation and entrepreneurship...17/23

Over decades Italy’s politicians have also persistently failed to open up Italy’s labour markets, shied away from tackling opaque private business governance, declined to dismantle regulation that chokes innovation and entrepreneurship...17/23

...have not cleaned up the banking sector & neglected weak standards in schools.

All this has eroded the country’s competitiveness relative to other European economies.

See the IMF here for a standard run down of Italy's supply side problems...18/23

imf.org/en/News/Articl…

All this has eroded the country’s competitiveness relative to other European economies.

See the IMF here for a standard run down of Italy's supply side problems...18/23

imf.org/en/News/Articl…

...When it comes to whether the UK is in danger of following Italy into this mire an optimist might argue out that there is no likelihood of the UK joining the euro, facing overly tight monetary policy, or counterproductive fiscal austerity ...19/23

…Yet the UK has already been suffering some of the same ills as Italy outside the euro.

In both countries, national productivity flat lined in the decade between the financial crisis and the pandemic, while in Germany it rose by 8 per cent...20/23

In both countries, national productivity flat lined in the decade between the financial crisis and the pandemic, while in Germany it rose by 8 per cent...20/23

...another decade of flat lining productivity in the UK *could* leave us closer to Italy than Germany.

And bear in mind mainstream estimates that Brexit will hold back UK productivity growth by around 4% over the coming 15 or so years...21/23

And bear in mind mainstream estimates that Brexit will hold back UK productivity growth by around 4% over the coming 15 or so years...21/23

…So: it’s no exaggeration to say if UK policymakers make the wrong policy choices - and duck hard decisions on taxes, spending and regulation - over the coming years relative national economic decline is a very real prospect...22/23

• • •

Missing some Tweet in this thread? You can try to

force a refresh