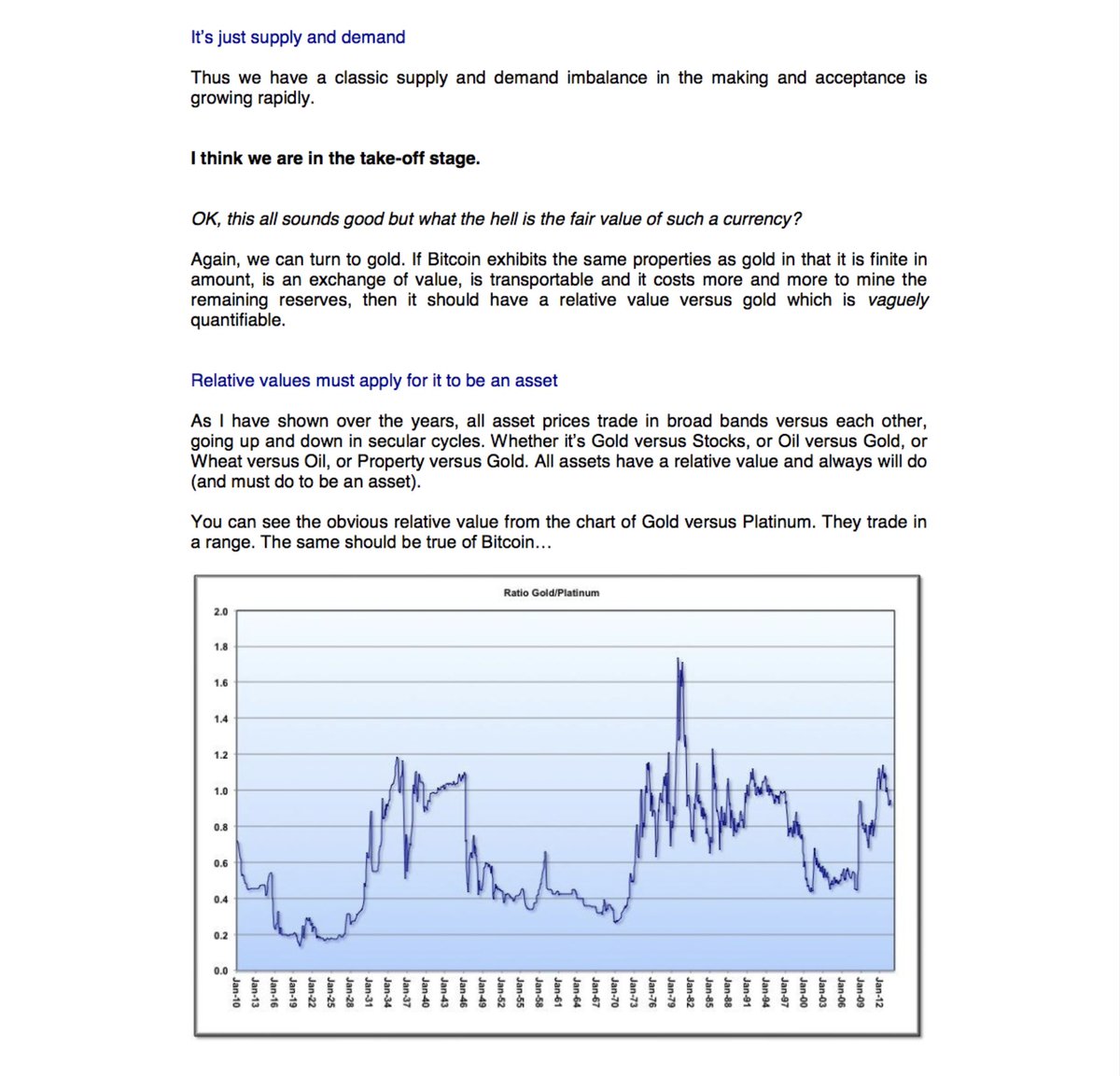

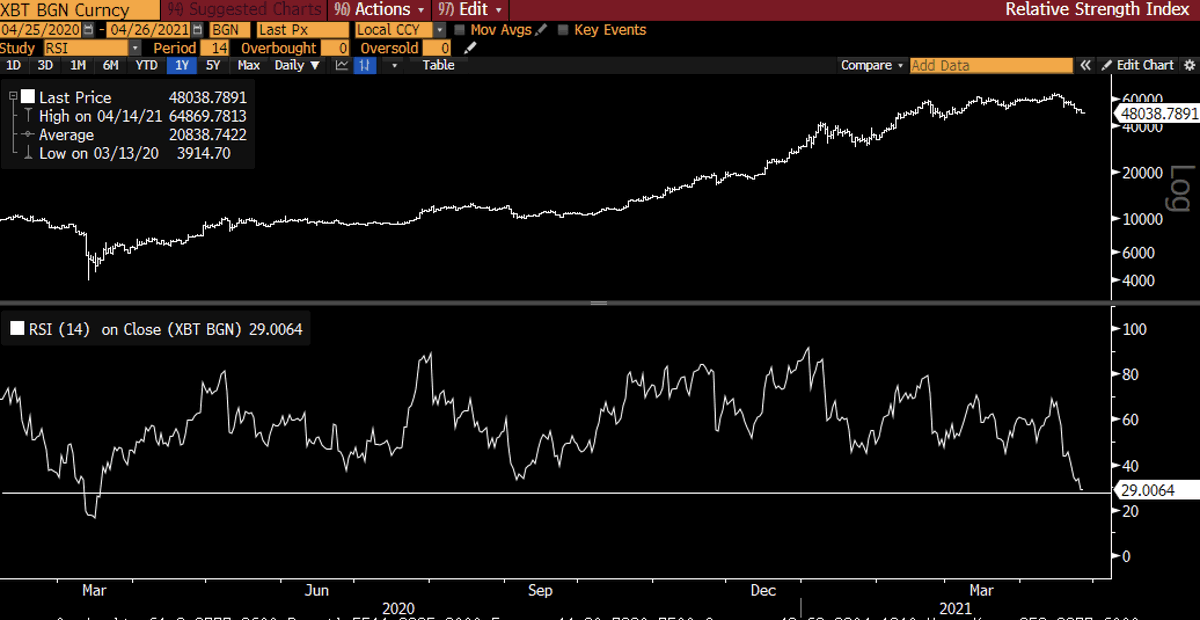

One of the key features of Network Effect models is volatility within a logarithmic trend. The vol is a feature not a bug as it is more than compensated by the returns over time.

As long as the participants in the network keep growing over time, the value of the network rises exponentially..

Generally speaking, the more volatility the price has, the higher the return over time IF the network grows.

Generally speaking, the more volatility the price has, the higher the return over time IF the network grows.

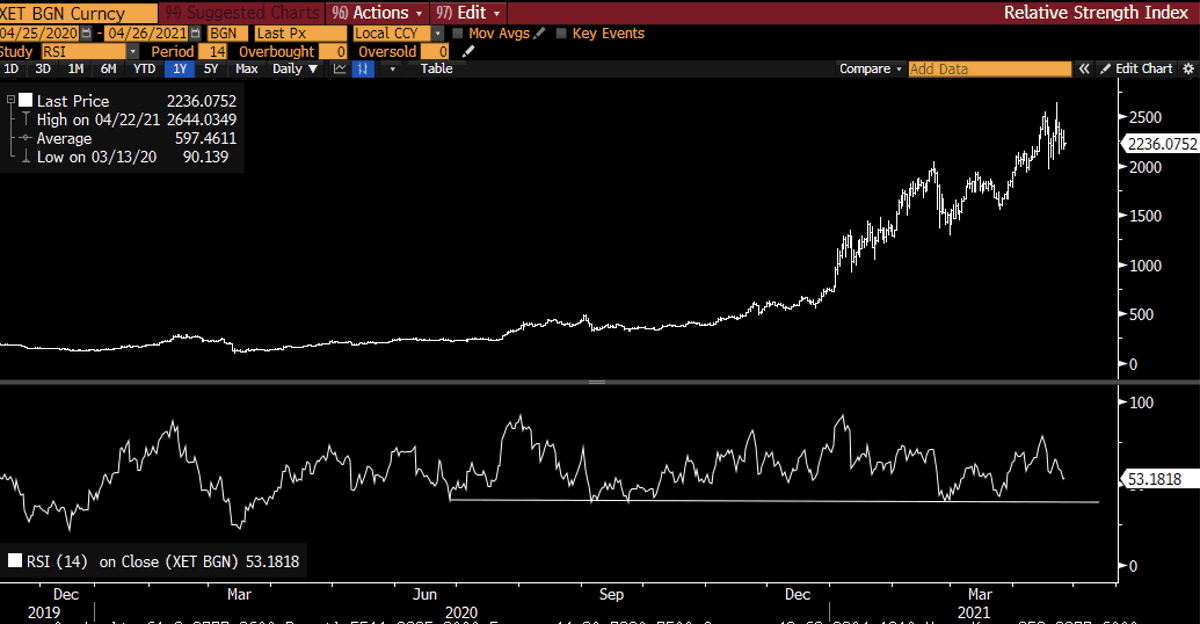

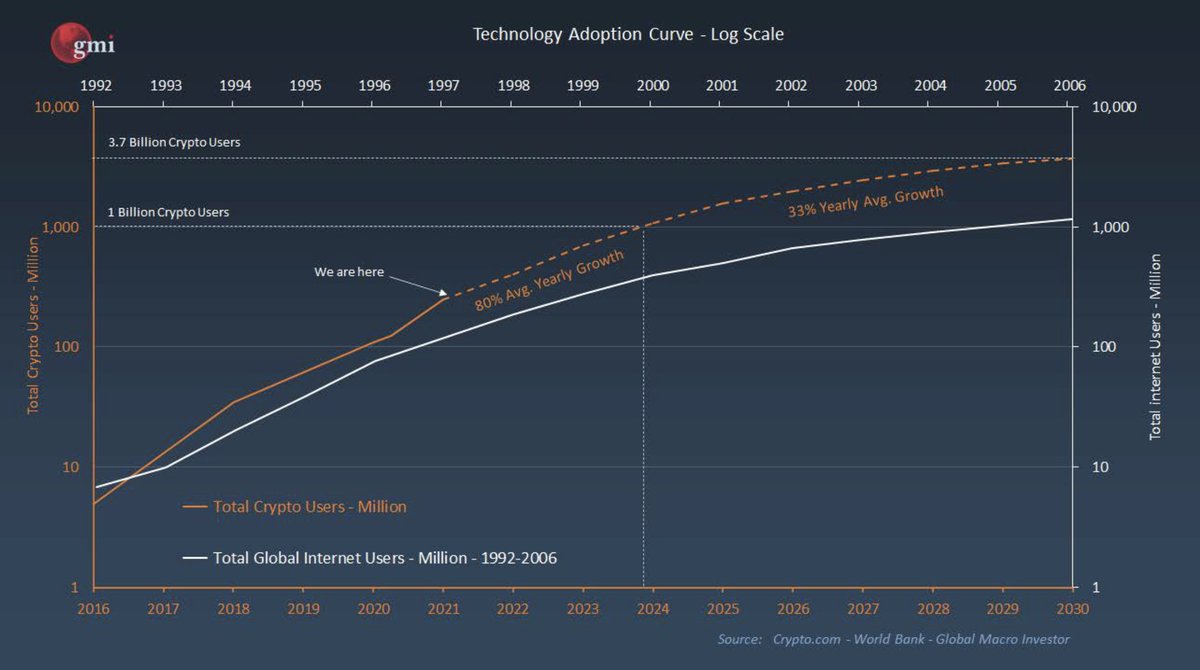

This concept in crypto can be best represented by this chart. Already it is the fastest rate of adoption of any technology in human history (113% per annum vs 63% for the internet).

Considering the chart above assumes a slowdown in adoption as more people come in, the only question you really need to ask yourself is whether adoption is going to slow massively or not. Even if we slow to 63% per annum, we still get to a billion users by 2026.

Then you need to add in the effect of Diem and CBDC's which create even larger networks that interoperate with the digital asset world.

This is why the price is volatile but exponential over time.

It will be the same with all the other new technologies too that are seeing massive network effects.

It will be the same with all the other new technologies too that are seeing massive network effects.

• • •

Missing some Tweet in this thread? You can try to

force a refresh