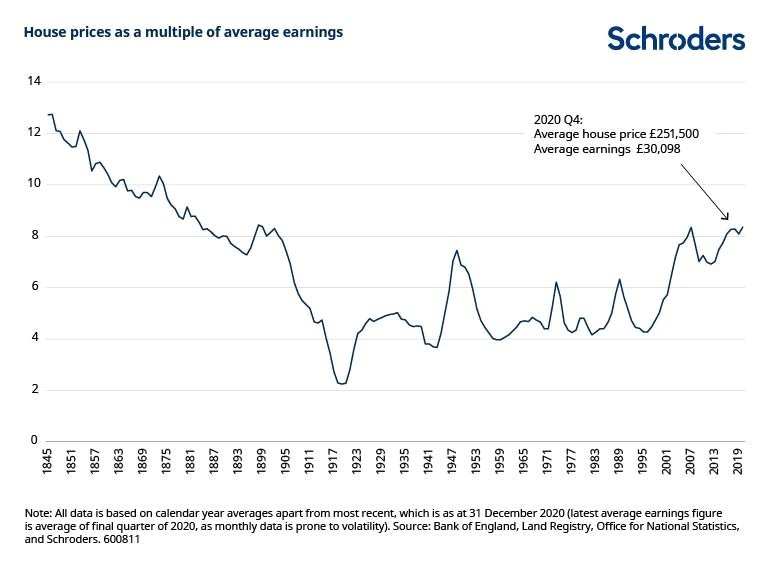

1/ At the top of the last real estate bubble,

we were told many US states (California, Nevada, Florida, etc) and various countries around the world (Spain, Ireland, etc) were suffering from property shortages.

we were told many US states (California, Nevada, Florida, etc) and various countries around the world (Spain, Ireland, etc) were suffering from property shortages.

2/ Once artificial demand pulled back as the downturn started, it turned out we never had any shortages at all.

Many were just buying their 3rd, 5th or 13th investment property by using excessive leverage.

I assume we will get a similar, or worse outcome in the next 5 years.

Many were just buying their 3rd, 5th or 13th investment property by using excessive leverage.

I assume we will get a similar, or worse outcome in the next 5 years.

3/ Excessive leverage fuels booms like nothing else,

and it typically create enormous oversupply (mortal enemy of long term prices).

I can only imagine how much malinvestment we will have to deal with once the tide pulls back and we notice many are swimming without shorts.

and it typically create enormous oversupply (mortal enemy of long term prices).

I can only imagine how much malinvestment we will have to deal with once the tide pulls back and we notice many are swimming without shorts.

4/ Federal Reserve together with other central banks should be directly blamed for creating a 3rd bubble in two & half decade span,

and potentially the worse inequality crisis in modern record history (worse than 1929 peak).

The fundamentals are worse than a decade or two ago.

and potentially the worse inequality crisis in modern record history (worse than 1929 peak).

The fundamentals are worse than a decade or two ago.

5/ As an investor and asset allocator, what can one do other than play the same risky games as everyone else?

We are all forced up the risk curve, often taking far higher risks in far more uncertain situations than we ever would,

if the market had a proper cost of capital.

We are all forced up the risk curve, often taking far higher risks in far more uncertain situations than we ever would,

if the market had a proper cost of capital.

6/ So we, together with many others, continue to invest as long as the music keeps playing.

Hopeful it WILL play for awhile longer, but honestly, the writing is already on the wall.

Expect we are trying our damn best to sidestep overpriced assets, and do something different.

Hopeful it WILL play for awhile longer, but honestly, the writing is already on the wall.

Expect we are trying our damn best to sidestep overpriced assets, and do something different.

7/ How successful will we be with our diversification approach?

Will certain assets remain uncorrelated if and when the “everything bubble” pops?

What will be the damage this time around, as the debt rises to even higher levels than 2000 & 2007 peak?

Remains to be seen.

Will certain assets remain uncorrelated if and when the “everything bubble” pops?

What will be the damage this time around, as the debt rises to even higher levels than 2000 & 2007 peak?

Remains to be seen.

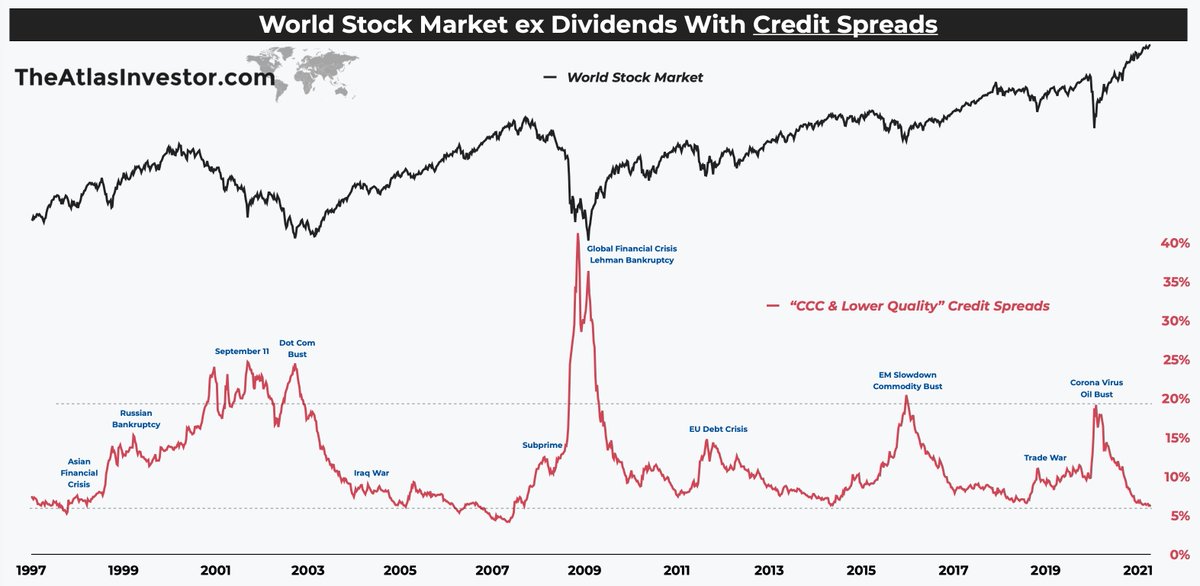

8/ In 2000 debt levels were high, Fed lost control of the tech bubble & pain was felt across the global economy.

In 2007, debt levels already reached extremely unsustainable levels — far higher than 1929.

Again, Fed lost control of the subprime, crashing the global economy.

In 2007, debt levels already reached extremely unsustainable levels — far higher than 1929.

Again, Fed lost control of the subprime, crashing the global economy.

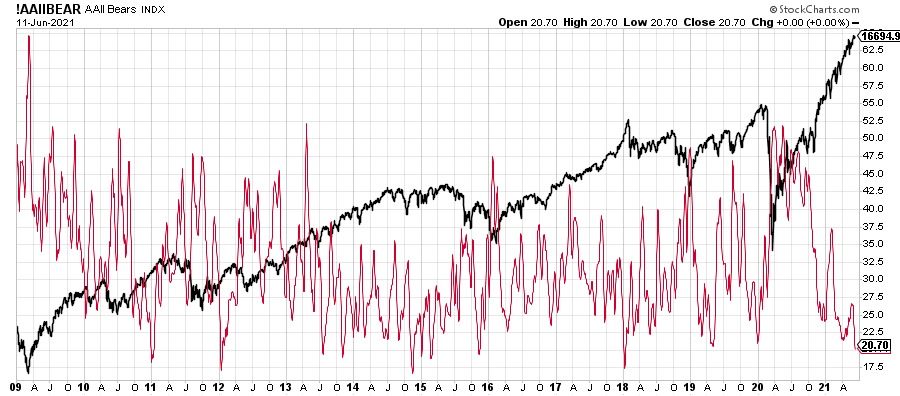

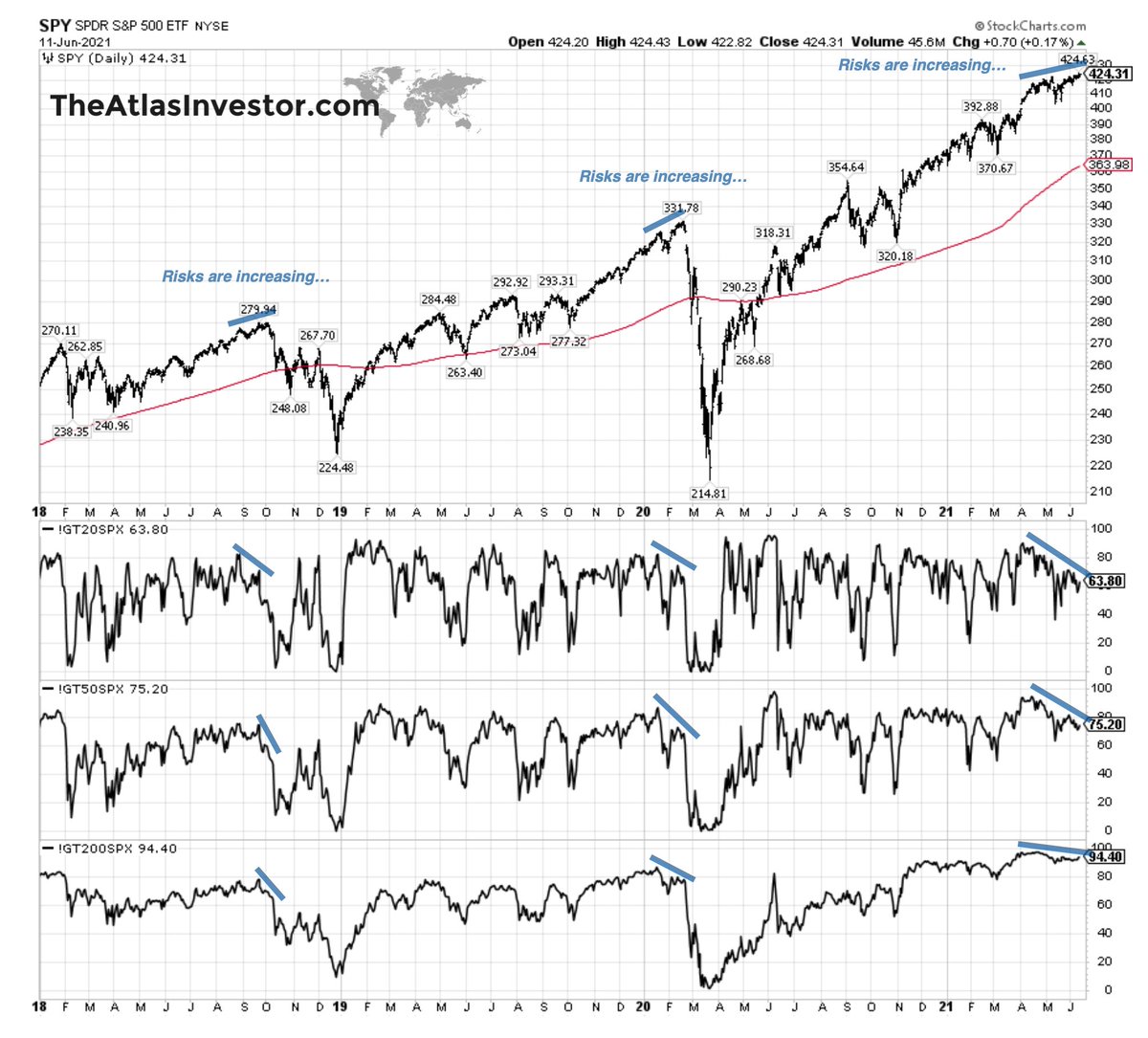

9/ Since the Great Recession, the stock & property markets tried to correct several times already.

In 2012, 2015, 2018 & even in 2020.

Each time the Fed & other CBs refused to let the free market clear properly.

I’d imagine the eventual crash will be one for the history books.

In 2012, 2015, 2018 & even in 2020.

Each time the Fed & other CBs refused to let the free market clear properly.

I’d imagine the eventual crash will be one for the history books.

10/ The last time we saw such a euphoric bubble in all traditional assets (stocks, bonds, property) was late 1980s in Japan.

Yes, it’s true.

It went far longer than anyone could imagine.

But eventually it topped, and 31 years later, it’s yet to recover.

Yes, it’s true.

It went far longer than anyone could imagine.

But eventually it topped, and 31 years later, it’s yet to recover.

11/ Bonus tweet.

No central bank in history ever had omnipotence regardless of what they said.

Bank of Japan lost control of their bubble, Fed lost control of the last two, Europeans didn’t save PIGS but only postponed the crisis.

Eventually the free market takes over.

No central bank in history ever had omnipotence regardless of what they said.

Bank of Japan lost control of their bubble, Fed lost control of the last two, Europeans didn’t save PIGS but only postponed the crisis.

Eventually the free market takes over.

• • •

Missing some Tweet in this thread? You can try to

force a refresh