Why #ETH is More Secure than #BTC

This 23-tweet thread summarizes the second of four arguments in my essay "Why ETH Will Win Store of Value"

michaelmcguiness.com/essays/why-eth…

This 23-tweet thread summarizes the second of four arguments in my essay "Why ETH Will Win Store of Value"

michaelmcguiness.com/essays/why-eth…

Security is a crucial store of value (SoV) property. An asset that's not around in a few decades wouldn't be much of a value store. Just as gold is immune to rot, corrosion, & other types of deterioration, a cryptocurrency SoV must be built to last w/ proper incentive engineering

With gold, you get security free. The laws of physics handle everything from no forgeability to no double spend.

With cryptocurrencies, however, you have to continually pay miners or validators to process transactions and keep the network secure.

With cryptocurrencies, however, you have to continually pay miners or validators to process transactions and keep the network secure.

Bitcoin rewards miners w/ newly minted BTC plus transaction fees every time a new block is created

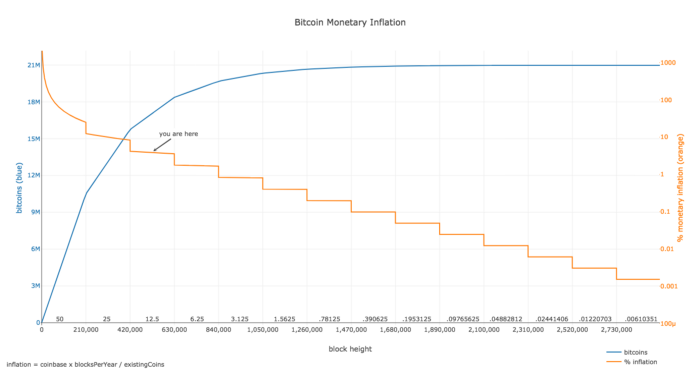

Per its hard-coded monetary policy, the # of new coins per block decreases over time & asymptotes at 0 in 2140

When this happens the sole compensation for miners will be txn fees

Per its hard-coded monetary policy, the # of new coins per block decreases over time & asymptotes at 0 in 2140

When this happens the sole compensation for miners will be txn fees

Many Bitcoiners don't believe this will be an issue because the dollar value of transaction fees will be so high when the block reward runs out that security spend will be sufficient.

In "Bitcoin's Security is Fine" @danheld articulates this quite well

danhedl.medium.com/bitcoins-secur…

In "Bitcoin's Security is Fine" @danheld articulates this quite well

danhedl.medium.com/bitcoins-secur…

I agree w/ many of Held's arguments & understand why Satoshi designed Bitcoin this way

With PoW, there's always a tradeoff between inflation (block subsidy) & security

BTC has chosen to pay its consensus engine less & less to maintain scarcity & cap the # of BTC at 21 million

With PoW, there's always a tradeoff between inflation (block subsidy) & security

BTC has chosen to pay its consensus engine less & less to maintain scarcity & cap the # of BTC at 21 million

Yet I disagree that USD-denominated security spend is what matters

As @VitalikButerin wrote

"the security needs of a thing have to be proportional to the size of that thing, because as [it] gets bigger, its enemies become bigger and more well-motivated"

reddit.com/r/ethereum/com…

As @VitalikButerin wrote

"the security needs of a thing have to be proportional to the size of that thing, because as [it] gets bigger, its enemies become bigger and more well-motivated"

reddit.com/r/ethereum/com…

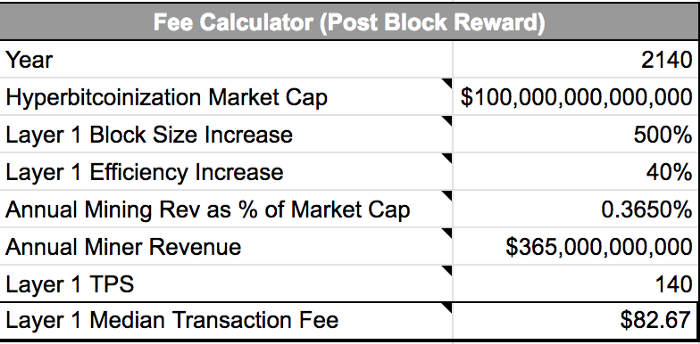

Lets look at Held's most optimistic scenario where BTC "survives, thrives, and continues to grow in market share exponentially, as it has done the last 10 years"

Here BTC has a $100 trillion market cap in the year 2140 & transactional demand drives $365Bn of annual miner revenue

Here BTC has a $100 trillion market cap in the year 2140 & transactional demand drives $365Bn of annual miner revenue

Is $365 billion enough security spend to protect the Bitcoin network against attackers? Maybe.

I'm really not sure and have no idea what the world will look like in 2140.

However I'm pretty sure we can do better.

I'm really not sure and have no idea what the world will look like in 2140.

However I'm pretty sure we can do better.

The above scenario for BTC results in a value-to-security ratio of about 273-to-1.

w/ ETH & proof of stake we can get to a ratio of 10-to-1.

At the same $100Tn market cap, this equates to a ~$10Tn cost to 51% attack ETH (> 27x better than the $365Bn Held projects for BTC)

w/ ETH & proof of stake we can get to a ratio of 10-to-1.

At the same $100Tn market cap, this equates to a ~$10Tn cost to 51% attack ETH (> 27x better than the $365Bn Held projects for BTC)

And the only thing this really assumes is that ~10% of all ETH is staked, which seems pretty reasonable.

Meanwhile, Held's projection assumes a 500% increase in block size and a 40% increase in efficiency, as well as significant transactional demand for Bitcoin's block space.

Meanwhile, Held's projection assumes a 500% increase in block size and a 40% increase in efficiency, as well as significant transactional demand for Bitcoin's block space.

In addition to a much lower value-to-security ratio, ETH also has a major advantage in terms of how it can respond to an attack.

After a 51% attack, BTC's only option is to move to a new PoW system based on commodity hardware (GPUs or CPUs)

After a 51% attack, BTC's only option is to move to a new PoW system based on commodity hardware (GPUs or CPUs)

The attacker could then just do the same attack w/ commodity hardware

Vitalik has called this a "spawn camping attack" where a 51% miner cartel keeps attacking over & over again rendering the chain useless

PoW has no way to destroy the mining power or penalize an attacker

Vitalik has called this a "spawn camping attack" where a 51% miner cartel keeps attacking over & over again rendering the chain useless

PoW has no way to destroy the mining power or penalize an attacker

ETH is less susceptible to this kind of attack w/ PoS.

Ethereum can "slash" or penalize attackers

If an attacker does something bad the network will penalize the attacker by seizing their staked ETH

This would be the BTC equivalent of destroying an attacker's mining equipment

Ethereum can "slash" or penalize attackers

If an attacker does something bad the network will penalize the attacker by seizing their staked ETH

This would be the BTC equivalent of destroying an attacker's mining equipment

Slashing makes ETH's security antifragile bc each attack redistributes ETH from dishonest nodes to honest nodes. The reduction in supply makes each subsequent attack more expensive.

And if 10% of all ETH is staked, an attacker could only attack the system 9 times.

And if 10% of all ETH is staked, an attacker could only attack the system 9 times.

Similarly, this antifragility exists at the single-attack level.

If you want to attack the Ethereum network and try to acquire 10% of all ETH outstanding, you will likely move the price higher as you try to do so, resulting in diseconomies of scale

If you want to attack the Ethereum network and try to acquire 10% of all ETH outstanding, you will likely move the price higher as you try to do so, resulting in diseconomies of scale

Perhaps the best argument I've heard in favor of PoW is that the physical hardware-driven nature of it adds friction to even very well-capitalized attackers

Manufacturing that much hardware takes a lot of time & the risk of detection is high. This is a genuine advantage of PoW

Manufacturing that much hardware takes a lot of time & the risk of detection is high. This is a genuine advantage of PoW

But there's also a crucial downside to physical hardware: it's very hard to mine at significant scale w/o being detected, whereas PoS is much more censorship-resistant.

The lack of footprint required to stake ETH is a huge advantage when it comes to security.

The lack of footprint required to stake ETH is a huge advantage when it comes to security.

To become an Ethereum validator, all you need is ETH, a raspberry pi, an SSD, & an internet connection

This is in stark contrast to Bitcoin where being a miner requires a massive footprint in the form of tremendous energy usage and huge warehouses to house the mining equipment.

This is in stark contrast to Bitcoin where being a miner requires a massive footprint in the form of tremendous energy usage and huge warehouses to house the mining equipment.

This footprint makes it easy for governments to detect & shut down Bitcoin mining activity

But with Ethereum, you could be anywhere in the world (perhaps behind a Tor network so you don't even have to leak your IP address)...

But with Ethereum, you could be anywhere in the world (perhaps behind a Tor network so you don't even have to leak your IP address)...

And even if a nation state were able to find and confiscate the physical Ethereum validating equipment, that's not where the staked ETH exists. Ether exists solely in the digital world and can only be confiscated by somehow getting the owner to hand over their private keys.

It's easy to forget that when Satoshi created BTC, it was the world's first successful attempt at creating digital scarcity

While clearly brilliant, s/he/they was in fact human & could not be expected to anticipate all of the potential issues that arise w/ incentive engineering

While clearly brilliant, s/he/they was in fact human & could not be expected to anticipate all of the potential issues that arise w/ incentive engineering

Since then there's been more than 12 yrs of R&D in the blockchain space, and Ethereum's "innovation-friendliness" gives it a major advantage.

In my view, it seems like a pretty good bet that Ethereum will be the more secure network in the long run.

In my view, it seems like a pretty good bet that Ethereum will be the more secure network in the long run.

Check out the full memo on @JoinCommonstock and follow me there for my writing on markets, crypto and all things investing.

share.commonstock.com/MtZTAExAGgb

share.commonstock.com/MtZTAExAGgb

• • •

Missing some Tweet in this thread? You can try to

force a refresh