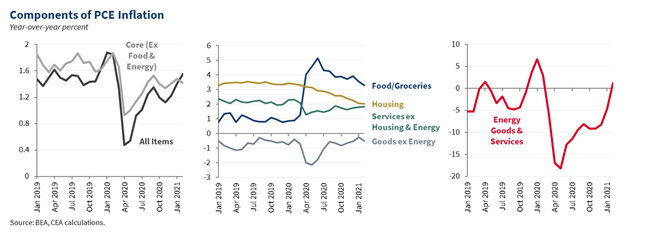

Inflation as measured by CPI increased at a 5.0% rate year-over-year last month and 0.6% month-over-month. Core inflation—without food/energy—rose 3.8% year-over-year and 0.7% month-over-month. The year-over-year numbers were impacted by base effects from last spring. 1/

The month-over-month inflation was a slight deceleration from the April inflation numbers, but slightly above expectations. 2/

Much of the annual inflation was due to base effects, reflecting the depressed prices from last spring. Controlling for base effects by smoothing across the 15 months since February 2020, the rate of CPI inflation was 3%. 3/

Cars once again accounted for a large share of the increase. Used cars, new cars, and car rentals together made up about half of core month-over-month inflation 5/

Prices of pandemic-affected services rose again this month and contributed 7 basis points to the core inflation increase in May, relative to 19 basis points in April. 6/

We know that the recovery from the pandemic will not be linear. The Council of Economic Advisers will continue to monitor the data as they come in. /end

• • •

Missing some Tweet in this thread? You can try to

force a refresh