I am going to take the other side of this. In a lot of ways.

First, @andrewrsorkin's point about $GME and $AMC being the "public" take on it I expect meant the "non-involved public"

Second, "the [US] general public" doesn't know much about "short selling abuses, short sale...

First, @andrewrsorkin's point about $GME and $AMC being the "public" take on it I expect meant the "non-involved public"

Second, "the [US] general public" doesn't know much about "short selling abuses, short sale...

https://twitter.com/dlauer/status/1400248449275154432

2/n: ...mismarking, FTDs, and the complete lack of regulatory enforcement and oversight."

Short sale mismarking? No epidemic of this. It happens. Internal, independent auditors, and the SEC find these things. People get fired. The SEC charged BTIG last week with 90 instances

Short sale mismarking? No epidemic of this. It happens. Internal, independent auditors, and the SEC find these things. People get fired. The SEC charged BTIG last week with 90 instances

3/n: dating to 2016-2017 from a single HF which had a history of abuses. One or more BTIG employees screwed up. The HF abused BTIG, and the market, and admitted it. The SEC found that BTIG didn't push back hard enough when the HF lied.

sec.gov/litigation/lit…

sec.gov/litigation/lit…

4/n: FTDs? Most of the general public would say "no, it is "FTD" no s - you know... the flower thingy... with the prancing naked guy?" The 'general public' is not up on "Failure to Delivers" or "First to Defaults". But we can talk about those. The most recent 10 days reported

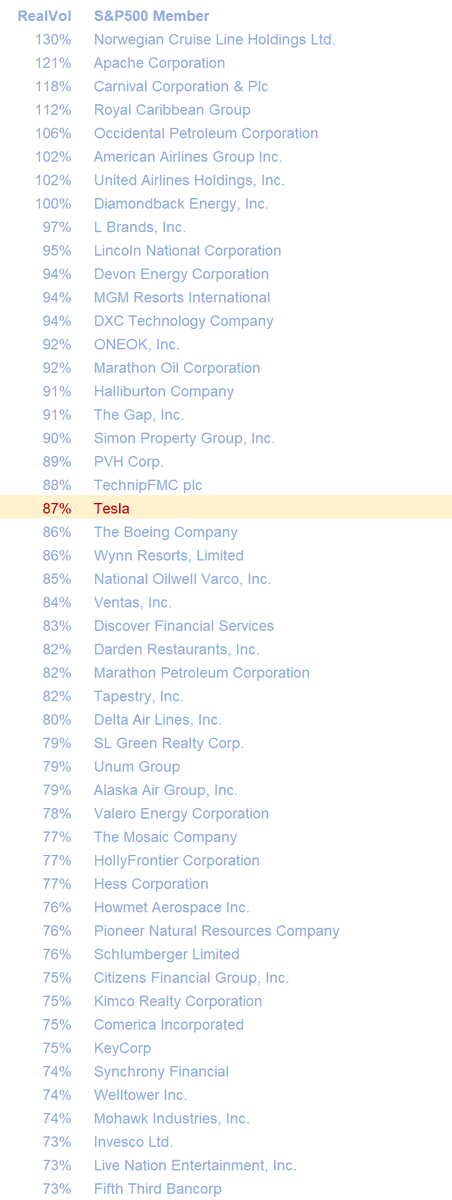

5/n: showed ~60,000 FTDs. Half <$15k. 93% for <US$1mm. The vast majority are simply B.O. laziness/screwups - The top 25 are 23 relatively liquid ETFs, TSLA, and a stock on the list for months because it has been taken over. The next 75? GOOG, SNAP, JNJ

6/n: lots more ETFs and some ADRs which obviously crossed from one party to another but didn't get created in time. Also some execs exercised options but the company didn't deliver.

Enforcement? You got me there. In some countries, FTDs are simply not tolerated. Period.

Enforcement? You got me there. In some countries, FTDs are simply not tolerated. Period.

7/n: But back to short-selling abuses. WHAT short-selling abuses? Serious question. Does that mean a lot of people short it at the same time? If they say bad things about it while they are short is that "abuse"? If mgmt says they are lying, are the short-sellers abusive then?

8/n: Like Wirecard, Hanergy, Steinhoff?

If people say good things about stocks they own is that "long holding abuse." If they lie? And induce others to buy because of that lying? What if a bunch of people buy at the same time b/c they read an article, blog, or watched a YT vid?

If people say good things about stocks they own is that "long holding abuse." If they lie? And induce others to buy because of that lying? What if a bunch of people buy at the same time b/c they read an article, blog, or watched a YT vid?

9/n: $GME and $AMC have not been that. People buy stocks en masse because they like things about them. People sell and short sell certain stocks en masse because they think they are really bad businesses doomed to fail.

10/n: There is some HIGHLY informed research on social media. There is, however, FAR more ill-informed commentary and malign disinformation on social media.

As to the "public disgust and upheaval"... about the GFC, most of it will go away, some will shout at kids on their lawn.

As to the "public disgust and upheaval"... about the GFC, most of it will go away, some will shout at kids on their lawn.

11/n: [and some like Steve Bannon will decide to foment racist populist insurrection because his Dad lost money on AT&T and got upset].

But there was bitterness after 2000-2002, 1973-1974, 1969, 1949, 1942, 1934, 1918, 1915, 1907, 1903. Heck, 1881-1900 was Not A Fun Time.

But there was bitterness after 2000-2002, 1973-1974, 1969, 1949, 1942, 1934, 1918, 1915, 1907, 1903. Heck, 1881-1900 was Not A Fun Time.

12/n: I've been in the finance industry for 2+ decades and neither I nor well-meaning pros who have two decades on me have any great ideas on how to best apportion GFC "blame". Do you blame appraisers who over-appraised properties? RE agents who knew it was stupid? RE agents

13/n: who didn't? People who bought 3 properties on 100% LT"V" no doc option ARMs expecting to sell before the re-rate? Politicians who encouraged lenders to make no-doc mortgages? Instos who begged to be able to buy packages of crap? Moody's & S&P who rated MBS using a model

14/n: which implied a national housing downturn wasn't possible?

Personally, I find most of FinTwit does not make fun of those with less training or experience. They make fun of those who have the experience who then say/do stupid stuff.

Personally, I find most of FinTwit does not make fun of those with less training or experience. They make fun of those who have the experience who then say/do stupid stuff.

https://twitter.com/dlauer/status/1400249610644377601

15/n: As to "something is rotten in these highly-shorted names" I would suggest...

a) 'highly-shorted-names' are a tiny fraction of the float available to buy in the market,

b) downside manipulation is MUCH harder than "the general public" thinks it is

c) every share shorted is

a) 'highly-shorted-names' are a tiny fraction of the float available to buy in the market,

b) downside manipulation is MUCH harder than "the general public" thinks it is

c) every share shorted is

16/n: c) cont... bought by someone else.

d) short sellers know they are fair game for other participants. "Short squeeze" is a well-used term.

e) as is now obvious on some of these "highly shorted names", upside manipulation is a lot easier than people generally think it is.

d) short sellers know they are fair game for other participants. "Short squeeze" is a well-used term.

e) as is now obvious on some of these "highly shorted names", upside manipulation is a lot easier than people generally think it is.

17/n: If AMC and GME or any others of these rapidly-rising stocks with high short interest are examples of the well-meaning "general public" fighting back against dastardly short-seller abuse, that would seem to me to be extraordinarily short-sighted.

People forget that AMC

People forget that AMC

18/n: and GMC fell for a long time before 2020.

If a name has a lot of shorts, it isn't necessarily "abuse". If it falls and it has a lot of shorts, it isn't "abuse". If a member of the general public owns a stock which goes down, that doesn't make their counterpart "abusive".

If a name has a lot of shorts, it isn't necessarily "abuse". If it falls and it has a lot of shorts, it isn't "abuse". If a member of the general public owns a stock which goes down, that doesn't make their counterpart "abusive".

Postscript: I am really interested and curious as to what short-selling abuses are out there. If people will supply tickers, I will try to come up with something.

• • •

Missing some Tweet in this thread? You can try to

force a refresh