1/ #DeFi yield opportunities for $LINK, a thread

With permissionless, compossible, and decentralized financial infrastructure, anyone can turn their tokens into productive assets

*NOTE* Nothing I describe here is risk-free, bug and hacks can happen, always DYOR before apeing

With permissionless, compossible, and decentralized financial infrastructure, anyone can turn their tokens into productive assets

*NOTE* Nothing I describe here is risk-free, bug and hacks can happen, always DYOR before apeing

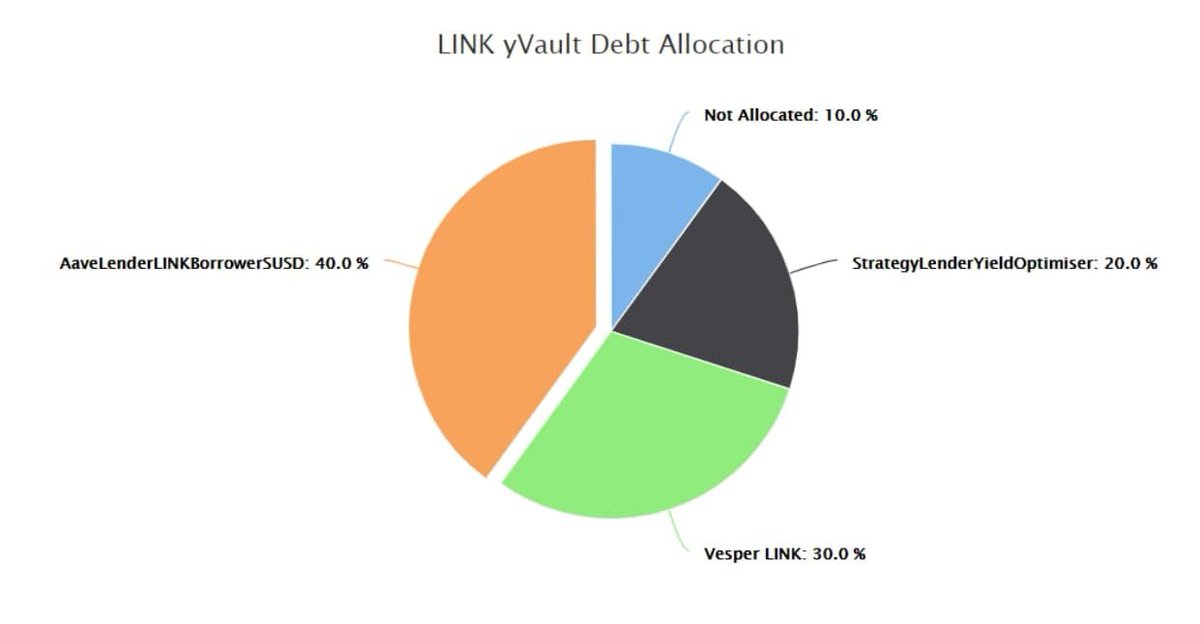

2/ The first yield opportunity is one of the newest on the street, @iearnfinance's V2 $LINK vault

This is a yield aggregation solution that automatically rebalances your funds into the DeFi protocols that earn you the highest yield on your assets, simple!

This is a yield aggregation solution that automatically rebalances your funds into the DeFi protocols that earn you the highest yield on your assets, simple!

https://twitter.com/iearnfinance/status/1402003844813443076?s=20

3/ If you're looking for a passive yield strategy, then this is what you're looking for

Yearn V2 vaults deploy a multi-strategy approach, where deposits are split across multiple yield protocols at the same time so as to not dilute yields once running at large scale

Yearn V2 vaults deploy a multi-strategy approach, where deposits are split across multiple yield protocols at the same time so as to not dilute yields once running at large scale

4/ Additionally, any yield earned (such as governance tokens or stablecoins) is automatically harvested from protocols, used to purchase $LINK off the market, and deposited back into the Yearn V2 vault, compounding your returns

This results in a direct buying pressure on $LINK

This results in a direct buying pressure on $LINK

5/ The Yearn V2 $LINK vault currently deploys three strategies:

1. Lend $LINK on money markets like @CreamdotFinance and @AaveAave

2. Yield farming on @VesperFi

3. Use $LINK as collateral on @AaveAave to borrow $sUSD and deposit into @iearnfinance and earn the difference

1. Lend $LINK on money markets like @CreamdotFinance and @AaveAave

2. Yield farming on @VesperFi

3. Use $LINK as collateral on @AaveAave to borrow $sUSD and deposit into @iearnfinance and earn the difference

6/ All strategy switching and rebalancing is automated for you, so you simply need to deposit your $LINK, wait x amount of time, and then withdraw more $LINK than your deposited

There is a 2% annual management fee and a 20% performance fee on any profits generated

There is a 2% annual management fee and a 20% performance fee on any profits generated

7/ You can even deposit any token you want and it'll be automatically converted into $LINK and deposited into the vault

While there are a lot of other @iearnfinance vaults, this one is specifically designed to allow you to earn yield on $LINK without losing any exposure

While there are a lot of other @iearnfinance vaults, this one is specifically designed to allow you to earn yield on $LINK without losing any exposure

8/ You can deposit your $LINK into the vault here yearn.finance/vaults/0x671a9…

It states the current yield is 0.61% APY, but I don't think it's accurate because the vault just launched and there isn't enough data yet

Back of the napkin math shows that it should be ~9% APY (variable)

It states the current yield is 0.61% APY, but I don't think it's accurate because the vault just launched and there isn't enough data yet

Back of the napkin math shows that it should be ~9% APY (variable)

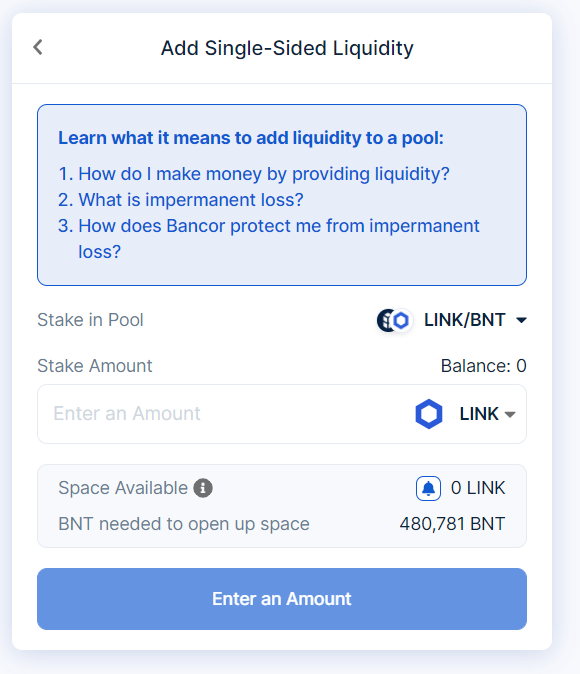

9/ The second yield strategy is probably the most well known in the community: @Bancor

Bancor is an automated market maker (AMM) decentralized exchange (DEX) that provides full impermanent loss (IL) insurance for deposits which is used as market liquidity for users

Bancor is an automated market maker (AMM) decentralized exchange (DEX) that provides full impermanent loss (IL) insurance for deposits which is used as market liquidity for users

10/ Liquidity providers in other DEXs are exposed to IL which can eat away at the value of their deposit, Bancor solves this issue by minting $BNT to cover any losses

The coverage starts at 0% and increases 1% for 100 days until you are 100% covered (retroactively as well)

The coverage starts at 0% and increases 1% for 100 days until you are 100% covered (retroactively as well)

11/ This makes Bancor best suited as a longer term passive yield strategy

Yield is generated from both trading fees from users as well $BNT subsidy rewards for depositors

The subsidy starts at a 1x multiplier and increases by 0.25 each week for 4 weeks for a total of 2x

Yield is generated from both trading fees from users as well $BNT subsidy rewards for depositors

The subsidy starts at a 1x multiplier and increases by 0.25 each week for 4 weeks for a total of 2x

12/ Bancor also supports single sided exposure, meaning you can stay 100% exposure to $LINK and $LINK alone

However, there is a cap on deposits, so when the max is reached, nobody can deposit until someone withdraws or more funds are added to the other side of the pool

However, there is a cap on deposits, so when the max is reached, nobody can deposit until someone withdraws or more funds are added to the other side of the pool

13/ You can set a notification to be alerted when there's space 9000.hal.xyz/recipes/bancor…

If there is room in the pool, you can deposit your $LINK into the pool app.bancor.network/eth/portfolio/…

Trading fee yield is currently ~1.65% APY and the $BNT subsidy is ~13% APY with the 2x boost

If there is room in the pool, you can deposit your $LINK into the pool app.bancor.network/eth/portfolio/…

Trading fee yield is currently ~1.65% APY and the $BNT subsidy is ~13% APY with the 2x boost

14/ The next yield solution is the $LINK / $sLINK liquidity pool on the DEX @CurveFinance

You are exposed to both tokens after depositing, however $sLINK is a @synthetix_io synth that is 500% overcollateralized by $SNX and pegged 1:1 to $LINK so you lose no $LINK price exposure

You are exposed to both tokens after depositing, however $sLINK is a @synthetix_io synth that is 500% overcollateralized by $SNX and pegged 1:1 to $LINK so you lose no $LINK price exposure

15/ The pool exists not just for swaps between $LINK and $sLINK, but to enable large amount of liquidity between $LINK and $BTC, $ETH, and various stablecoins

This is achieved by using $sLINK as a bridge asset as it can be converted into $sETH, $sBTC, $sUSD, etc at zero slippage

This is achieved by using $sLINK as a bridge asset as it can be converted into $sETH, $sBTC, $sUSD, etc at zero slippage

16/ This increases the liquidity available for $LINK and allows holders to earn trading fees while still be 100% exposed to $LINK!

The pool is meant to be a 50/50 split between $LINK and $sLINK, however the pool is currently skewed 70% $LINK and 30% $sLINK, this has implications

The pool is meant to be a 50/50 split between $LINK and $sLINK, however the pool is currently skewed 70% $LINK and 30% $sLINK, this has implications

17/ When depositing $LINK, there is a minor amount of slippage (<1%), however if the skew remains the same when you withdraw, you get a full rebate to cover any losses

You can deposit and stake in the gauge $LINK and/or $sLINK in the liquidity pool here curve.fi/link/deposit

You can deposit and stake in the gauge $LINK and/or $sLINK in the liquidity pool here curve.fi/link/deposit

18/ Current yield is 0.14% APY from trading fees and 5% to 13% APY from the $CRV subsidy reward

The $CRV rewards is a range because it depends on how much $CRV you stake, the more and longer your $CRV is locked up, the higher your yield becomes to the ceiling

The $CRV rewards is a range because it depends on how much $CRV you stake, the more and longer your $CRV is locked up, the higher your yield becomes to the ceiling

19/ Interestingly, you can even deposit your $crvLINK (tokenized deposit) into @iearnfinance which will auto harvest your $CRV, sell it to buy $LINK, deposit it back into Curve, compounding your yield

This is power of #DeFi composability!

This is power of #DeFi composability!

20/ I've saved the best (in terms of yield) for last, this is shorter term play, but there's no IL and the tokens are simply proof of capital to distribute governance tokens to users

This is @universe_xyz which has an ongoing 20 week yield farming program for $XYZ

This is @universe_xyz which has an ongoing 20 week yield farming program for $XYZ

21/ This farm is simple, deposit your $LINK and then at the end of each epoch (1 week), you earn $XYZ

The current yield is 29% APY

This yield is variable as there is a static amount of tokens distributed each week

You can ape in here dao.universe.xyz/yield-farming

The current yield is 29% APY

This yield is variable as there is a static amount of tokens distributed each week

You can ape in here dao.universe.xyz/yield-farming

22/ This thread will probably dilute the yield, but I'm a fan of the project and would like to see the token supply distributed

It's actually an evolution of Non-Fungible Pepes, before the "creator" of Pepe intervened as he tends to do

(disclose: I own vesting $XYZ)

It's actually an evolution of Non-Fungible Pepes, before the "creator" of Pepe intervened as he tends to do

(disclose: I own vesting $XYZ)

23/ For reference, the pool currently has $26M in $LINK deposits and if that doubles, then the yield gets cut in half and vice versa

So this is some serious alpha that is counter intuitive to share, but you're my frens

Sorry for diluting your yields my apes, kek

So this is some serious alpha that is counter intuitive to share, but you're my frens

Sorry for diluting your yields my apes, kek

24/ And there you have it my frens! These are some of the best #DeFi yield opportunities for $LINK currently

There are other DeFi options not mentioned and CeFi as well (not going to give up custody of my linkies), but this info should be more than enough to get you started

There are other DeFi options not mentioned and CeFi as well (not going to give up custody of my linkies), but this info should be more than enough to get you started

25/ Btw, this is the second time I've written this thread after accidently hitting F5 refresh on the wrong browser window (hope to god it doesn't happen again)

But the power of DeFi is it's transparency and I want to help my linke frens however I can, enjoy the yield

But the power of DeFi is it's transparency and I want to help my linke frens however I can, enjoy the yield

• • •

Missing some Tweet in this thread? You can try to

force a refresh