Do you want to create GOOGLE SHEET SCREENER which shows those stocks which are BREAKING OUT 20 DAY HIGH and 20 DAY LOW?

The concept propounded by SIR RICHARD DONCHIAN

Let's take a deep dive

If you find this interesting then feel free to TAG😁, LIKE👍 and RT♻

The concept propounded by SIR RICHARD DONCHIAN

Let's take a deep dive

If you find this interesting then feel free to TAG😁, LIKE👍 and RT♻

Donchain Channel is a very interesting Trend Following Tool which looks as shown below. The UPPER LINE is called UPPER BOUNDARY and the LOWER LINE is called LOWER BOUNDARY. Trades can be set up in two manners

1. Trend Continuation

2. Trend Fading(Turtle Soup - Ref. Street Smart)

1. Trend Continuation

2. Trend Fading(Turtle Soup - Ref. Street Smart)

The problem over is not the trading part the main problem is to screen out those stock during the market hour or EOD basis for figuring out those stocks which are breaking out of UB or LB. Google Sheets can do a fair amount of job in screening out those stocks

=MAX(INDEX(GoogleFinance("NSE:"&C2,"HIGH",WORKDAY(TODAY(),-20),TODAY()),0,2))

This is the formula which you can put for setting up 20DAY HIGH

Here C2 refers to the cell which contains 'STOCK SYMBOL'

This is the formula which you can put for setting up 20DAY HIGH

Here C2 refers to the cell which contains 'STOCK SYMBOL'

=MIN(INDEX(GoogleFinance("NSE:"&C2,"LOW",WORKDAY(TODAY(),-20),TODAY()),0,2))

This is the formula which you can put for setting up 20DAY LOW

As mentioned above C2 refers to the cell which contains 'STOCK SYMBOL'

This is the formula which you can put for setting up 20DAY LOW

As mentioned above C2 refers to the cell which contains 'STOCK SYMBOL'

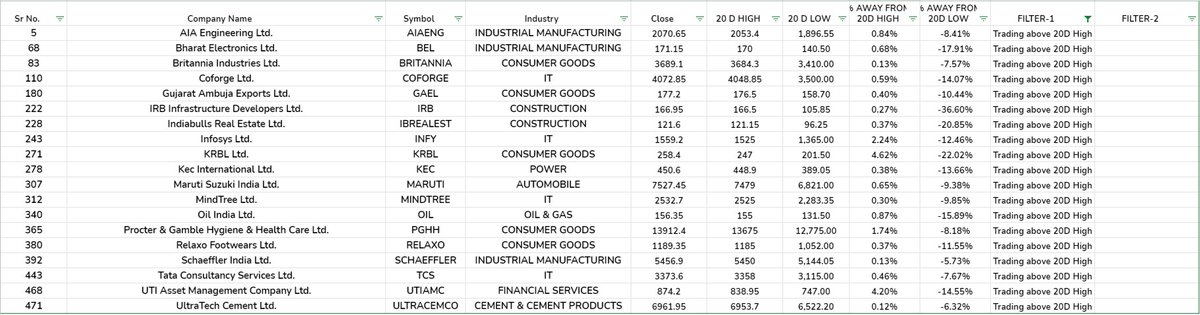

The layout that I have set up for my screener is shown below for which I have selected the universe of NIFTY 500 stocks and to filter out the same I have used 'IF' function based on CLOSE & 20DHIGH / 20DLOW

This is not the only way to do the same I found this useful so thought of sharing. There are many other screeners which do the same

@Trendmyfriends is one of the handles which I came across recently and I have found that he is a PRO in this type of TREND FOLLOWING SYSTEM

@Trendmyfriends is one of the handles which I came across recently and I have found that he is a PRO in this type of TREND FOLLOWING SYSTEM

Basic Functions - GOOGLE FINANCE

support.google.com/docs/answer/30…

support.google.com/docs/answer/30…

• • •

Missing some Tweet in this thread? You can try to

force a refresh