Queens Park Rangers 2019/20 financial results covered a season when they finished 13th in the Championship, an improvement on the previous year’s 19th place, though the campaign was disrupted by COVID-19. Some thoughts in the following thread #QPR

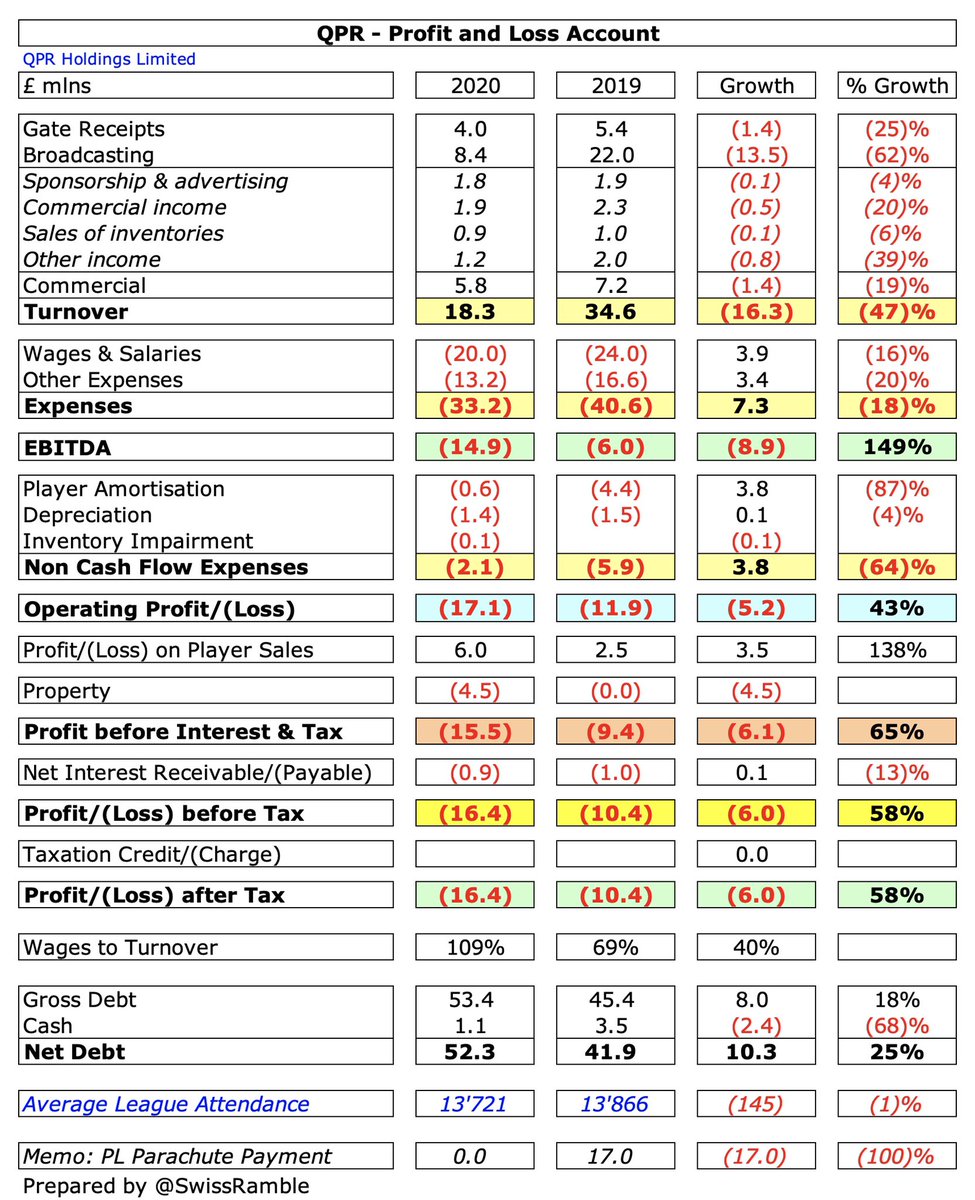

#QPR loss widened from £10m to £16m, as revenue fell £16m (47%) from £34m to £18m, though expenses were cut £11m (24%) and profit on player sales increased £3m to £6m. Also impacted by £4.5m write-off of previous training ground development.

The main reason for #QPR £16m revenue reduction was broadcasting, which dropped £14m (62%) from £22m to £8m, as parachute payments stopped, though gate receipts were also down £1.4m (25%) from £5.4m to £4.0m, while commercial fell £1.4m (19%) from £7.2m to £5.8m.

To offset the steep revenue reduction, #QPR cut the wage bill by £4m (16%) from £24m to £20m, while player amortisation was down £3.8m (87%) from £4.4m to just £0.6m, while other expenses decreased £3.4m (20%) from £16.6m to £13.2m.

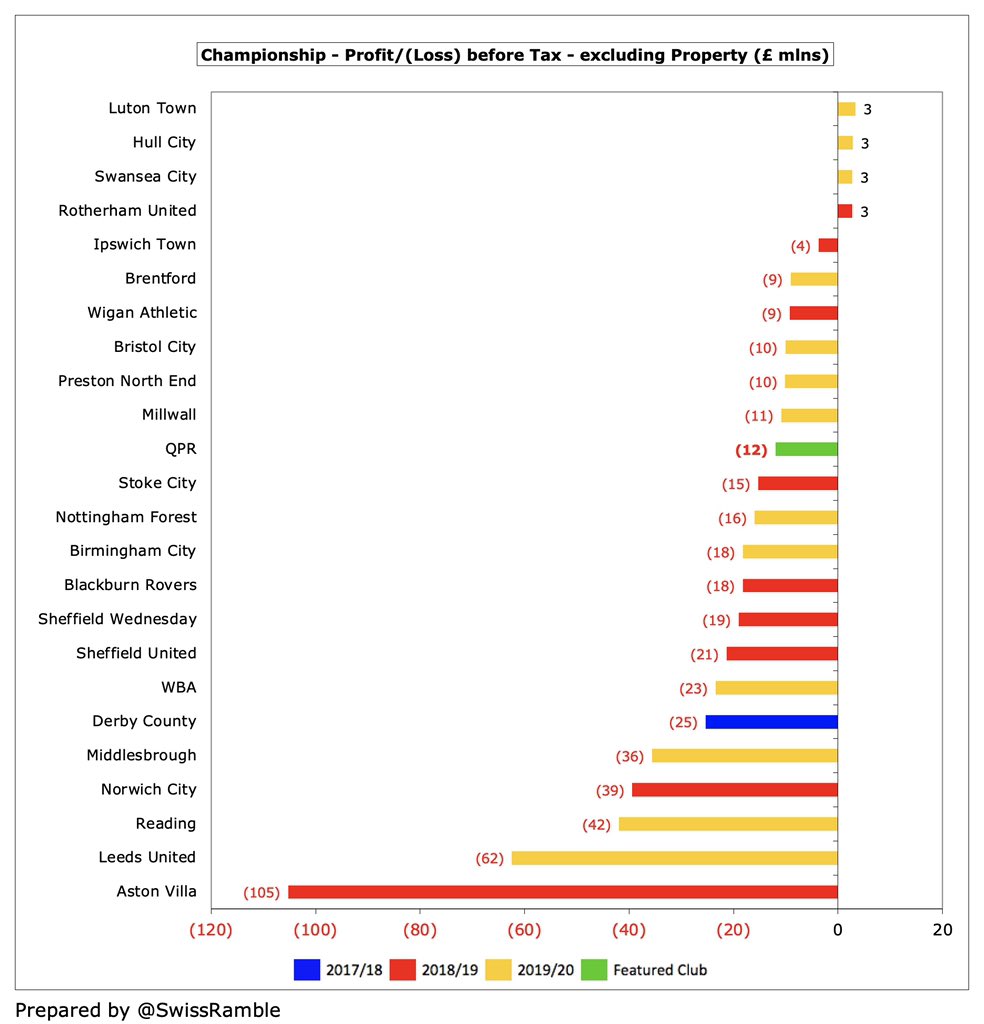

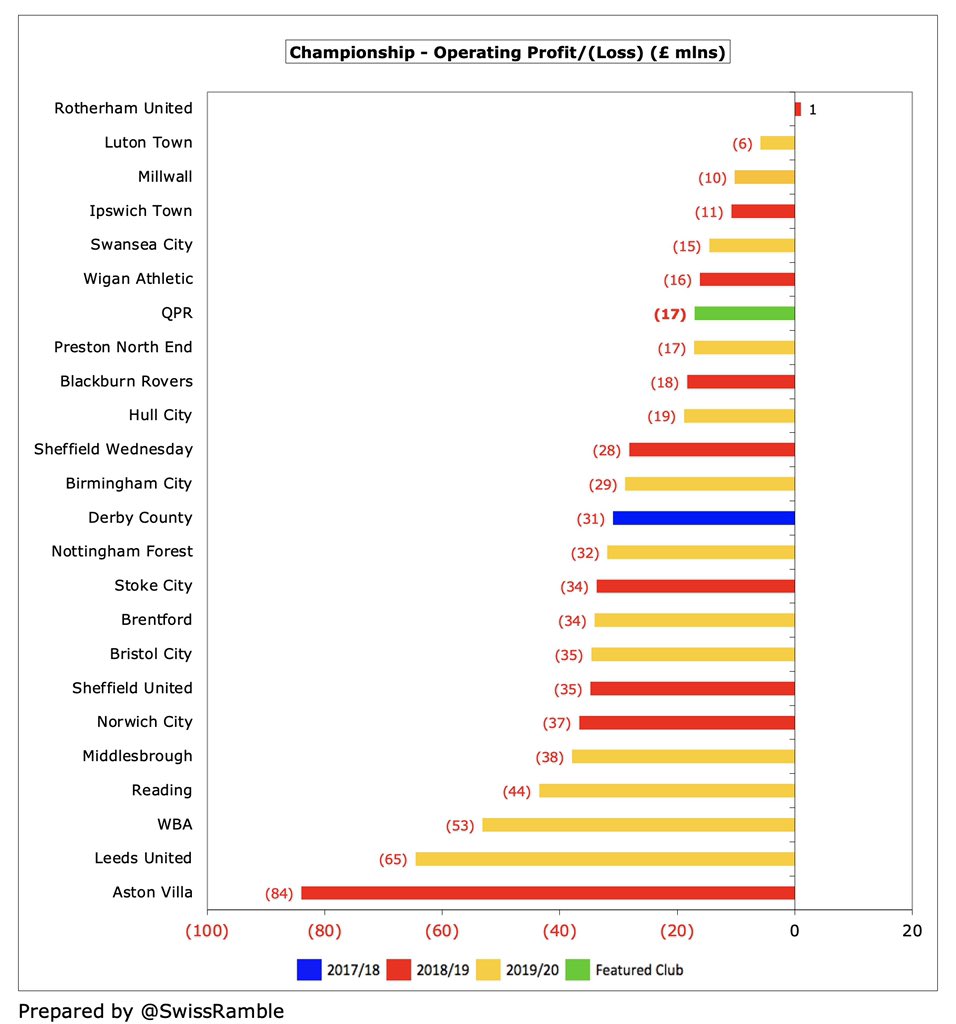

Although #QPR £16m loss is obviously not great, many clubs have reported even larger losses in 2019/20, including Leeds United £62m (large promotion bonus), Reading £42m, Middlesbrough £36m and WBA £23m.

It is also worth noting that some clubs’ figures have been boosted by the sale of stadiums, especially #DCFC £40m, #SWFC £38m and #AVFC £36m, so their underlying profitability was even worse than reported. In contrast, #QPR were hit by the £4.5m training ground write-off.

Excluding property sales, only 3 Championship clubs are profitable in 2019/20 to date (#LTFC, #HCAFC and #Swans, all £3m). Very few clubs manage to make money in this ultra-competitive division, though largest losses often from promoted clubs – including hefty promotion bonuses.

#QPR have not quantified the effect of COVID-19, though they said they lost “a significant amount” of match day, retail and sponsorship income. The 2020/21figures will be even worse, as nearly the whole season has been played behind closed doors.

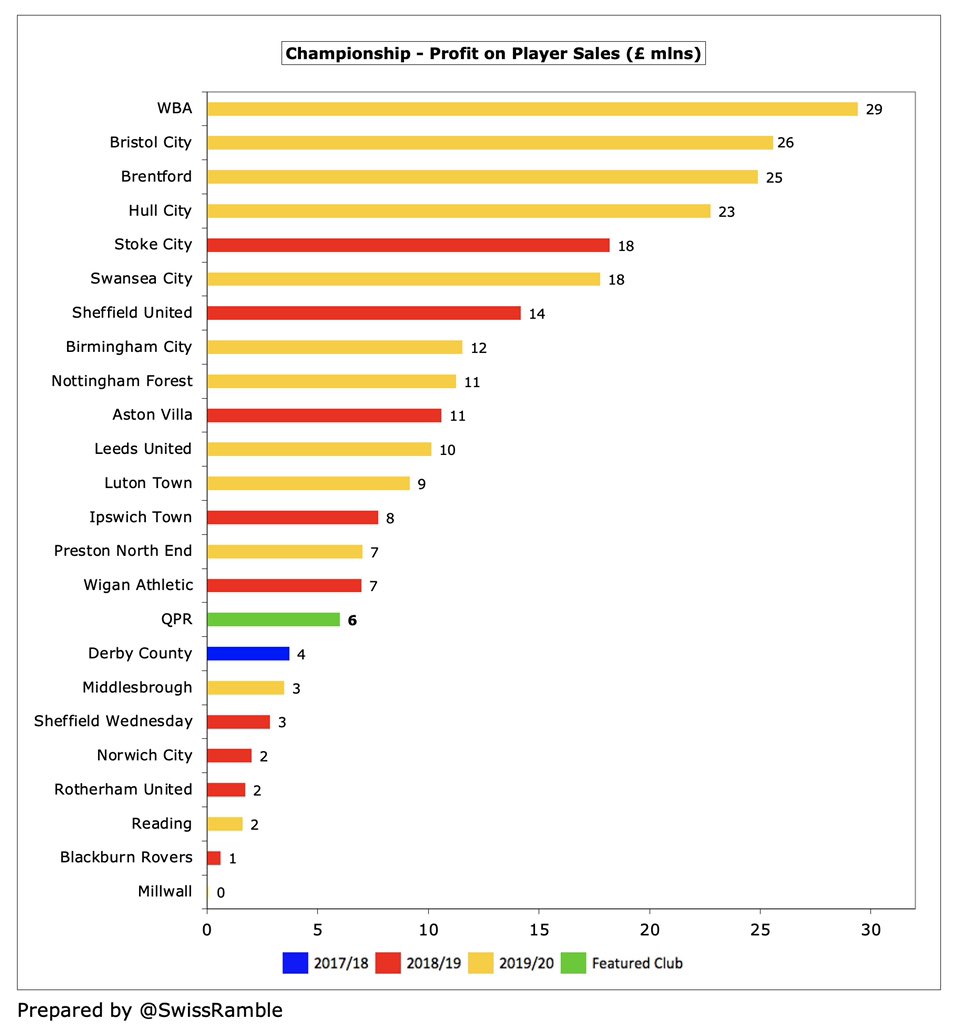

#QPR profit on player sales more than doubled from £2.5m to £6.0m, mainly from Luke Freeman to #SUFC, Darnell Furlong to WBA and Massimo Luongo to #SWFC. That’s a solid improvement, but still a fair bit lower than WBA £29m, Bristol City £26m, Brentford £25m and Hull City £23m.

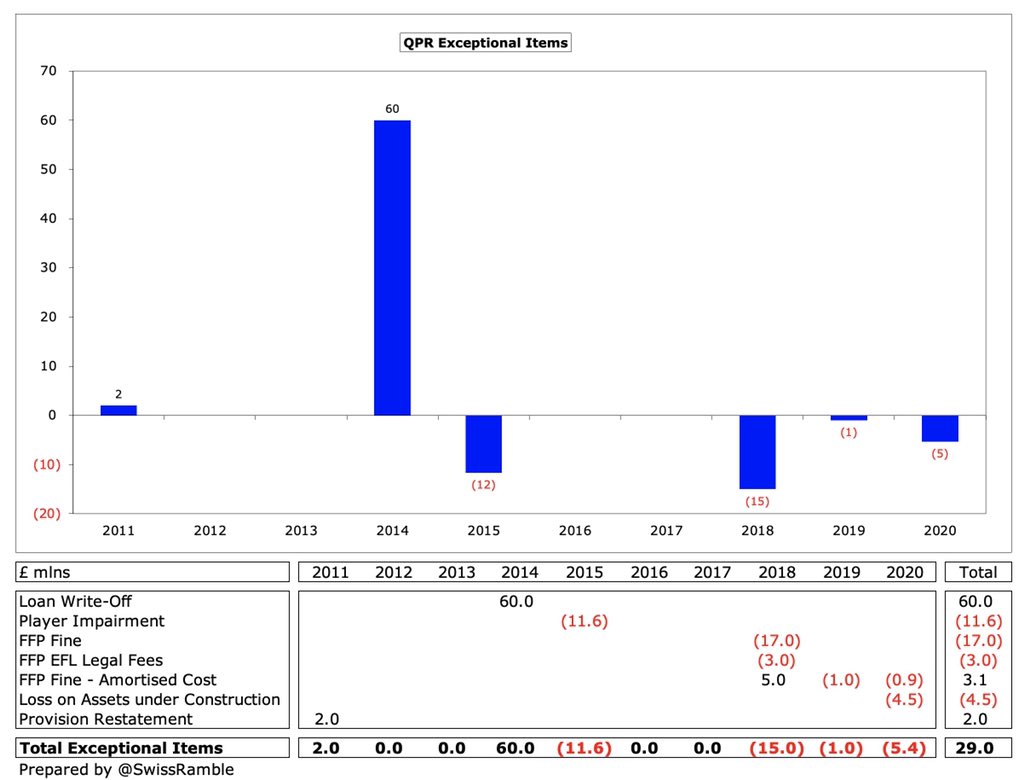

#QPR have consistently lost money over the years. Since Tony Fernandes arrived in August 2011, total losses have been £225m – or £285m if we exclude the £60m loan write-off that was questioned by the EFL. To be fair, underlying losses have been smaller in recent years.

FFP has significantly impacted #QPR figures in last few years. Not only was 2014 loss reduced by £60m write-off of a shareholder loan, but 2018 was hit by a £20m fine (partly offset by £5m accounting adjustment in finance income), while last two seasons included £1m finance cost.

Although #QPR have let some players leave for nothing to get them off the wage bill., profits from player sales have been increasing with £28m made in the last five years. This season will benefit from the club record transfer fee received from Eberechi Eze’s move to #CPFC.

Director of Football Les Ferdinand has emphasised the importance of player trading to #QPR going forward: “The simple fact is every single one of our players is up for sale. That’s where the club is at this moment in time. If we receive the right offer, then they will go.”

#QPR operating loss (i.e. excluding player sales and interest) worsened from £12m to £17m, though this is actually one of the better performances in the Championship. Almost every club in this division posts substantial operating losses, i.e. half of them are above £30m.

Since relegation from the Premier League, #QPR revenue has dropped £68m (79%) from £86m in 2015 to £18m in 2020, very largely due to £57m less TV money in the Championship, though commercial and match day have both halved in the last 5 years, down £6m and £4m respectively.

#QPR revenue decrease last season was mainly driven by parachute payments ceasing (down from £17m), though broadcasting is still the most important revenue stream, accounting for 46% of total revenue, followed by commercial 32% and match day 22%.

Following the decrease in 2019/20, #QPR £18m revenue is now in the bottom half of the Championship, and is only a quarter of the amount earned by clubs most recently relegated from the Premier League, whose revenue is around £70m.

Obviously, #QPR no longer benefit from parachute payments, having received £65m in total in the previous 4 years. Six Championship clubs had parachutes in 2019/20, led by Cardiff City, #FFC and #HTAFC (£42m), followed by Stoke City, Swansea City and WBA (£34m)

If parachute payments were excluded, #QPR £18m would be 14th, still a long way behind the leading clubs in terms of revenue (e.g. a third of table-topping #LUFC £54m). On this basis, their 9th place in this season’s Championship means that the club has outperformed.

#QPR broadcasting income fell £14m (62%) from £22m to £8m, due to no parachute payment, which is the club’s lowest since 2011. Most Championship clubs earn £7-10m, but there is a significant gap to those with parachute payments (e.g. Stoke City received £51m in 2018/19).

#QPR match day income fell £1.4m (25%) from £5.4m to £4.0m, largely due to playing 4 home games behind closed doors because of the pandemic. Much lower than £8.1m in the Premier League, so now bottom half of the Championship, around a third of #LUFC £11m.

#QPR average attendance (for games played with fans) dropped slightly from 13,866 to 13,721, which is down 4,100 since relegation and is one of the lowest in the Championship. The club has frozen season ticket prices for 2021/22, the sixth consecutive season.

#QPR have been looking for a new ground for some time with the Linford Christie Stadium in Wormwood Scrubs a possibility. CEO Lee Hoos admitted, “This club is not financially sustainable in the long-term while we remain at Loftus Road” (known as Kyan Prince Foundation Stadium).

#QPR commercial income fell £1.4m (19%) from £7.2m to £5.8m, comprising sponsorship & advertising £1.8m, commercial income £1.9m, sales of inventories £0.9m and other income £1.2m. Bottom half of the Championship, a long way below the likes of #LUFC £34m and Bristol City £14m.

#QPR terminated their 1-year shirt sponsorship with Football Index after they went into administration, replaced by builders Senate Bespoke from 2021. The kit supplier has been Errea since 2017. The club’s owners paid £300k for sponsorship for “certain areas in the stadium”.

#QPR wage bill was cut by £4m (16%) from £24m to £20m, which means that wages have decreased by a staggering £55m (73%) from £75m in the Redknapp promotion campaign in 2014. Halved since £41m in the first season after relegation (with parachute payment) in 2016.

To give some more colour to those free spending days, #QPR’s £75m wage bill back in 2013/14 is still the fourth highest ever in the Championship, only surpassed by #AVFC £83m, (2018/19), #NUFC £80m (2016/17) and #LUFC £78m (2019/20). All the high earners have since left.

Following the decrease, #QPR £20m wage bill is now firmly in the bottom half of the Championship, only just ahead of the likes of Millwall £19m and Hull City £18m. Less than a third of #LUFC £78m and WBA £67m, though both of those clubs included hefty promotion bonuses.

#QPR wages to turnover ratio increased from 69% to 109%, though this is still one of the better results in the Championship, where the vast majority of clubs have ratios well over 100%. This is also significantly lower than Rangers’ club record of 195% in 2014.

No remuneration was paid to #QPR directors for the 8th year in a row. In contrast, the directors at some clubs received a tidy sum, e.g. Birmingham City £1.6m (senior management), Stoke City £858k, Reading £583k and Blackburn Rovers £570k.

#QPR player amortisation, the annual charge to write-off transfer fees over a player’s contract, fell from £4.4m to just £0.6m, significantly lower than the club’s £17m peak in 2013. One of the lowest in the Championship, miles below big spenders like WBA £20m and #Boro £18m.

#QPR only spent £55k on player purchases in 2019/20, which is unsurprisingly the lowest in the Championship, miles below #LUFC £46m, WBA £34m, Brentford £31m and Bristol City £26m. For some more perspective, even newly promoted Luton Town spent £2m.

In fact, #QPR have spent less than £2m on new players in the last 3 years, though 2019 included a transfer embargo as part of the FFP settlement. This is a huge reduction from the £64m they splashed out on transfers in the preceding 3-year period. Have spent £7m since year-end.

#QPR gross debt rose £8m from £45m to £53m, almost all of which is from the owners (interest-free with no fixed payment terms) plus £546k EFL loan. Would have been much higher if the owners had not capitalised £215m loans and written-off another £60m.

Nevertheless, #QPR £53m debt is still 10th highest in the Championship, though far below the likes of #BRFC £142m, Stoke City £141m, Birmingham City £116m and #Boro £116m. Also owe £10.5m as part of FFP settlement, but since the accounts have converted another £17m into capital.

#QPR only paid £6k interest, one of the lowest in the Championship. That said, much of the debt in this division is provided interest-free by club owners. The highest payments were at Hull City and Birmingham City, both with £1.7m.

In addition, #QPR have £0.6m transfer debt, which is much reduced from £23m five years ago. They are in turn owed £2.8m by other clubs, so they have £2.2m net transfer receivables.

#QPR improved £17m operating loss by adding back £2m amortisation & depreciation and £1m working capital movement to give £14m negative cash flow. Boosted by £4m net player sales (sales £4m, purchases £0m), largely funded by £7m owner loans, giving £2m net cash outflow.

#QPR cash balance therefore fell from £3.5m to £1.1m. This was on the low side, but in fairness most Championship clubs had less than £2m cash in the bank. Not a great buffer in the current economic climate, so club continues to require funding from the owners.

Since Fernandes arrived, the owners have pumped over a quarter of a billion (£262m) into #QPR. The club spent the majority (£166m) covering operating losses and £75m on net player purchases, though £62m of that was in the first two years, with only £12m on infrastructure.

Since these accounts, #QPR have completed the purchase of Heston Sports Ground for £4.5m to develop a new training facility, financed by a £10m bond issued to Ruben Gnanalingam’s family (5-year term, 6% interest per annum).

#QPR reported loss over the FFP 3-year monitoring period is £64m, but they can exclude academy, community & infrastructure (estimated at £4m a year), FFP fine £20m, COVID impact £3m and £4m training ground write-off. This gives £28m FFP loss against the £39m limit.

As #QPR chief executive Lee Hoos said, “There are a number of clubs flirting with FFP limitations and I am pleased to say we are not one of them. We are in a strong position in that respect.” That said, this has clearly been a key factor in the club’s recent strategy.

Hoos stated that #QPR’s finances are “in a good position after a lot of hard work over the last five years.” While it is true that the club have done very well to get costs under control, they are still reliant on their owners, especially now that parachute payments have stopped.

Like other clubs, the pandemic has “significantly impacted” #QPR’s plans, but their future is likely to involve the development of academy products, either leading to success on the pitch or profitable sales, as was seen last summer with the talented Eze.

• • •

Missing some Tweet in this thread? You can try to

force a refresh