#angelbroking so many UC. 🤣

This thread is to understand the biz & what excites me about it. A bit about the #broking industry too. This is going to be a long thread, so please don't hold your breath. As always retweet if you like, so max people can benefit. 🙏

This thread is to understand the biz & what excites me about it. A bit about the #broking industry too. This is going to be a long thread, so please don't hold your breath. As always retweet if you like, so max people can benefit. 🙏

#Brokers provide the UI/UX to the end participant to execute their trades. Traditionally, brokers have made money through couple of major sources:

1. Brokerage: In the olden days, brokers used to have “packs” (say X trades in Y days for Z rupees) and also provide custom plans to their clients with a focus on driving volume. This got disrupted with the advent of discount brokers like Zerodha.

Most brokerage houses now offer flat brokerage for some segments and 0 brokerage for others. The idea is, people who trade more, pay. People who are in it for buying and holding, anyway do not contribute volumes, let’s make that free (from brokerage PoV).

Flat brokerage is the idea that each trade costs the same and so larger trades do not cost more. Earlier, brokerages would charge 0.1% of the trade as brokerage. So a 1cr trade would cost Rs 10,000! Now, it costs Rs 20.

2. #Margin #funding: When one wants to execute a trade, there is a concept of leverage. If I as a #trader bring my capital of 1 lakh rupees, I can ask the brokerage to lend me money (leverage) and use the larger capital to amplify the effects of my trade, making more money.

This is known as margin funding for the brokerage. Since the brokerage can square off your positions by the end of the day, this business is very low risk for the brokerage (unlike traditional lenders who can have NPAs). Brokerages charge interest for the margin lending.

Okay, so the broking industry revenues are tightly coupled stock market performance. Bull run causes greed to explode in the hearts of people causing new client additions to soar through the roof. Bear markets have the opposite effect. See motilal revenues, correlate with nifty

One can clearly see the 2014-2018 bull market, 2018-2020 bear market and the new bull market.

Coz of cyclicality brokers are eager for new sources of revenues. Major one which good brokerages build is a distribution platform for loans, insurance, mutual funds.

Coz of cyclicality brokers are eager for new sources of revenues. Major one which good brokerages build is a distribution platform for loans, insurance, mutual funds.

ICICI securities gets ~25% revenue from this distribution stream.

Last bit on broking industry before we dive into #angelbroking . Look at under-penetration of demat accounts in India, compared to china and US.

Last bit on broking industry before we dive into #angelbroking . Look at under-penetration of demat accounts in India, compared to china and US.

Up until 2018-2019, #angelbroking used to be a full broker with many branches, physical order placing. They realized that this model does not scale & also had high operating costs and thus decided to transition to becoming a fully digital broker with no physical presence

Where does angel earn its money from? As a broker, angel earns majority of its revenue from broking. The “interest” we see in the chart below is the margin funding book which is also growing nicely.

Broking revenue is subdivided into F&O, cash, commodity. Cash segment contributions going down due to recent rules by SEBI (businesstoday.in/markets/market…) which while ensuring client protection also forced many traders to migrate from cash segment to F&O segment.

Income from Margin Funding

Word of caution: margin funding book is very volatile and hence growth trends cannot be extrapolated from 3 quarters. As an example, angel’s margin funding book was 1,000 cr in 2018 peak, and is 1500 cr right now.

Word of caution: margin funding book is very volatile and hence growth trends cannot be extrapolated from 3 quarters. As an example, angel’s margin funding book was 1,000 cr in 2018 peak, and is 1500 cr right now.

Angel also has the ARK engine which consists of Alpha-generating algorithms based on multiple fundamental and quantitative factors (a quant smart-beta investing strategy). Claim they were 1st brokerage to develop such an algorithm (difficult to verify).

Another interesting trend we see play out across the industry and definitely for angel is that they want to become a tech platform which enables other apps to integrate seamlessly, increasing value added for the clients.

Let's talk about Angel's growth now.

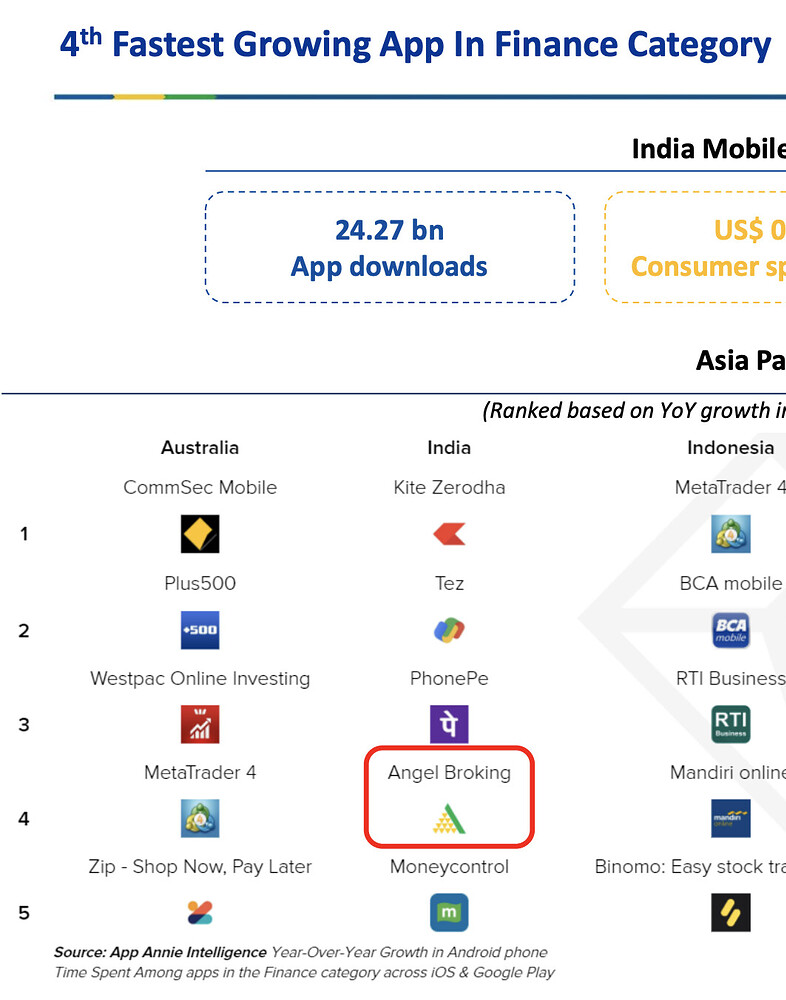

Angel has been consistently gaining market share and scale, which we can see in the following tweets.

Angel has been consistently gaining market share and scale, which we can see in the following tweets.

Angel is adding new clients rapidly. A lot of them are coming from tier 2 and tier 3 cities. Do take a special look at Angel’s share in incremental demat clients which has risen from 6.9% to 17.6%.

A second lever for growth has been the bull market. One can clearly see the large increase in number of trades happening and ADTO (Average daily turnover, a measure of trading volume). Remember, cash segment has been impacted by SEBI rules and thus F&O growth is extraordinary.

Let's talk about Angel's profitability

Broking, specially digital has high ROCE. Costs are very minimal (maintain a sub-linearly scaling computer network, employee pack) & client acquisition costs (showing ads on Google).

Broking, specially digital has high ROCE. Costs are very minimal (maintain a sub-linearly scaling computer network, employee pack) & client acquisition costs (showing ads on Google).

Client acquisition cost (CAC) is the key lever management can control in order to balance between profitability and growth). Increase CAC, increase growth, reduce profitability. Reduce CAC, increase profitability, reduce growth.

Good thing about this industry & business is that there are multiple operating levers. Client addition, spreads the fixed costs over a larger revenue base leading to not just high but improving ROCE.

Whenever management can execute any cross-sell (say sell MF units to a trader) that is at almost 0 cost. So any incremental distribution revenues flow directly to bottomline. Wow, so much operating leverage.

**What excites me about Angel**

1. AMC entry: In the Q4FY21 concall, they announced their intention of getting into the AMC business in the next 1-2 years. This by itself is a big enough trigger and primary reason for the rerating (UC) we have seen recently.

1. AMC entry: In the Q4FY21 concall, they announced their intention of getting into the AMC business in the next 1-2 years. This by itself is a big enough trigger and primary reason for the rerating (UC) we have seen recently.

What i was more fascinated by was their vision for what this AMC biz would look like. Instead of setting up a traditional AMC, they want to focus on a more tech-enabled and algorithmic kind of AMC. ETFs, Smart-beta products, Quant strategies.

They realize that trends which have happened in the west are likely to repeat in India and thus preparing early enables them to stay ahead of the curve.

2. New CEO hire: The reason I believe that they would be able to do this is their recent CEO hire. Their ex-ceo died (RIP) & they hired the new CEO, Narayan (linkedin.com/in/narayangang…) who is an absolute tech giant and is the ex-CTO of ola & ex-head of engineering at Uber. Wow.

His leadership could transform angel from a broking house to a true fintech. Angel concall was the first time I heard an indian CEO talk about 4 9s reliability. (the angel broking app has 99.9% reliability & wants to take it up to 99.99%.

CEO is also talking about how they want to scale the system to be robust in the face of 10x more traffic. They want to build a robust data sciences team, hire more folks.

3. Angel’s client acquisition strategy: reinvest their increased profitability (due to operating leverage) into client acquisition. They would reinvest all of that incremental margins into higher client acquisition by doing higher spends on digital ads.

This strategy is clearly working which we see in angel’s faster than industry growth. Also, 38-39% of angel’s total client base is active, compared to industry average of 32%. This means they aren’t just acquiring dud customers, the customers are active

4. Distribution revenues: are only 1% of the topline. ICICI securities has 25% of topline as distribution revenues. Not that angel would find it easy to scale this up to 25% but management has a clear focus on increasing revenues from cross-selling and distribution of products.

All of this is very low cost for the business & this would provide significant operating leverage, flowing directly into the bottomline. Angel’s strategy of maintaining profitability would thus allow them to acquire better (more active) clients and also grow faster than industry

5. Industry tailwinds 1: A word on why I am excited about the broking industry as a whole as well. There is severe under penetration of equity in India which makes demat account growth a long term secular trend with short terms cycles (bull/bear markets) in the middle.

Although cyclical, if we carefully look at MOSFS revenue graph I has posted, we realize that the revenues do not go down very dramatically in down years (20% down from 2018 peak post 2018).

Reason investors lose money is because they buy the company at unreasonable valuations right before a market crash (MOSFS was at 34 pe before 2018 crash. Business went down, valuations crashed and the twin engines of growth became twin engines of degrowth).

6. Industry Tailwinds 2: In addition broking industry has a mega-trend which has started but not at all played out which is margin funding. Total margin funding book for the Indian brokerage industry is < 1B$ currently (See client funding link at www1.nseindia.com/products/conte…)

Guess the size for China and US markets?

This same industry is 100B$ in China (ceicdata.com/en/china/csf-m…) and 800B$ in US (finra.org/investors/lear…). Wow.

This same industry is 100B$ in China (ceicdata.com/en/china/csf-m…) and 800B$ in US (finra.org/investors/lear…). Wow.

Will the same trend play out in India? I think there is a possibility that it will. Specially with the new SEBI norms on regularising margin funding norms, we should see more structure emerge in this part of the industry

7. Angel’s client base: Consensus estimates are for an economic revival in India. This would enable larger tradable incomes for angel’s tier 2/3 clients enabling higher growth for #angelbroking margin funding business

Risks to the investment thesis

1. Entire broking industry is cyclical. Any large/prolonged bear market can cause angel’s business metrics to invert from growth to degrowth causing the double engines of value destruction to kick in: derating and business degrowth

1. Entire broking industry is cyclical. Any large/prolonged bear market can cause angel’s business metrics to invert from growth to degrowth causing the double engines of value destruction to kick in: derating and business degrowth

2. Angel might not get an AMC license. (I personally place low probability on this event)

3. Angel’s bet on smart-beta and ETFs might be a trend which doesn’t playout in India in which case it would be a bad capital allocation decision.

3. Angel’s bet on smart-beta and ETFs might be a trend which doesn’t playout in India in which case it would be a bad capital allocation decision.

4. Angel’s clients mostly and incrementally come from tier 2 and tier 3 cities. Prolonged economic distress either due to covid or otherwise can cause their ability to trade to suffer.

End of thread.

Lastly thanks to @NeilBahal sir who openly talks about angel and inspired me to deep dive into #angelbroking

Lastly thanks to @NeilBahal sir who openly talks about angel and inspired me to deep dive into #angelbroking

@threader_app compile

Disclaimer: I am invested in angel, this is not a buy or sell reco. Only sharing my knowledge.

• • •

Missing some Tweet in this thread? You can try to

force a refresh