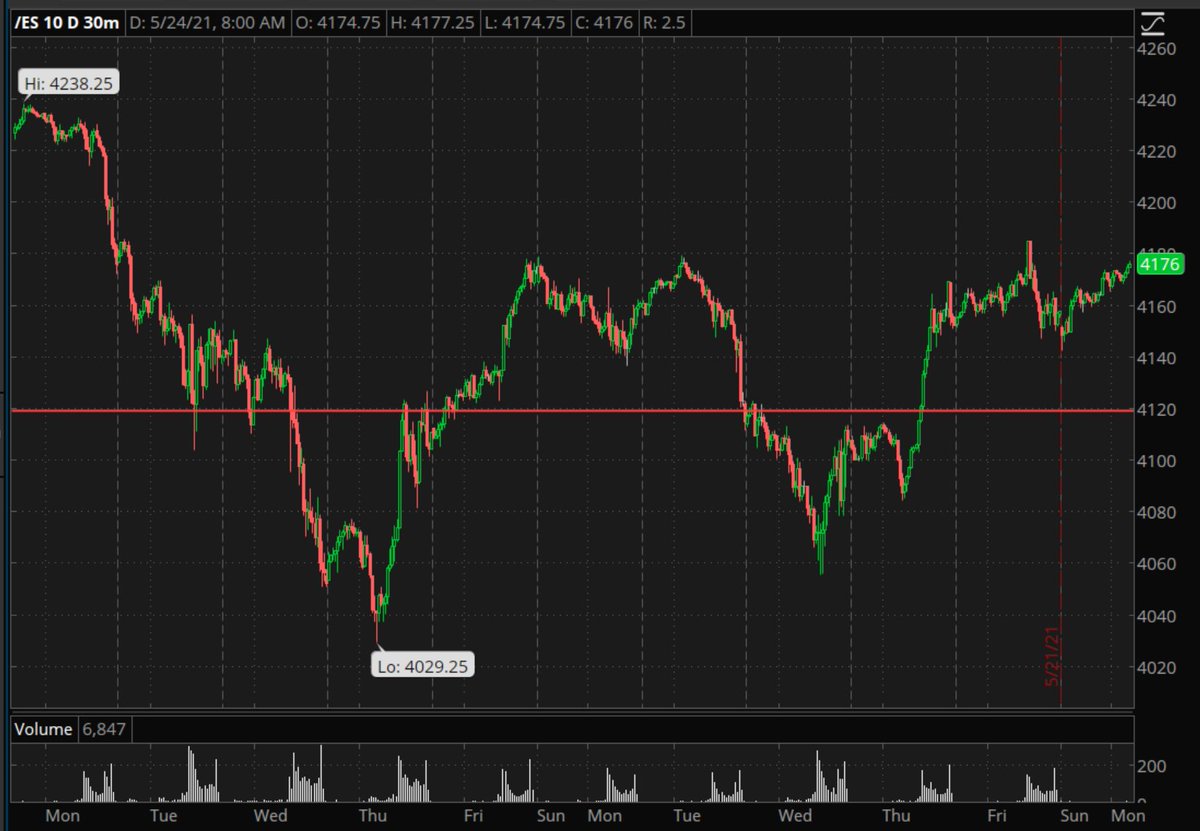

starting this week at the highs of last week for #NQ_F #ES_F. Seems like bullish sentiment might be building on the notion that stocks survived crypto wipeout and that is now another risk point removed.

probably want to watch the dollar #DX_F $DXY today for any sign a.m. Everything Trade doesn't hold up. It's been oscillating around 90, the low from Feb & a busy trading level. Related, yields in middle of 3-month range but right at top from 7yr auction spaz

odd that $TSLA's unch in this big growth rip to start the day. Momentum and growth surging. Wells Fargo out w/TSLA neutral rating and price target at $590. Pretty clear it's having some issues w/600

lots of strength in Qs here (purple) trying to get over last week's highs. Dollar, however, still has some room before taking out last week's lows.

I would probably wait to declare the stock market crypto-proof. The #bitcoin $btc chart is still very much downtrending and showing very little buying interest below 40k so far. The btc-stock relationship may have convexity that isn't clear until very deep wipeout.

• • •

Missing some Tweet in this thread? You can try to

force a refresh