Unpopular opinion: Bitcoin falling from #1 would be one of the most bullish things to ever happen to crypto

“But ser,” the threatened maxi says, “Bitcoin falling from #1 would mean Lindy isn’t a thing. That means nothing can hold value.”

Well ser, what about the revolutionary thought that valuable things will hold value, and non valuable things won’t?

What you’re really saying with that argument is “so many people have bought into this that we can’t have everyone lose”

1) this is the definition of a sunk cost mentality

2) aren’t we trying to get rid of too-big-to-fail institutions?

1) this is the definition of a sunk cost mentality

2) aren’t we trying to get rid of too-big-to-fail institutions?

The reality is that bitcoin is digital gold, in that it is just as useless. In a world of smart contracts, what need is there for pet rocks?

Maybe we will, maybe we won’t, but we should be accruing value to something that produces value. Not something that everyone just happens to be so deep in that it’s scary to think about them all losing

Imo, framed in this way (narratives are important!), dethroning the king would be immensely bullish

It would signal that this industry is capable of thinking critically and acting responsibly

It would signal that this industry is capable of thinking critically and acting responsibly

It’d also add a lot of legitimacy

Think about it: the first thing that you learn about as a crypto newcomer is Bitcoin, this slow, expensive, and completely useless (relative to others) asset that also happens to be worth more than the rest combined

Think about it: the first thing that you learn about as a crypto newcomer is Bitcoin, this slow, expensive, and completely useless (relative to others) asset that also happens to be worth more than the rest combined

What kind of message does that send? Does that inspire confidence? Or does that make you think, “this market is either really stupid or a scam or both”

There’s a few nuances I would like to address, just to frontrun the midwits that think they know everything

1) this would 1000% produce volatility. Bitcoin is still seen as this “safe” asset, even though it has time and time again demonstrated that it is not

However, completely disproving that via flippenings would throw some chaos in the mix

However, completely disproving that via flippenings would throw some chaos in the mix

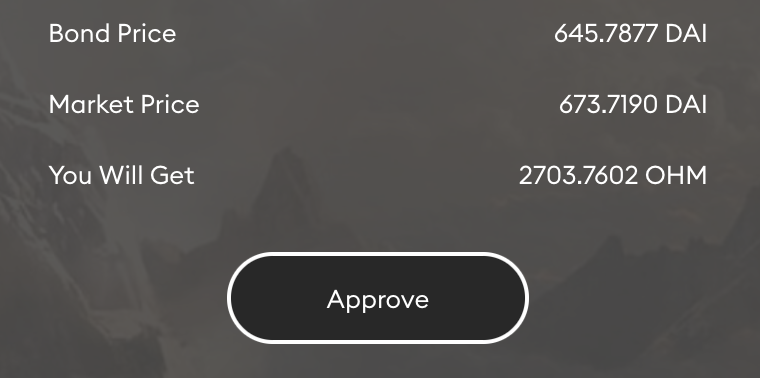

https://twitter.com/ohmzeus/status/1397639207624093700

2) this would result in a loss of value. Some of that money is going to flow into other things, but more of it will just evaporate. There is wealth contractions in market downturns, just like there is wealth expansion in upturns

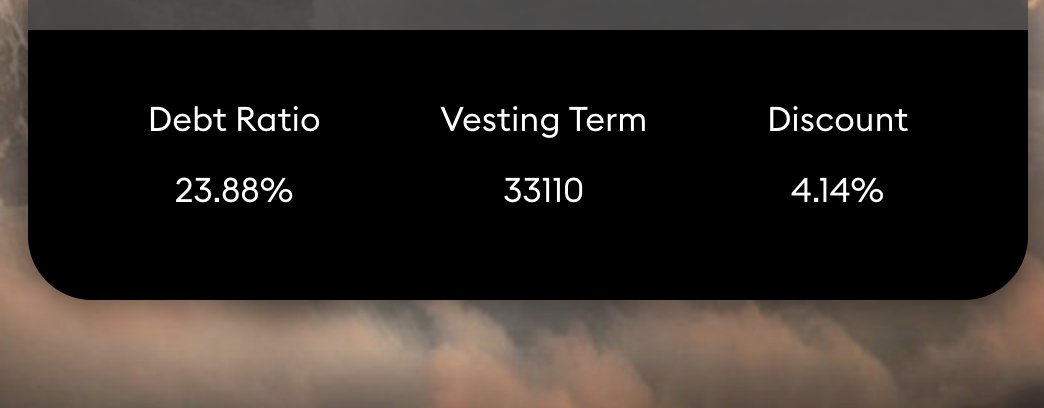

https://twitter.com/ohmzeus/status/1391827881588924426

3) Bitcoin actually does provide value for one thing imo: energy grid regulation. The argument that mining can better regulate waste energy is totally valid.

The questions you need to ask are whether it is the only thing that can do that, and whether that is the most valuable use case in the industry

I can go on about how Bitcoin has massive undilutable inequality; that many large holders got those coins from... unscrupulous... activities that we probably don’t want to reward;

that it’s value capture starves other projects producing more value; that it’s shown zero ability to solve any of the very real problems it’s supposed to fix (Bitcoin fixes this is the funniest meme of all time), but I think I’ve made my point

• • •

Missing some Tweet in this thread? You can try to

force a refresh