TURNING POINT: Big Oil has suffered a huge defeat today on its climate change strategy, with Exxon, Chevron and Shell (by far the 3 largest Western oil majors) enduring either big shareholder rebellions or losing important legal fights | #OOTT $XOM $CVX $RDSB #ClimateAction

THE LIKELY CONSEQUENCES: 1) Activists and climate change campaigners will be embolden by their victories (if Engine 1, with a ~$50 million stake in Exxon, can get 2 board directors, imagine what a bigger activist can do?), so expect more pressure and more legal fights. 1/5

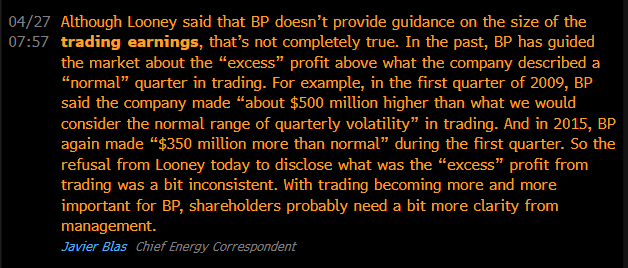

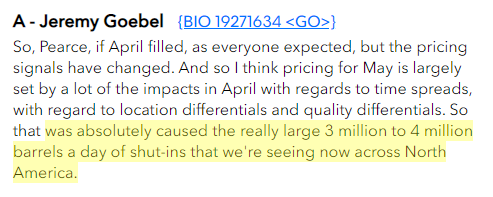

2) Big Oil will likely have to reduce capex even further. Exxon is likely to have to abandon even its attempt to keep oil production flat (the growth plans were already gone). Exxon and Chevron will follow Shell / BP into managed oil output decline. That's bullish oil price 2/5

3) I don't see how CVX can hit scope-3 targets without selling assets (and same goes for XOM). And if RDSB truly has to reduce emissions by 45%, it would need to sell more oil assets. However, selling assets just moves the emission problem elsewhere, rather than solve it 3/5

4) Society seems to be trying to resolve climate change focusing on supply, rather than demand. At some point, we need a conversation about choices - and what fighting climate change means for the Western world life style. Some of those behavior changes are easy. Others no. 4/5

5) What about returns? So far, there's little sign Big Oil can generate the RoACE it's used to in oil/gas in renewables. And I'm skeptical of EV charging as a business. So either accept lower RoACE (and cut divi as Shell / BP did), or stop capex and run the business for cash 5/5

• • •

Missing some Tweet in this thread? You can try to

force a refresh