Ready to build ser

The upcoming OHM x FRAX partnership is a big one. I hope you’re paying attention anon

Find out why

👇👇👇👇👇👇👇👇👇

The upcoming OHM x FRAX partnership is a big one. I hope you’re paying attention anon

Find out why

👇👇👇👇👇👇👇👇👇

https://twitter.com/samkazemian/status/1400308062636765185

For those unfamiliar with Olympus or Frax, they’re actually quite similar protocols

Both have a protocol treasury acting as a massive whale. That treasury influences the market through market operations to manifest desirable behavior

Both have a protocol treasury acting as a massive whale. That treasury influences the market through market operations to manifest desirable behavior

In the case of Olympus, that behavior is currently to feed the treasury with assets and liquidity.

In the case of Frax, that behavior is a stable peg at $1.

Frax cares about price and less about backing. Olympus cares about backing and less about price.

In the case of Frax, that behavior is a stable peg at $1.

Frax cares about price and less about backing. Olympus cares about backing and less about price.

In their 6 month history, FRAX has never broken peg. That gives us confidence in the safety of our reserves.

With its greater efficiency versus something like dai, and the collaborative nature of the team and project, Frax starts looking pretty attractive

With its greater efficiency versus something like dai, and the collaborative nature of the team and project, Frax starts looking pretty attractive

So what might this partnership look like?

The nature of these protocols means the possibilities are pretty expansive

The nature of these protocols means the possibilities are pretty expansive

There’s a few obvious ones:

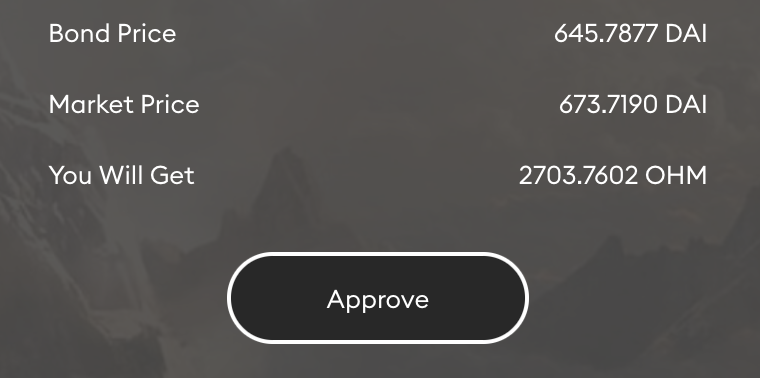

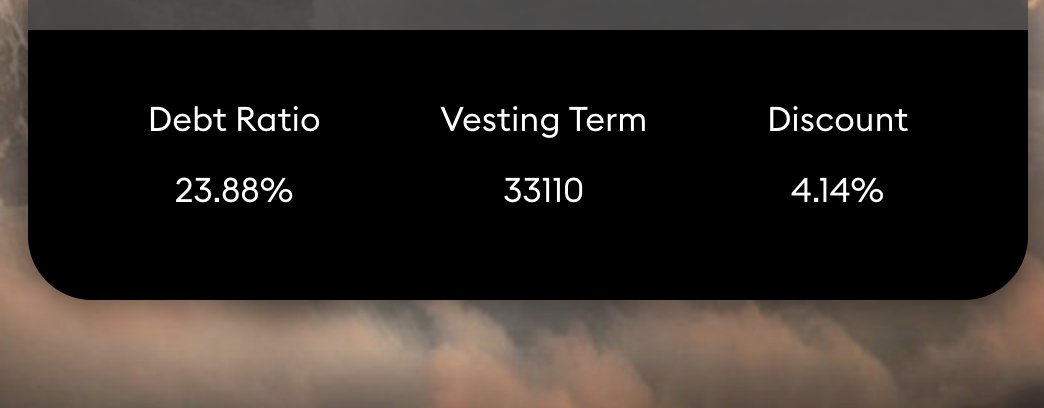

We can open a pool between OHM and FRAX (like we are on Monday) to allow trading between our assets.

This one is pretty standard, not that cool

We can open a pool between OHM and FRAX (like we are on Monday) to allow trading between our assets.

This one is pretty standard, not that cool

Olympus can accumulate that pool through bonds. It gets a bit more interesting here.

By buying liquidity, we can drive continual demand for FRAX-OHM and as a result, demand for FRAX.

By buying liquidity, we can drive continual demand for FRAX-OHM and as a result, demand for FRAX.

FRAX can do the same on their end. By minting FRAX with their excess reserves, they can drive demand for OHM and OHM bonds.

This has already been proposed on the FRAX forum. @samkazemian voiced interest in kicking it off with $1m in bonds from the FRAX treasury. That’s pretty cool.

gov.frax.finance/t/allow-frax-t…

gov.frax.finance/t/allow-frax-t…

We can also drive demand for FRAX alone via reserve bonds, allowing us to assist Frax in providing liquidity outside of our own market

All of these fuel the growth of the other. We can create strong recursive loops of liquidity and demand for our respective currencies.

Now what happens when you bring the Frax Price Index into the picture? This is a really ambitious idea that I’m excited to see take form in the coming years

You’ll have FRAX hard peg itself to a CPI-esque set of metrics

You’ll have OHM soft peg itself to those metrics through its FRAX backing

You’ll have OHM soft peg itself to those metrics through its FRAX backing

I’d expect this to start looking like the forex market. You’ll have multiple loosely correlated, high-liquidity low-volatility floating currencies trading against and feeding into each other

The decentralized reserve currency space won’t (or at least shouldn’t) be winner take all.

There will certainly be dominant players (and I’ll be damned if OHM isn’t one of them), but I expect a whole new industry to form around the ideas that OHM and FRAX are spearheading

There will certainly be dominant players (and I’ll be damned if OHM isn’t one of them), but I expect a whole new industry to form around the ideas that OHM and FRAX are spearheading

There is immense power to cooperation between these monetary authorities. We are whales in our own markets, and we can be whales in each others

This distributes market responsibility and should decrease risk on both ends

This distributes market responsibility and should decrease risk on both ends

The outcome if we are successful is legitimate alternatives to fiat pegged stablecoins. True decentralized currencies, not just mislabeled decentralized assets.

There’s a long road to get there, but I’m excited to take this first step.

@OlympusDAO x @fraxfinance will be one to behold.

@OlympusDAO x @fraxfinance will be one to behold.

• • •

Missing some Tweet in this thread? You can try to

force a refresh