Bizarre and brazen moves are common on the penny stock side of the stock exchanges. Vikas Proppant and Granite Ltd just released this intimation, announcing en-masse resignation of the entire management and board of the company to "bring in professional management". (1/7)

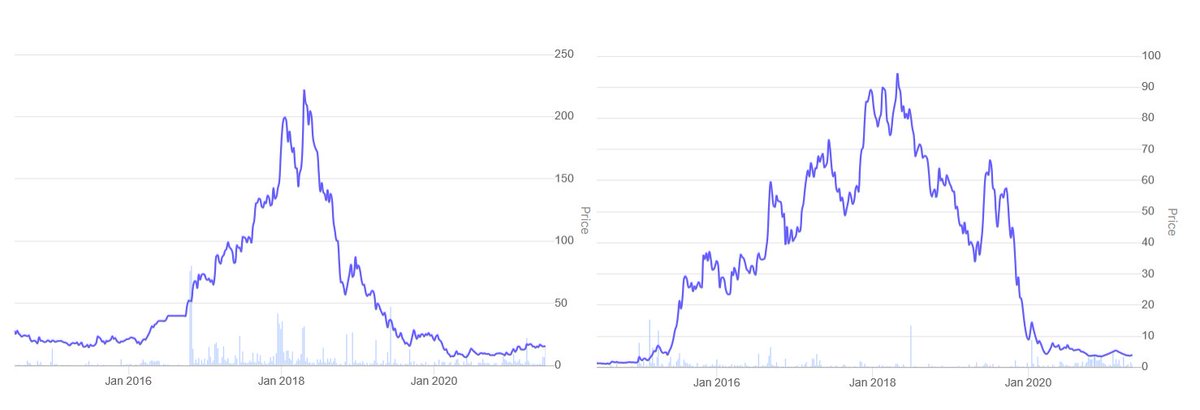

The shares of this company were heavily manipulated in the last 2 years, following the typical pattern of operators hand-in-hand with enabling management. Here's a look at the stock chart. Take a look at the volumes before the rise and the volume of trapped retailers after. (2/7)

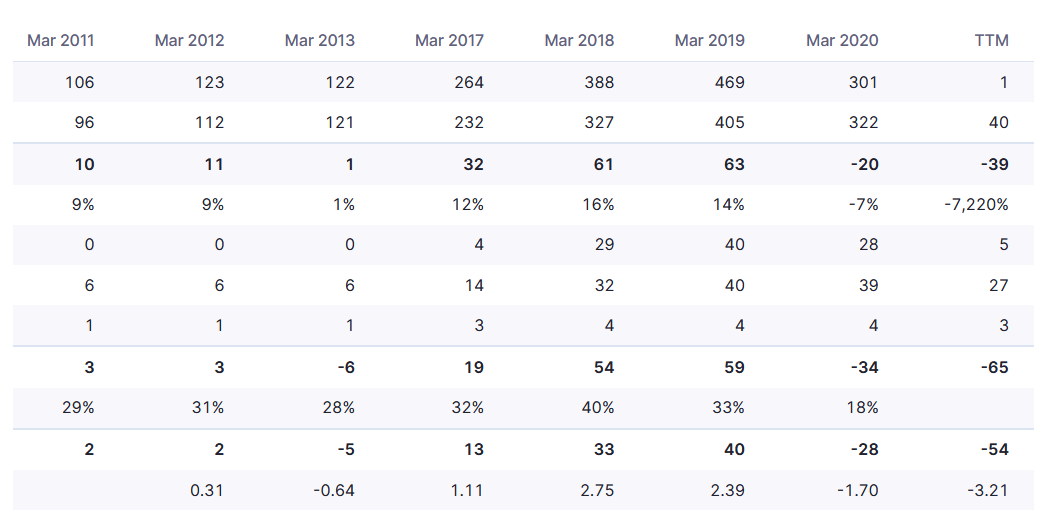

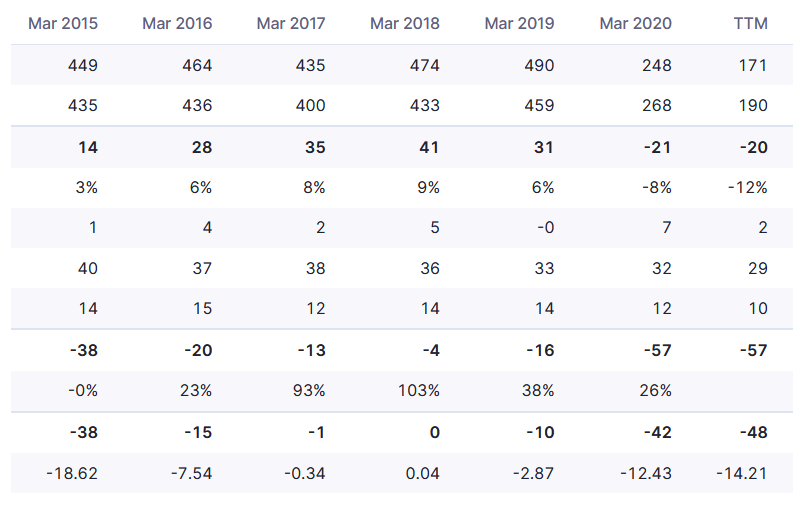

Company has had almost no revenue in the last 3-4 years, except for a brief blip in 2019 when the stock prices also went up 6-8x in a very short span of time. In fact, it has been selling fixed assets this year. (3/7)

There's this hilarious announcement in January 2021, attempting to pump the stock based on "personal" visit by promoter to operation site, and use of heavy jargon for what is essentially mining rock out of the ground. (4/7)

Here's another announcement in July 2020 talking about 'share grabbing' and invitation to shareholders (hand-picked by management) for a site visit and personal chat with the erstwhile MD. (5/7)

Interesting to note that the previous MD, B.D. Aggarwal, passed away in September 2020. Quite likely the shenanigans started earlier during his tenure, and now the rest of the promoter group finally caught up and decided to exit the ship that was worse than sunk. (6/7)

While the utility of this analysis is minimal at best, it does serve as a useful reference point to recognize stock pumping. With experience, such manipulations are easy to spot even while they're taking place. The real game, of course, is spotting the sophisticated ones ;) (7/7)

• • •

Missing some Tweet in this thread? You can try to

force a refresh