What: litigation funding cases in the UK

Why: carefully selected & diversified portfolio of litigation cases can return 30%+ annually while being totally uncorrelated to traditional assets during a potential crash, plus Pound might rise vs $USD giving additional returns

Why: carefully selected & diversified portfolio of litigation cases can return 30%+ annually while being totally uncorrelated to traditional assets during a potential crash, plus Pound might rise vs $USD giving additional returns

https://twitter.com/InvestmentTalkk/status/1407803883431284751

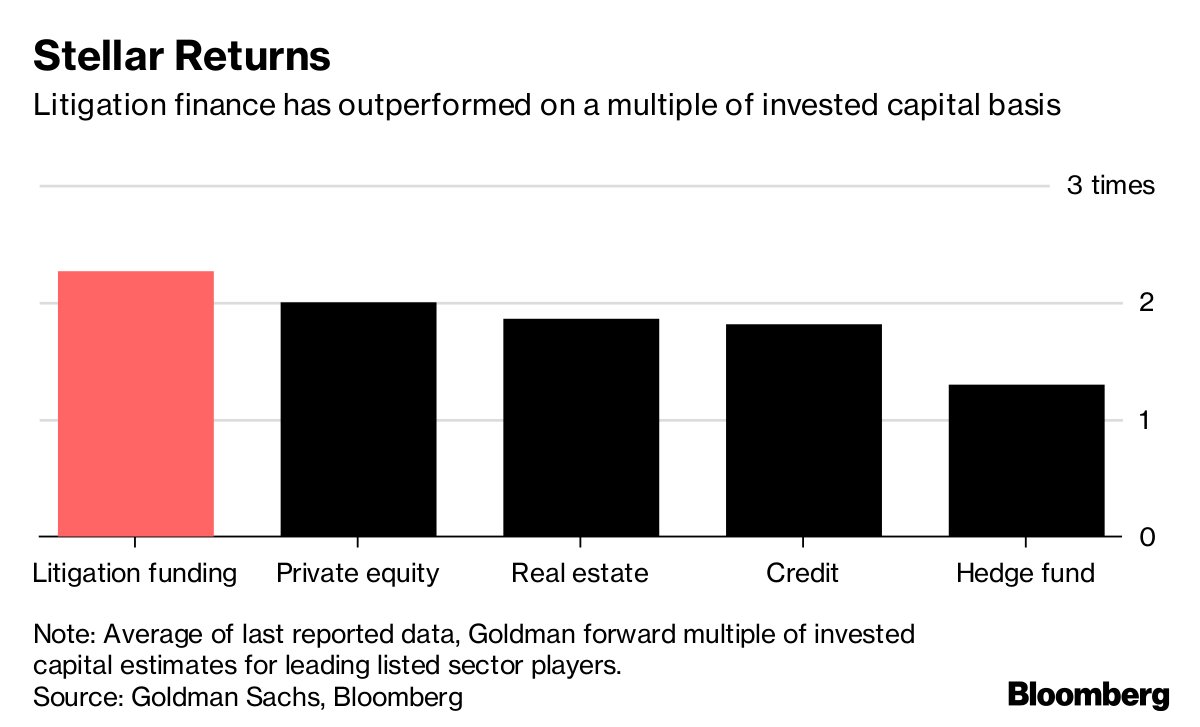

Litigation funding is outperforming all other asset classes including private equity, real estate, private debt, hedge funds, and the stock index funds.

Yet it still remains very unsexy due to a high barrier of entry (expertise & know-how, large minimum ticket sizes, etc).

Yet it still remains very unsexy due to a high barrier of entry (expertise & know-how, large minimum ticket sizes, etc).

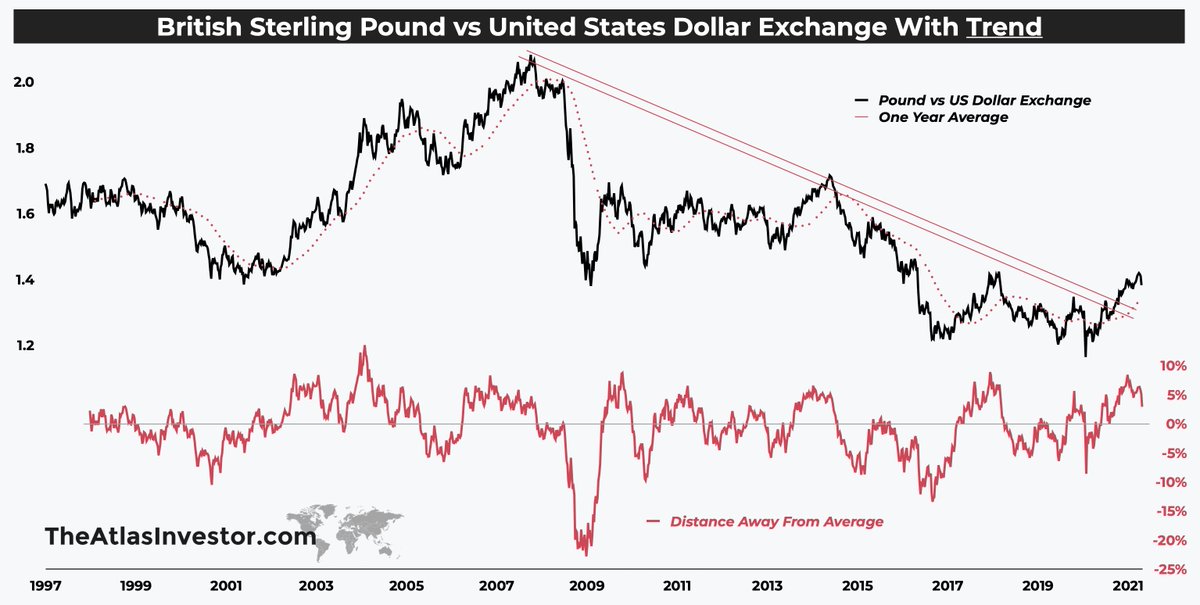

Additionally, the UK litigation cases are denominated in British Pounds — has recently broken out of its 13-year downtrend against the greenback.

We are hopeful the Pound might continue appreciating, gifting investors a double return (underlying ROI + exchange rate carry).

We are hopeful the Pound might continue appreciating, gifting investors a double return (underlying ROI + exchange rate carry).

We invest in three litigation strategies, but we do not buy public assets since that defeats the whole uncorrelated feature litigation funding offers.

Three strategies are:

i) individual cases

ii) litigation funds

iii) law firm financing

Three strategies are:

i) individual cases

ii) litigation funds

iii) law firm financing

https://twitter.com/THE137thAriel/status/1408061107160428545?s=20

The final point worth mentioning is real estate & private equity deals are difficult to sell, especially during a downturn.

Litigation cases, on the other hand, either settle prior to court or receive a judgment at trial, creating a natural liquidity event.

Litigation cases, on the other hand, either settle prior to court or receive a judgment at trial, creating a natural liquidity event.

• • •

Missing some Tweet in this thread? You can try to

force a refresh