Flexibility & versatility are key traits of investors.

The ability to view the same thing from different perspectives is critically important.

Since we develop our own RE projects as well as participate via lending in others, we attempt to learn from both sides.

Examples.👇

The ability to view the same thing from different perspectives is critically important.

Since we develop our own RE projects as well as participate via lending in others, we attempt to learn from both sides.

Examples.👇

In the post-Covid markets, it has become more important than ever for lenders (senior & mezzanine debt) to assess the true financial position of the borrower (sponsor).

Lenders should demand strong finances & ample liquidity to sidestep future potential problems...

Lenders should demand strong finances & ample liquidity to sidestep future potential problems...

...which are common in the world of RE development (cost overruns, slow sales & delays).

As a lender, we want to know if the developer can handle these issues without additional emergency funding?

As a developer, we want to leave ample cash on the sidelines so we don't rely...

As a lender, we want to know if the developer can handle these issues without additional emergency funding?

As a developer, we want to leave ample cash on the sidelines so we don't rely...

...on future external funding sources, which often come at high costs if and when projects are delayed.

Moving along, the industry standard is for developers to set aside 5% of the construction budget as contingency lumpsum.

This helps with unplanned & unforeseen events.

Moving along, the industry standard is for developers to set aside 5% of the construction budget as contingency lumpsum.

This helps with unplanned & unforeseen events.

As a lender, we have preferred at least a 7% contingency but often ask for 10% of building costs.

Most would think this is unnecessary, as a developer we follow the same rule.

This is why in over 25 years of rehab & construction we've never had a project bankrupt or lose money.

Most would think this is unnecessary, as a developer we follow the same rule.

This is why in over 25 years of rehab & construction we've never had a project bankrupt or lose money.

The cost of all commodities, including natural resources used as building materials (lumber, copper, etc) is rising rapidly.

Developers with 5% contingency might be feeling the heat, especially where we operate: luxury residential market.

Developers with 5% contingency might be feeling the heat, especially where we operate: luxury residential market.

The third point is regarding realistic project length expectations.

If Covid has shown us anything — especially in the UK, EU & AU markets we are active in — construction periods have seen major delays for a variety of reasons.

Site shutdowns, broad Covid lockdowns...

If Covid has shown us anything — especially in the UK, EU & AU markets we are active in — construction periods have seen major delays for a variety of reasons.

Site shutdowns, broad Covid lockdowns...

...supply-chain delays, delays in sales, and actual handover of dwellings.

As lenders, we are penciling in longer loan durations/facilities, instead of the traditional 24-month terms.

The key question we ask during underwriting is if the development can absorb additional...

As lenders, we are penciling in longer loan durations/facilities, instead of the traditional 24-month terms.

The key question we ask during underwriting is if the development can absorb additional...

...6-12 months of accruing interest, especially the higher cost 2nd ranking mezzanine rates which typically run at 15%+ in the UK and Australia.

As developers, we are also penciling in longer project durations — and despite the low cost of debt — we are reducing leverage levels.

As developers, we are also penciling in longer project durations — and despite the low cost of debt — we are reducing leverage levels.

The fourth and final point to touch upon is having multiple exit strategies,

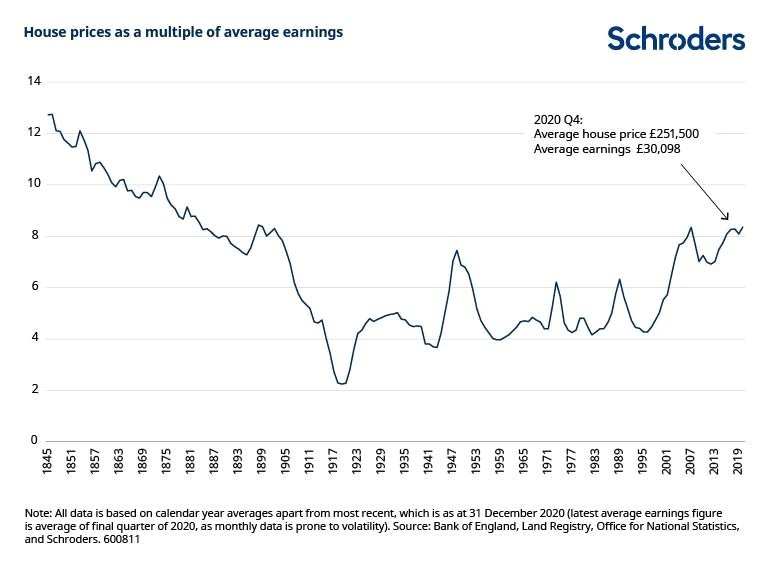

since market conditions are currently disconnected from fundamentals with heavy stimulates by governments & central banks — with no promise the party will last forever.

since market conditions are currently disconnected from fundamentals with heavy stimulates by governments & central banks — with no promise the party will last forever.

As lenders, one of the more critical questions is whether our construction loan can be refinanced timely with a longer-term, cheaper amortized mortgage facility after practical completion (for newbies: this means the end of the construction period)?

Therefore, it is also very...

Therefore, it is also very...

...important for us to be sitting at conservative LTV levels so a large number of sales aren't mandatory and developer exit bridging finance can come in and re-finance our construction loans with ease.

On the other hand, I already mentioned that as developers we are using...

On the other hand, I already mentioned that as developers we are using...

...very little or no leverage right now.

In the luxury game leverage isn't needed if one has other edges like in-house architecture & builders, supply of expensive materials, etc.

When everything goes well, we often clear 1.5-2X MOIC after tax over 1-2 year periods (unlevered).

In the luxury game leverage isn't needed if one has other edges like in-house architecture & builders, supply of expensive materials, etc.

When everything goes well, we often clear 1.5-2X MOIC after tax over 1-2 year periods (unlevered).

Furthermore, increasing valuations across many markets & regions,

where the majority of investors are jumping in at any price without much prudence,

makes us conduct our affairs with strict underwriting, demanding a larger margin of safety & far less leverage than normal.

where the majority of investors are jumping in at any price without much prudence,

makes us conduct our affairs with strict underwriting, demanding a larger margin of safety & far less leverage than normal.

This also means we miss out on many deals others pay a premium for and we are fine with that.

We have never made great money during booms, we are often sellers in those periods.

We have always made great money in busts, buying distress & value.

We have never made great money during booms, we are often sellers in those periods.

We have always made great money in busts, buying distress & value.

Hope this was an interesting read about how we run our capital in real estate, with a lender's hats 🎩 and a developer's 🏗 hat.

Operating on both sides helps us maintain discipline and execute our mandate.

Operating on both sides helps us maintain discipline and execute our mandate.

• • •

Missing some Tweet in this thread? You can try to

force a refresh