$PATH & $SNOW = Unrelated but truly Special Businesses.

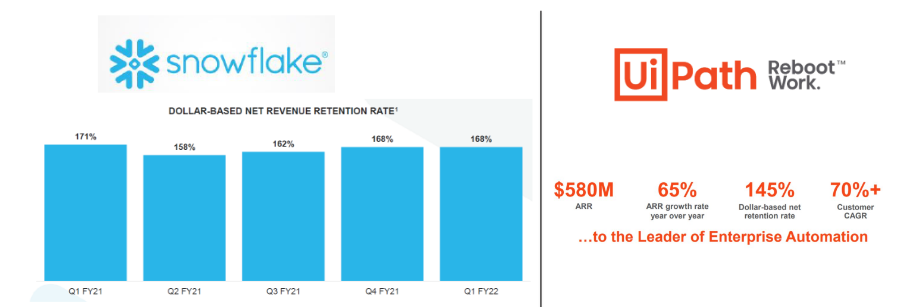

Below is one example⬇️. Look at the Record $ Retention by both companies. They almost don't new customers to grow!

I'm reviewing two of the *most overvalued* companies in SaaS. Both have major updates this week. Thread 1/6

Below is one example⬇️. Look at the Record $ Retention by both companies. They almost don't new customers to grow!

I'm reviewing two of the *most overvalued* companies in SaaS. Both have major updates this week. Thread 1/6

2/ What's special?

Beyond record level of $ retention on existing customer base, both companies are producing some of the most unbelievable compounded revenue growth rates ever seen in SaaS.

Clearly, this is why both companies have the highest valuations.

data h/t @publiccomps

Beyond record level of $ retention on existing customer base, both companies are producing some of the most unbelievable compounded revenue growth rates ever seen in SaaS.

Clearly, this is why both companies have the highest valuations.

data h/t @publiccomps

3/ Both have major updates:

$SNOW Investor Day this Thursday.

My Expectations:

- Discussion about their new chips

- Some developments around compute

- A new product announcement?

- Data ecosystem or marketplace news?

This was a nice interview w. the CEO

$SNOW Investor Day this Thursday.

My Expectations:

- Discussion about their new chips

- Some developments around compute

- A new product announcement?

- Data ecosystem or marketplace news?

This was a nice interview w. the CEO

https://twitter.com/InvestiAnalyst/status/1400565145710088194

4/ $PATH - First Earnings Report Tomorrow:

Important factors that I expect for them over the next couple of quarters before adding more to my position:

I've highlighted some of my expectations:

Important factors that I expect for them over the next couple of quarters before adding more to my position:

I've highlighted some of my expectations:

https://twitter.com/InvestiAnalyst/status/1402030312129970177

5/ $PATH Bull & Bear Notes shared earlier:

Below are some notable analyst notes and commentary pre-earnings:

Below are some notable analyst notes and commentary pre-earnings:

https://twitter.com/InvestiAnalyst/status/1401395826564419585

6/6 -Let's see what each delivers by Friday!

It's fun studying both companies and looking at similarities. You learn what makes them special!

Depending on my schedule, by end of the week, I'm hoping to put some of my findings for both Co's into writing👍

investianalystnewsletter.substack.com/welcome

It's fun studying both companies and looking at similarities. You learn what makes them special!

Depending on my schedule, by end of the week, I'm hoping to put some of my findings for both Co's into writing👍

investianalystnewsletter.substack.com/welcome

$SNOW provides a news update on their Data Collaboration platform before Thurs.

+ Available listings on the Data Marketplace are up by 76% over past 6-months

+ Key partners like $ZI & Foursquare

+ “Try before you buy” new product capabilities will be key

investors.snowflake.com/news/news-deta…

+ Available listings on the Data Marketplace are up by 76% over past 6-months

+ Key partners like $ZI & Foursquare

+ “Try before you buy” new product capabilities will be key

investors.snowflake.com/news/news-deta…

• • •

Missing some Tweet in this thread? You can try to

force a refresh