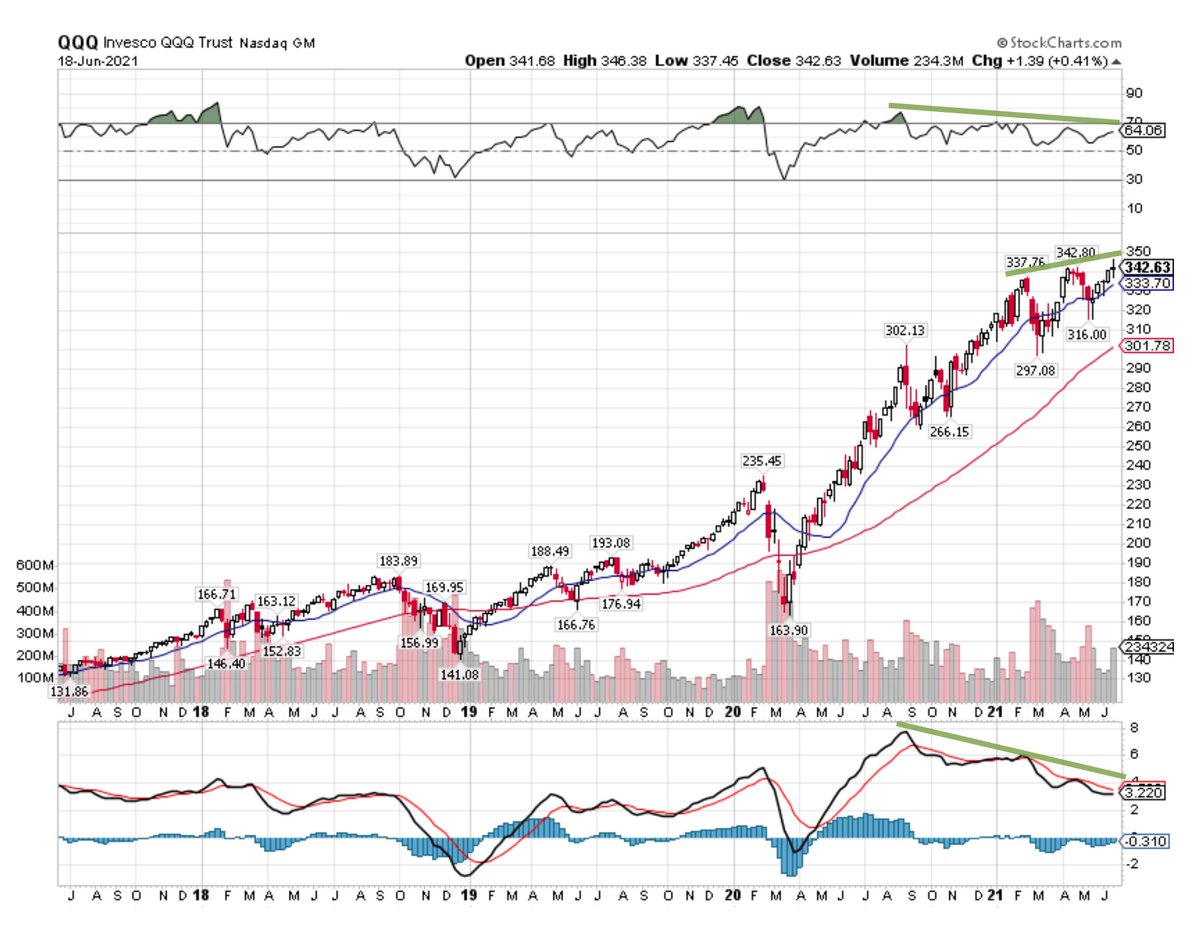

Technically, the Nasdaq 100 seems to have peaked in February of this year.

Sure, the index has managed marginal new highs even in recent days but seems to be losing momentum (bearish technical & breadth divergences).

$QQQ $NDX

Sure, the index has managed marginal new highs even in recent days but seems to be losing momentum (bearish technical & breadth divergences).

$QQQ $NDX

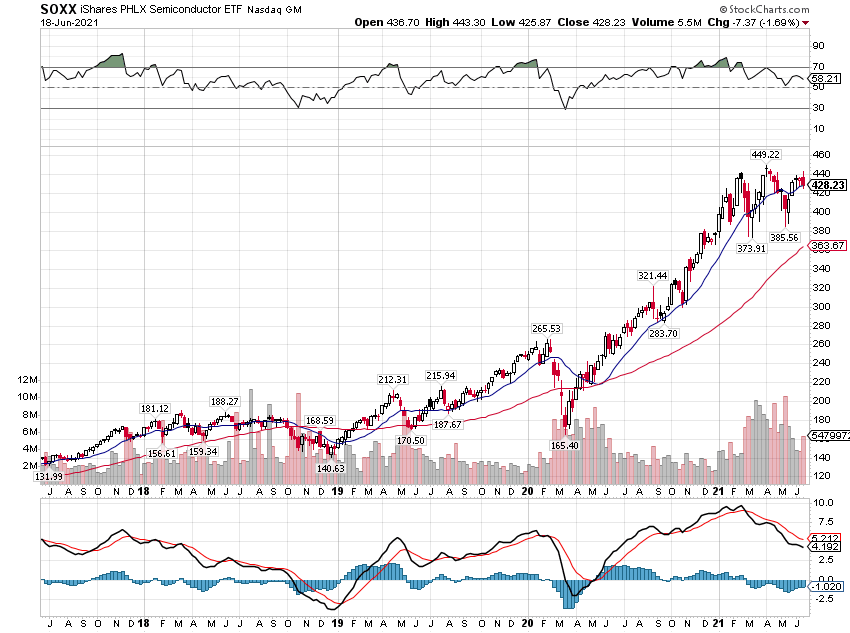

Additionally, the economically sensitive semiconductor sector also peaked in February and has failed to make new highs since.

Worth watching closely. $SOXX

Worth watching closely. $SOXX

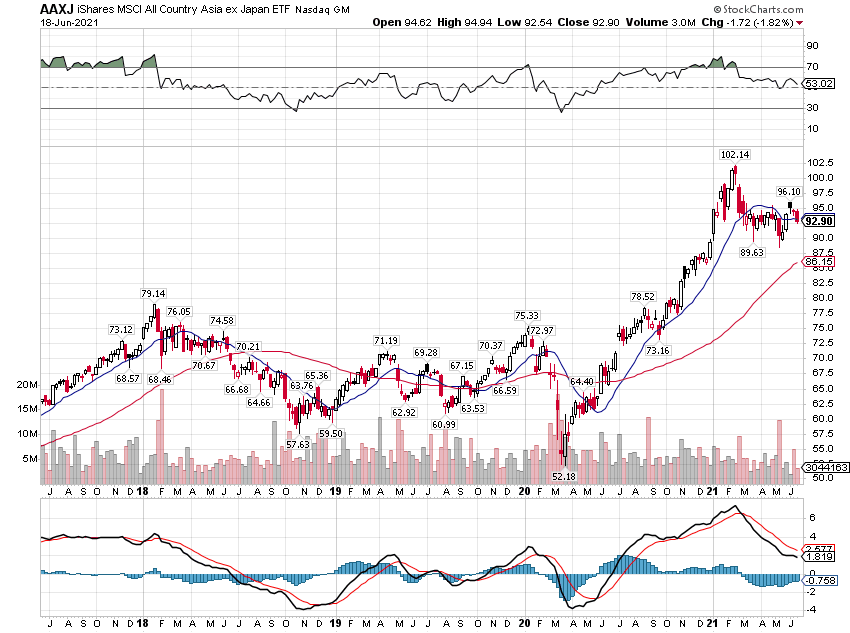

Another economically sensitive sector is Asia, especially emerging economies in this region.

A clear and decisive peak in February for the broad Asian equity index.

If the world is reopening, recovering & returning to above growth — why are global equities underperforming?

A clear and decisive peak in February for the broad Asian equity index.

If the world is reopening, recovering & returning to above growth — why are global equities underperforming?

The final chart to share.

Economically sensitive US small call index made a new high in recent days, which IMHO looks to be a classic bull trap.

Whenever an index is overextended and makes a new high with deteriorating breadth, it's often a cause of great concern.

$IWM $IJS

Economically sensitive US small call index made a new high in recent days, which IMHO looks to be a classic bull trap.

Whenever an index is overextended and makes a new high with deteriorating breadth, it's often a cause of great concern.

$IWM $IJS

• • •

Missing some Tweet in this thread? You can try to

force a refresh