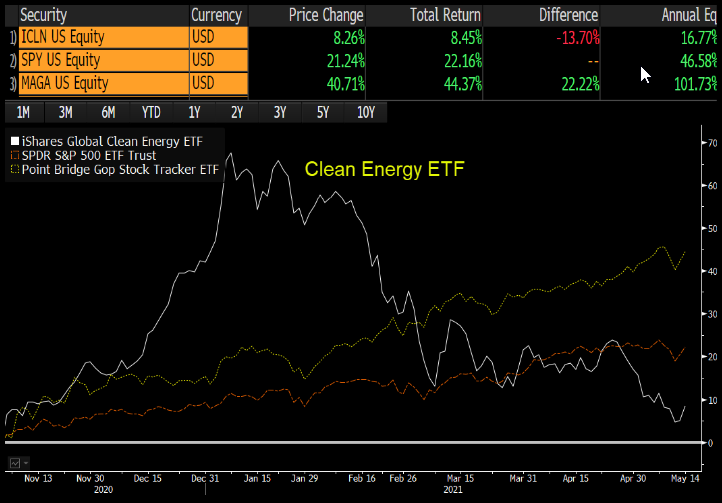

While semi-shock, kinda makes sense as Cathie is on the board of 21Shares, which is a progressive bitcoin ETP issuer in Europe. They get US penetration and ARK can use own fund in their active ETFs. This pod/thread has good background on 21Shares ICYI:

https://twitter.com/EricBalchunas/status/1392808511713824768?s=20

While this def adds to excitement, I have recently become less bullish on bitcoin ETF approval the more I come to think SEC has hands tied by bigger forces in US gov. Thus, I think ETF may be in holding pattern until there's some kind of reg framework or crackdown on crypto.

Also interesting pretty sure this is this is first bitcoin ETF filing with a fee in the initital filing and it is 95bps, so gives idea of what the others may come in at. (ht @maybebullish )

• • •

Missing some Tweet in this thread? You can try to

force a refresh