How Ethanol Policy changed the fortunes of GLOBUS SPIRITS❓

👉So, Globus spirits is one of the largest grain based distillers in India.

👉They sell country liquor in the markets of Rajasthan ,Haryana,West Bengal and Delhi.

Have 30% mkt share in Rajasthan in IMIL segment.

👉So, Globus spirits is one of the largest grain based distillers in India.

👉They sell country liquor in the markets of Rajasthan ,Haryana,West Bengal and Delhi.

Have 30% mkt share in Rajasthan in IMIL segment.

👉They enjoy around 30%+ Ebitda margins in IMIL segment (earlier they were 20%+)

👉So, the co. decided to enter Bihar market and set up a distillery there.

👉And when all the capex was completed,they faced a huge setback from the state govt.

👉So, the co. decided to enter Bihar market and set up a distillery there.

👉And when all the capex was completed,they faced a huge setback from the state govt.

👉After Nitish Kumar was sworn in as C.M., he declared Bihar a Dry state,as a result of which their plant was shut down.

👉After all the legal struggles and battle they received an order from High Court in oct 2019 whch allowed them to operate d plant in order to produce ENA.

👉After all the legal struggles and battle they received an order from High Court in oct 2019 whch allowed them to operate d plant in order to produce ENA.

👉And with the change in Govt. policies allowing Grain based Ethanol to be included in blending with the fuel, they got shot in the arm.

👉Now wat happened is the Grain Based distilleries which were earlier producing ENA , started diverting their supplies towards EThanol to OMCs

👉Now wat happened is the Grain Based distilleries which were earlier producing ENA , started diverting their supplies towards EThanol to OMCs

👉As a result of which supplies of ENA got impacted & realizations started to improve.

👉Earlier it ws buyers market & distillers were at d mercy of beverage mfg. but after the supply of ENA dried up, the buyer's mkt hv totally changed to seller's mkt.

ecoti.in/1PPcMZ16

👉Earlier it ws buyers market & distillers were at d mercy of beverage mfg. but after the supply of ENA dried up, the buyer's mkt hv totally changed to seller's mkt.

ecoti.in/1PPcMZ16

👉ENA realizations earlier used to be in the range of Rs.45-47 but now they have improved to Rs.51-52 & they are revised annually on 1st dec of every year by the govt.

👉GS enjoy even higher ethanol prices in the range of Rs.57 in deficit states such as W.B & Rajasthan.

👉GS enjoy even higher ethanol prices in the range of Rs.57 in deficit states such as W.B & Rajasthan.

👉Though IMIL is far more profitable buss. but in W.B. due to scarcity of ENA, they enjoyed better profitability than IMIL, though IMIL margins has picked up now.

👉So, due to favorable govt. policies their margins have picked up in the ENA and Ethanol space.

👉So, due to favorable govt. policies their margins have picked up in the ENA and Ethanol space.

👉Presently they sell very lil quantity of Ethanol & majorly ENA cz its more profitable to do.

And out of Total Capacity of 500KLPD about 160KLPD is fungible.

👉Since demand for Ethanol is about to inc further due to 20% blending program by 2025, they have decided to almost

And out of Total Capacity of 500KLPD about 160KLPD is fungible.

👉Since demand for Ethanol is about to inc further due to 20% blending program by 2025, they have decided to almost

👉Double their capacity to 920KLPD within next two years.

Now the question is whether they will be able to sustain these margins? 🚨

👉RM prices right now are 25% lower than what they usually are. Since all their RM is broken rice which is waste product from the mills.

Now the question is whether they will be able to sustain these margins? 🚨

👉RM prices right now are 25% lower than what they usually are. Since all their RM is broken rice which is waste product from the mills.

👉The prices are determined by the mills and it all depends upon paddy production every year and obviously the MSP inc by the govt.

👉Rise in RM prices might effect d margins but unlike last few years, now sellers determine the prices in ENA buss. and they can easily pass it on.

👉Rise in RM prices might effect d margins but unlike last few years, now sellers determine the prices in ENA buss. and they can easily pass it on.

👉And Ethanol prices are revised annually in order to adjust any inflationary pressure on the RM side.

👉In IMIL buss the prices are revised yearly or within 2 years by the state govts.

👉Going forward, looking at the major push by the govt. towards ethanol blending and

👉In IMIL buss the prices are revised yearly or within 2 years by the state govts.

👉Going forward, looking at the major push by the govt. towards ethanol blending and

👉Soaring crude prices ,it's unlikely that govt. will back out on this program.

👉In order to meet 20% blending target by 2025, India need 1500cr ltrs of yearly ethanol supply vs current 600-700crs ltrs.

And that is evenly split between 50% for sugar based ethanol and 50%

👉In order to meet 20% blending target by 2025, India need 1500cr ltrs of yearly ethanol supply vs current 600-700crs ltrs.

And that is evenly split between 50% for sugar based ethanol and 50%

for Grain based ethanol.

👉Therefore, we can confidently say that it's not a hyped story, rather a Structural Change for Ethanol or ENA mfgs.

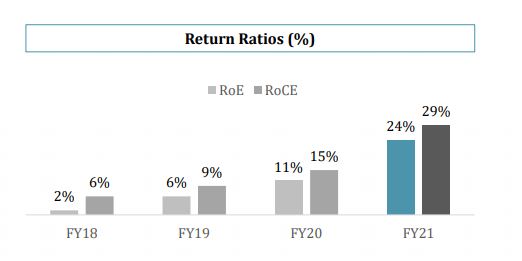

Even after current run up the stock still trades at 12x P.E. (TTM) and operating with healthy return rations of 25%+

👉Therefore, we can confidently say that it's not a hyped story, rather a Structural Change for Ethanol or ENA mfgs.

Even after current run up the stock still trades at 12x P.E. (TTM) and operating with healthy return rations of 25%+

👉With 30% inc in capacity by Q3 onwards and doubling by next year, it feels like story has just begun.

👉Not to forget , they r also planning on a 3year Strategic plan to grow their IMIL & IMFL (Unibev) further.

@nid_rockz @pd_log @mmvRavindra

👉Not to forget , they r also planning on a 3year Strategic plan to grow their IMIL & IMFL (Unibev) further.

@nid_rockz @pd_log @mmvRavindra

Unroll @threadreaderapp

• • •

Missing some Tweet in this thread? You can try to

force a refresh