My View On The #Crypto Market and $BTC.

🔹What happened?

🔹Do I think the bull market is over?

🔹What's next?

🔹What will I be doing?

🔹What happened?

🔹Do I think the bull market is over?

🔹What's next?

🔹What will I be doing?

🔹What happened?

First off, what the hell happened?! Especially on May the 19th in particular?

Of course there's plenty of arguments and narratives for what happened. Be it Elon, China FUD or just the general end of the bull market as a whole.

1/x

First off, what the hell happened?! Especially on May the 19th in particular?

Of course there's plenty of arguments and narratives for what happened. Be it Elon, China FUD or just the general end of the bull market as a whole.

1/x

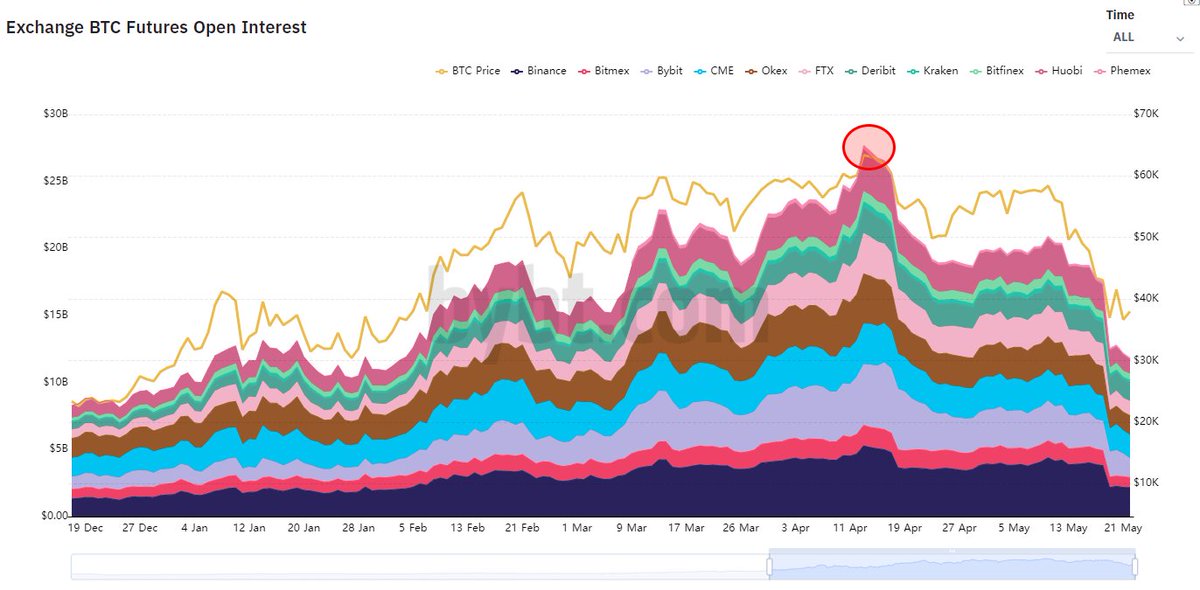

The one thing that's most likely though, which we can see from the data, is the fact people have been over-leveraging into longs... A LOT.

We knew this was happening all along and usually we got away with a 20-30% dip but this was not like the other corrections.

2/x

We knew this was happening all along and usually we got away with a 20-30% dip but this was not like the other corrections.

2/x

This time, open interest, which is the total position size of both longs and shorts on futures, was at a pretty hefty peak all time high of over $27B.

3/x

3/x

Looking at the funding rates at the time, it was clear that most derivatives we're paying a big premium compared to spot meaning a lot of people were betting with huge long positions on price going up further.

4/x

4/x

So as price started falling further than people expected, we can see these huge drops in open interest as mostly longs are closing, getting stopped out or straight up liquidated. Which then put on even more selling pressure as it snowballed further and futher.

5/x

5/x

Of course there's also shorts taking profit in all of this but as can be seen in the liquidation chart, A LOT of the longs have been completely wiped out.

6/x

6/x

This seems to be the best explaination for the size and speed of the drop, especially on May 19th.

Besides that, the market had an amazing run up until that point with very few big corrections.

A lot of new traders and investors also joined us meanwhile.

7/x

Besides that, the market had an amazing run up until that point with very few big corrections.

A lot of new traders and investors also joined us meanwhile.

7/x

Most of these people haven't seen huge drops like these happen before or don't use proper risk management.

Even though most of their portfolio's may be small, add millions of people together and them selling/getting rekt has quite the impact on price I'd imagine.

8/x

Even though most of their portfolio's may be small, add millions of people together and them selling/getting rekt has quite the impact on price I'd imagine.

8/x

We're also seeing big amounts of FUD over the past few weeks. It's true that FUD gets absorbed very easily with little to no price drop when the market is bullish.

But even then, it seems like "all of the sudden" everything is coming in at once.

9/x

But even then, it seems like "all of the sudden" everything is coming in at once.

https://twitter.com/DaanCrypto/status/1395753555303206919

9/x

We're seeing probably the 100th message of "China banning Bitcoin" and obviously, seeing in how much panic the market is, it reacts by an instant drop in price. This gives me September 2017 feels.

Most of this is usually just to scare people away.

10/x

Most of this is usually just to scare people away.

10/x

🔹Do I think the bull market is over?

Quick answer: No, not yet. But I got levels in mind where I'll be reconsidering that statement. More about that later.

11/x

Quick answer: No, not yet. But I got levels in mind where I'll be reconsidering that statement. More about that later.

11/x

Even though this drop is very scary, we've seen this happen before in 2013 where $BTC's price even went as far as -80% only to make another huge peak later that year.

Many people reference to this cycle as a "double peak cycle".

12/x

Many people reference to this cycle as a "double peak cycle".

12/x

Even though I doubt we'd go -80% only to recover after. We could be seeing a similar scenario here again. Where price comes down after it's initial parabolic run, consolidates for a while and then continues to make a new all time high later this year.

13/x

13/x

Currently, sentiment seems rock-bottom. Fundings are negative and the market seems to be in panic mode.

Historically, these times have proven very well for buying in the long term.

The same can be said about an euphoric sentiment for selling.

14/x

Historically, these times have proven very well for buying in the long term.

The same can be said about an euphoric sentiment for selling.

14/x

I've always believed that once the stock market tops out and the DXY (Dollar index) bottoms out, we'd see Bitcoin go down with it.

Bitcoin and crypto as a whole have been moving with stocks quite well over the past few years on high timeframes.

15/x

Bitcoin and crypto as a whole have been moving with stocks quite well over the past few years on high timeframes.

15/x

The thing now is, that stocks are nearly at an all time high and the dollar isn't showing much signs of life for a bounce either.

Whether that's healthy or not in our current economy, I won't get into but it's definitely something to watch.

16/x

Whether that's healthy or not in our current economy, I won't get into but it's definitely something to watch.

16/x

With increasing inflation (regardless of what the FED may say), huge money prints, a weak dollar and stocks at near all time highs...

Is Bitcoin, the best performing asset of the decade, really entering a new bear market right now?

Just as institutions are getting in?

17/x

Is Bitcoin, the best performing asset of the decade, really entering a new bear market right now?

Just as institutions are getting in?

17/x

Of course anything is possible and institutions aren't godly beings that know everything either.

I just strongly doubt that Bitcoin would end it's cycle here sooner than anything else.

18/x

I just strongly doubt that Bitcoin would end it's cycle here sooner than anything else.

18/x

If the stock market would start falling all of the sudden and we'd enter a risk-off environment again, just like during the covid crash. That would definitely change my bias towards the crypto market a lot.

But as we speak, that's not the case just yet.

19/x

But as we speak, that's not the case just yet.

19/x

I would also like to get into the fact: Who is buying here? Price went up approximately 30% from the "bottom" and has sustained itself quite well in the 35-40K range for the time being.

Is it retail investors trying to double down on their underwater investments?

20/x

Is it retail investors trying to double down on their underwater investments?

20/x

I doubt that. They don't have the pockets to sustain such downwards pressure and they probably don't even want to buy.

Volume seems to be at all time highs on most exchanges so it's not like the order books are so thin that it's relatively easy to sustain price.

21/x

Volume seems to be at all time highs on most exchanges so it's not like the order books are so thin that it's relatively easy to sustain price.

21/x

That means that some people with big pockets are still buying and have absorbed all the selling pressure from the past days.

One of these turns out to be Alameda. I really also recommend checking out @AlamedaTrabucco's thread below:

22/x

One of these turns out to be Alameda. I really also recommend checking out @AlamedaTrabucco's thread below:

https://twitter.com/AlamedaTrabucco/status/1395211754683109383

22/x

🔹What's next?

There is still A LOT of Bitcoin being sold and bought and I expect volatility to remain relatively high as we chop around as Bitcoin finds a bottom.

Whether the bottom is in already (I think so) or not.

23/x

There is still A LOT of Bitcoin being sold and bought and I expect volatility to remain relatively high as we chop around as Bitcoin finds a bottom.

Whether the bottom is in already (I think so) or not.

23/x

This chop will scare away or stop out everyone trying to trade in this area.

If you believe in Bitcoin, buy spot. Don't even try to use leverage here unless you're an expert scalper.

24/x

If you believe in Bitcoin, buy spot. Don't even try to use leverage here unless you're an expert scalper.

24/x

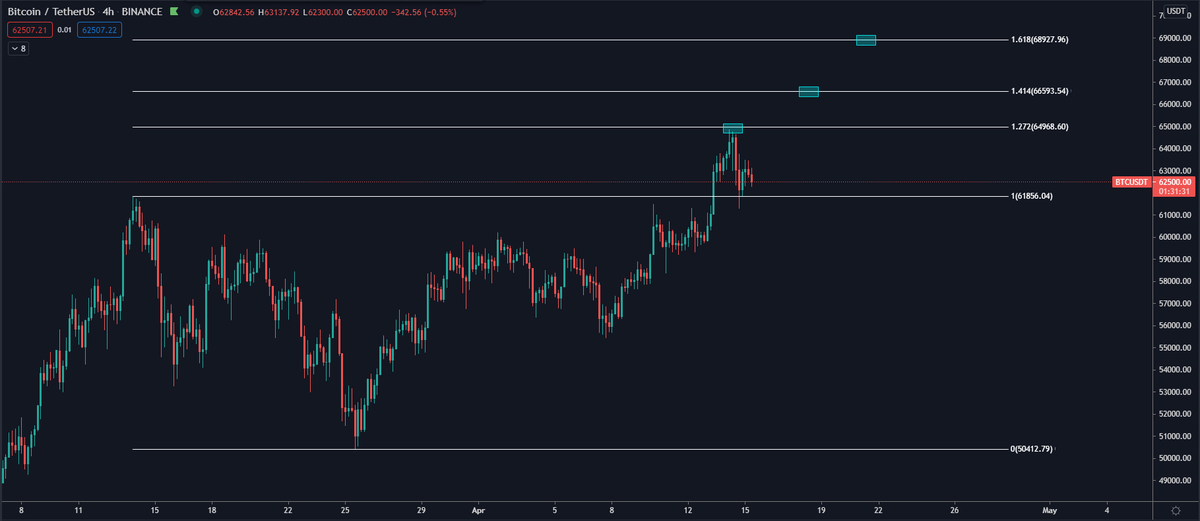

The two areas of interest I'm watching right now are the $42-43K area as well as the $28.8-30K area.

Getting above $43K would be great and I'd have a lot more confidence in this being a giant shakeout.

25/x

Getting above $43K would be great and I'd have a lot more confidence in this being a giant shakeout.

25/x

🔹What will I be doing?

If we start consolidating below $28.8K I would reconsider my bias and start looking to get out of the market as a whole.

I'd then:

A. Buy back lower ($19-23K)

B. Buy back on a solid retake of the level with a better probability of moving up.

26/x

If we start consolidating below $28.8K I would reconsider my bias and start looking to get out of the market as a whole.

I'd then:

A. Buy back lower ($19-23K)

B. Buy back on a solid retake of the level with a better probability of moving up.

26/x

Obviously, I do recognize that there's always the possiblity that I'd be in disbelief right now. Who knows one is, as it's happening after all?

That's why I'm trying to keep a clear mind and have a plan ready in case it turns out I'm wrong.

27/x

That's why I'm trying to keep a clear mind and have a plan ready in case it turns out I'm wrong.

27/x

I've taken out approximately 2/3 of my profits already along the way up so whatever happens I can be very satisfied with the result regardless of what happens from here.

28/x

https://twitter.com/DaanCrypto/status/1375890084944297989

28/x

I'd like to end this off by saying these are all just my thoughts and how I see the market as it is right now.

Please don't see this as financial advice and always use more sources, indicators, charts as well as risk management when making financial decisions.

29/x

Please don't see this as financial advice and always use more sources, indicators, charts as well as risk management when making financial decisions.

29/x

Thanks for reading and I hope I could help you out a bit more during this time of uncertainty.

I always try to provide as much value as possible. Even during darker times in the market 🙂.

For now I wish you all an incredible week ahead.

30/x

I always try to provide as much value as possible. Even during darker times in the market 🙂.

For now I wish you all an incredible week ahead.

30/x

TL;DR: I don't think the bull run is done yet. Dump was mostly due to over-leveraged longs. I'm leaning towards this being a big shake-out before the final move later this year.

Invalidation when price finds acceptance below $28.8K.

Have a good day! 👍

31/x

Invalidation when price finds acceptance below $28.8K.

Have a good day! 👍

31/x

• • •

Missing some Tweet in this thread? You can try to

force a refresh