Personal income fell by 13% in April, a smaller fall than market expectations, as fewer economic impact payments went out than in March (which saw a large increase in personal income) 1/

Aggregate compensation (reflecting both number of employees and wages/benefits paid) again grew at 0.9 percent month-over-month, a strong pace. It rose further above its pre-pandemic high from last February. 2/

Nominal spending on goods decreased slightly, driven by nondurable goods, while spending on services continued to increase. The increased spending on services and decreased spending on goods likely reflects a reopening economy. 3/

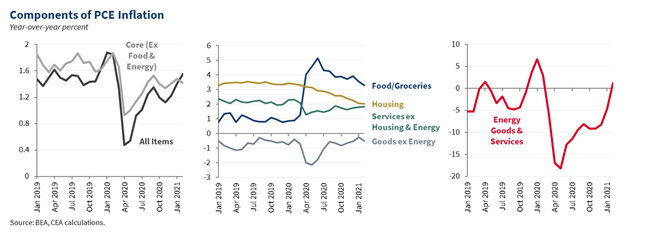

Year-over-year, headline PCE inflation increased by 3.6%. Adjusting for base effects from depressed pandemic prices last spring, it increased by 2.4%. This index hit its pandemic nadir in April 2020. 5/

Core inflation, which removes volatile food and energy to make it easier to track the trend, rose by 3.1% year-over-year. Adjusted for base effects, it rose by 2.2%. About 60 percent of the acceleration was due to base effects. 6/

The rise in core inflation was driven by an increase in the price of durable goods, which rose by 1.4% month-over-month, up from 0.6% the month before. 7/

The price of nondurable goods rose by 0.3%, down from 0.8% the month before, and services held steady at 0.5% month-over-month. 8/

The fastest price rise in durable goods was price gains in motor vehicles and parts. 9/

Prices in pandemic-affected services (e.g. airfare) rose by 8% in April. Prices in those services remain 8% below their pre-pandemic level. 10/

Overall, this report is consistent with a strengthening labor market and an economy restarting from a pandemic. /end

• • •

Missing some Tweet in this thread? You can try to

force a refresh